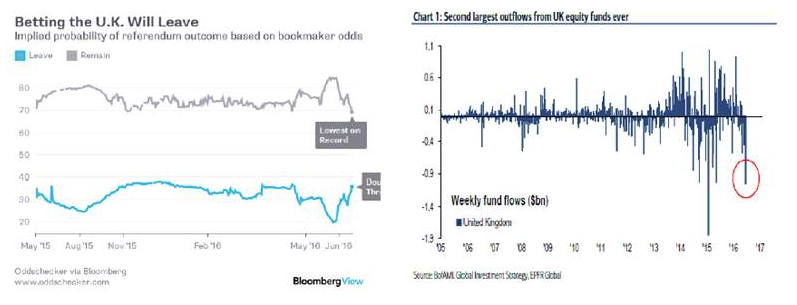

This coming week may very well end with either a European relief rally or a ratcheting up in global volatility. Either way, British voters will set the stage at the polls this coming Thursday, (June 23), deciding the future economic and political course for the EU through the next crisis. Although the Greeks and Scots heralded their break-away initiatives roughly a year ago, the magnitude of the UK splintering away from the economic union will be significantly more substantive if the British electorate opts out of the EU. Pollsters this past week’s-end began lowering the odds of an EU exit, with the larger betting firms in the UK more confident of a REMAIN vote, placing a +60 percent chance of the voters averting the BREXIT. Although the results of the vote are yet to be realized, the ongoing debates point to fairly serious economic, regulatory, political and nationalist consequences. One of the more significant risks that could be unleashed is the threat of a further unraveling from the peripheral nations of the EU, such as Italy, Spain or Greece (again). On the economic front, the UK Treasury has estimated that an EU exit would ultimately lower the nation’s GDP by 3.6% after two years, in turn raising unemployment by 520,000. And, let’s not forget the potential consequences of being forced to sift through the four decades of EU member contracts, regulations and laws that are suddenly back on the block.

With EU rhetoric taking center stage last week, the global ”risk-off” theme was pervasive, with domestic equity markets settling lower by Friday, offset by sharp bond rallies (and the resulting lower yields). As one report noted, the sovereign 10-year bond yields for the likes of the UK, Japan and Germany hit fresh record lows, while the yield on the 10-year German Bund actually went negative. Institutional investors were also taking notice of the elevated risk tone in the markets, raising cash levels to the tune of an average of 5.7%, which according to the latest Global Fund Manager Survey is the highest level since November 2001, on concerns about a potential “summer of shocks” and “quantitative failure.” While the markets will likely remain on edge through this coming week, it is again worth noticing that on the domestic front, all isn’t bad. True, recent (more dovish) Fed policy commentary did take note of the recent slowdown in the labor markets, but they also noted that household spending is strengthening. We also note that labor market surveys remain tight, the housing market is stable, and there are stealth signs of improving trends in Core CPI, PPI, and Import Prices. More news potentially down the road with one more countdown, the final revision in Q1 GDP later this month (expected on June 28).

