And like that teenager, investors are wondering, “Where should I go from here?” The problem is the cues we have been trained to watch for. Unemployment (was that a 6.5 percet or 7 percent target?), inflation, or, wait . . . no, it’s housing prices, right? We are now all confused, adrift without anchorage!

Now What?

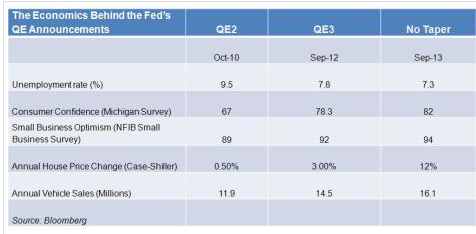

So what is an unanchored, unsure and unsteady fixed income investor to do? Perhaps it’s time to sit back, take a deep breath and think about the things that matter to interest rates over the long run: economic data. On this front, my colleague (and boss) Ken Taubes, points out in his recent blog that the data continues to confirm that the U.S. economy looks just fine. When we compare economic data today to that during the anxious times of the QE announcements starting with QE2 (QE1 was responding to a liquidity crisis, not economic malaise), it’s clear that conditions are dramatically better.

One simple, yet effective rule of thumb to guide us in determining the likely path of interest rates (in this case the 10-year U.S. Treasury is the best proxy) is to turn to the “Golden Rule.” Over time, interest rates should be equal to nominal GDP. This generally accepted rule of thumb links productivity and population growth to the direction of interest rates – which, not coincidentally, are the long-term drivers of GDP growth. Nominal GDP also happens to be the sum of real economic growth plus inflation. Thus we link interest rates to GDP growth and inflation.

Fuzzy Visions of Guideposts, the Concerns of Investors

We don’t think so and would point to the dramatic improvements in the U.S. oil and gas production as evidence of this country’s ability to innovate in the face of structural headwinds. But the debate here is extensive and I would recommend that you read my colleague Paresh Upadhyaya’ s papers The U.S. Dollar: Awaiting the Upcoming Bull Market, and Revisiting the U.S. Dollar Bull Market for a more comprehensive assessment. But we are also willing to concede that the path towards reaching 3 percent real growth could be a long one given the aforementioned headwinds, and we therefore think 1½-2 percent is a reasonable expectation for 2014.

Maybe it’s time to grow up and say goodbye to the parents (the Fed).

Like a teenager caught between the decision of going to college and leaving friends behind or living in the comfort of home and going nowhere, debt markets have been reeling between taper angst and infinite quantitative easing euphoria.

Like a teenager caught between the decision of going to college and leaving friends behind or living in the comfort of home and going nowhere, debt markets have been reeling between taper angst and infinite quantitative easing euphoria.

What the Federal Reserve says really matters to the markets these days so much so that even experienced investors are spending an inordinate amount of time trying to interpret the minutest of changes in phraseology. Ironically, this is because the Fed’s success in establishing its credibility through forward guidance appears to have trapped them. After the market’s horrified response to the idea that quantitative easing (QE) was in fact not infinite, the Fed is now backpedalling, possibly fearing the negative feedback loop that was created by their taper discussions — a loop they themselves constructed in the first place by committing to “buying everything the Treasury would issue.”

As we argued in The Danger of Duration, a series of three papers you can read at us.pioneerinvestments.com, the need for QE to support an economic recovery is over. The question, therefore, is – where do rates go from here?

Given the fuzziness around the Fed’s guideposts, the key questions for investors are, 1) what is the ability of the U.S. economy to produce real GDP growth; and 2) what is the path of inflation? Inflation is the easier number to get agreement on: it’s low – currently around 1.5 percent, as measured by the Consumer Price Index (CPI). For 2014 the median expectation is for 2 percent (based on an interpolation between consensus and the Fed 5-year forward breakeven rate used to measure inflation expectations). Real GDP is another matter. The debate is whether or not given structural deleveraging and deteriorating demographics the long-term ability of the U.S. to grow real GDP at around 3 percent is permanently impaired.

Mike Temple is responsible for oversight of Pioneer Investments’ U.S. credit research department. His duties include independent research of credits, sector analysis, and coordination of research efforts in high yield, bank loan, investment grade, emerging markets, and municipal credit. He has been the Portfolio Manager of an institutional “Credit Opportunity” strategy since 2008, and is also a Portfolio Manager of Pioneer Absolute Return Credit Fund.

Teenage Melodrama and the Market’s Infatuation with QE

September 30, 2013

« Previous Article

| Next Article »

Login in order to post a comment