Check out these discouraging numbers:

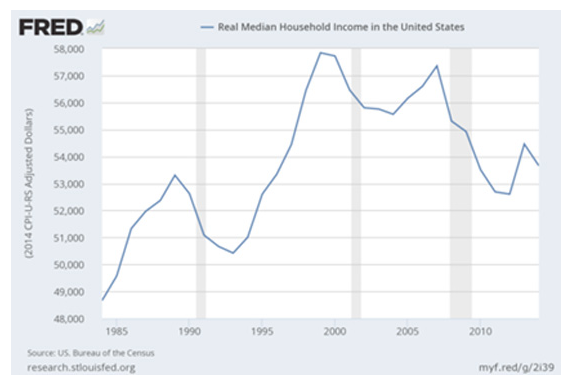

39% of American workers make less than $20,000 a year.

No wonder that an estimated 62% of Americans are living paycheck to paycheck.

And all of us—low, medium, and high income combined—are working longer than ever to pay a growing tax bill. According to the nonpartisan Tax Foundation, tax freedom day, the day when the nation as a whole has earned enough to pay the state and federal tax bill for the year, arrived on April 24.

That means all the money we made in the first 114 days of 2016 went to taxes.

So… what do you think all this American angst means for the stock market? Of course, the Wall Street crowd is more concerned about every syllable that comes out of Janet Yellen’s mouth than any economic or corporate statistic.

However, the stock market is butting up against a very serious ceiling of resistance that I believe will limit—if not wipe out—any gains.

So what’s an investor to do?

Nervous Nellie Strategy #1: Load up on dividend-paying stocks with a generous yield. In this topsy-turvy world of ZIRP (zero interest rate policy) and NIRP (negative interest rate policy), stocks that pay out decent-size, sustainable dividends will be among the few that will hold their value.

52% of American workers make less than $30,000 a year.

63% of American workers make less than $40,000 a year.

72% of American workers make less than $50,000 a year.

And it doesn’t help that Americans continue to rack up debt. Example: Outstanding auto loans have hit more than a trillion dollars, with an average balance of $12,000 per person that consumes nearly 8% of the average borrower’s disposable income!

The Bern Of Financial Stress

April 19, 2016

« Previous Article

| Next Article »

Login in order to post a comment