The pressures on financial advisors can be quite intense. Given the competition they face from artificial intelligence (i.e., robo-advisors) and other professionals (such as accountants), there is a considerable need for them to create an effective business model and know how to use it. The question then becomes: What is that model, and who are its optimal clients?

Three Business Models

In the first quarter of 2016, we surveyed 803 U.S. financial advisors to evaluate their thought processes. Three types of business models dominated (Figure 1):

• Wealth managers provide a number of different financial services to their clients including money management, insurance and, at times, credit. About a quarter of the sample were wealth managers.

• Financial advisors in multi-family offices add expertise in administrative and lifestyle services to a solid wealth management platform. Multi-family offices represented the smallest segment of our survey—about 17% of the sample.

• Investment managers concentrate their efforts on providing various money management services. They constituted slightly more than half the financial advisors surveyed.

There are many meaningful differences among financial advisors depending on the business model they have adopted.

Wealth Management, The Most Profitable

The majority—slightly more than half—of the financial advisors earned, on average, between $250,000 and $500,000 over the last three years. Around a fifth earned between $500,000 and $1 million, with 23% earning less than $250,000. Only about 5% earned more than $1 million annually.

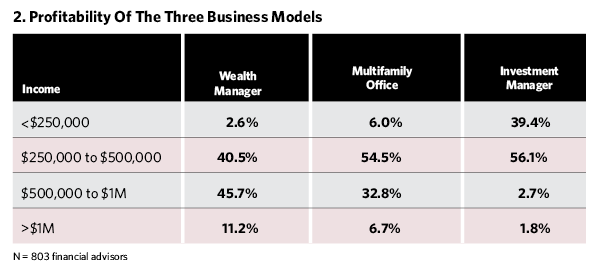

Considering the relative profitability—based on the average income of the partners/owners—of the three business models, wealth managers were the most successful (Figure 2).

In all the business models, there were financial advisors earning millions of dollars annually. It is just that the relative percentage of wealth managers was greater; slightly more than 10% of them earned $1 million or more in 2015. About 45% of them annually earned between $500,000 and $1 million. Two-fifths were in the $250,000 to $500,000 range, and the remainder earned less than $250,000 annually.

Next in line were financial advisors at multi-family offices. Almost 7% of these financial advisors earned $1 million or greater. About a third annually earned between $500,000 and $1 million; a little more than half earned between $250,000 and $500,000 with eight financial advisors working in these firms annually earning less than $250,000.

When you delve into the structures, including the deliverables of the various business models, the best practices at these firms become apparent. For example, the financial advisors in multi-family offices that concentrate on delivering wealth management services while strategically outsourcing much lower-margin lifestyle and administrative services to external providers earned more than the average wealth manager. Also, most of the financial advisors at multi-family offices who are taking this approach earned more than $500,000 annually.

This means expertise and expenses are critical to success. Pricing deliverables in multi-family offices is usually a less-than-sophisticated process, even though it is critically important. Some multi-family offices are wrapping everything they provide in an assets-under-management fee or even a total client wealth fee. Others are focusing on a variety of different fees charged hourly, by project, through retainers or on investments. Conceptually, all the different pricing structures can be viable. What is essential is to have integrated, value-based pricing where the focus is on provable value provided, not cost.

Finally, about 2% of investment managers made more than $1 million annually. About twice as many earned between $500,000 and $1 million. Nearly three-fifths were in the $250,000 to $500,000 range and two-fifths earned less than $250,000 annually.

When executed extremely well, the multi-family office is the superior model for compensation. If those in the wealth management model boast a greater proportion of high-earners, it’s because the model is considerably easier. Their ability to derive more non-investment-management revenues from clients is instrumental in that greater profitability.

Growing Competition For Wealthier Clients

In a related vein, about nine out of 10 of the financial advisors identify the affluent (those with investable assets of $1 million or more, or individuals with a net worth of $10 million or more) as preferred clients. This is characteristic of financial advisors regardless of the business model they have adopted.

As they all try to concentrate on the wealthy, competition among financial advisors is intense (something reported by almost nine out of 10 of those surveyed). More than 90% of investment managers, 84% of wealth managers and four out of five financial advisors in multi-family offices feel this way.

When we dig deeper into the data, we find a direct relationship between the range of services offered and the perceived level of competition. Being able to proficiently deliver a sleeve of high-quality services desired by the wealthy can be a distinct competitive advantage. This regularly enables financial advisors to address things besides money management. Also, it can be very appealing to the wealthy if the advisor can deliver a broader range of solutions than peers can—especially to the ultra-wealthy.

While the “ideal” clients for financial advisors are affluent, the question becomes: “How wealthy are the affluent?” For many advisors, the super-rich (those with a net worth of $500 million or more) are out of their league.

The Super-Rich Are Likely To Be Poor Clients For Many

The ranks of the super-rich are expanding, and four out of five of those surveyed are very or extremely motivated to work with them. Such clients have significant assets to invest, are regularly looking for legitimate ways to reduce their taxes and are very good referral sources.

But several things offset these advantages. The super-rich, through their family offices or more directly, are strongly inclined to negotiate the costs of services and ask advisors to compete for their business. They might very well have hundreds of millions, if not billions, to invest, but the investment management fees are often more in line with those of institutional investors and can even be lower.

Another problem is gaining access to them. While there are proven methods (content marketing and street-smart networking) relatively few financial advisors are effectively employing these processes.

The super-rich can be very demanding clients. While they might not be the best clients for the amount of fees charged, in gross dollars they can be astoundingly good sources. But the way they often approach business situations can make them difficult for many advisors to work with. Being able to deliver both exceptional expertise and service is always a requirement. Thus, your operational efficiency is essential, or little of the revenue will make it to your bottom line.

Despite the appeal of ultra-high-net-worth clients, some advisors will not be able to gain access to them or profitably work with them. But those advisors that truly understand this segment and can provide high-caliber financial solutions will find the super-rich to be remarkably lucrative clients.

What is critical is that an advisor adopt the business model that works best for him or her.