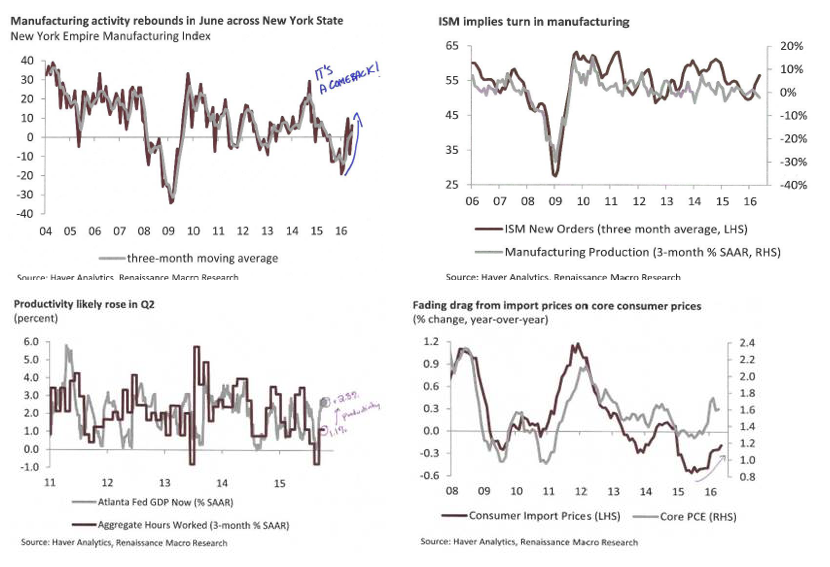

Manufacturing & Productivity

Another week’s data and apparently another (positive) flip-flop in the manufacturing data. There was improvement in headline PPI, Trade Service prices and also in the Empire Manufacturing Index, all of which are supportive of a possible cyclical bounce. The New York Empire Index story reflects a strong uptick from May to June, with manufacturing up now for three of the last four months. Overall outlook from survey participants improved to its highest level since December of last year, while capital spending intentions also rose from a +3 to +11. It should be noted though that actual production levels for this past month fell by .4%, bringing capacity utilization down to 74.9% (optimum output being closer to 80%). It is interesting to note that US business leaders responding via the Washington-based Business Roundtable are modestly optimistic about their sales, and plans for hiring over the next six months, noting that the last (weak) employment report was likely an aberration. They also note the risks in the market today from the pending BREXIT vote, and the protectionist agenda dominating today’s global political debates.

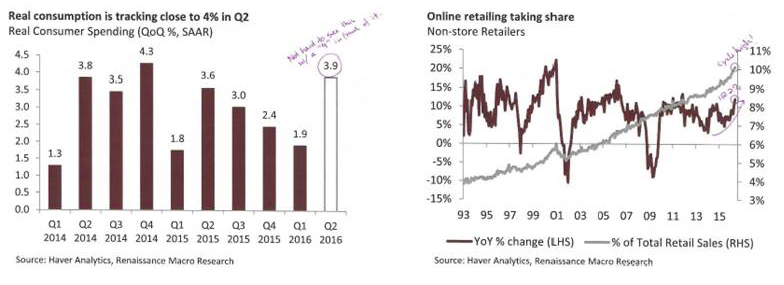

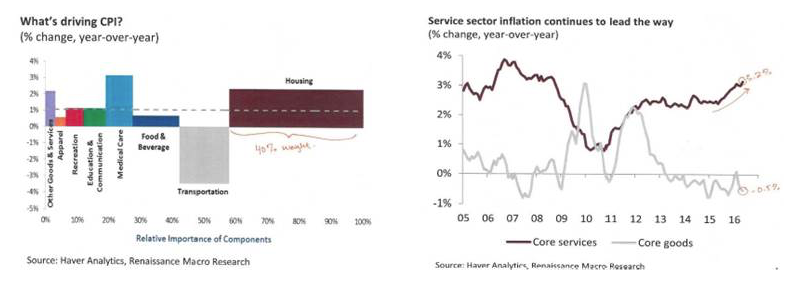

Consumption & Inflation

Consumption is trending up following a fairly strong May report, highlighting retail sales up .5% (and tracking up 1.3% from April). Of the 12 categories excluding gas stations, (up 2.1%), eight of the twelve categories were positive on a monthly comparison. Sporting good sales were up 1.3% (summer) while clothing stores were up .8%, up a second consecutive month. One detractor was building material store sales, off for the third consecutive month and representing an anomaly vs. the otherwise improving housing markets. The overall control group (less autos, gas and building materials) was up .4% on a monthly basis, following an upwardly revised 1% gain for April. Net result was a three month gain of 5.3%, vs. a prior estimate of 4.1%. Improving domestic retail sales this past month sets the stage for an accelerating 2Q consumer spending report and a subsequent uptick in real 2Q GDP.

Last month’s headline CPI inflation was up .2% on a monthly comparison, following a .4% report for April. Headline PPI rose by +.4% as well. The report also highlights slight increases in energy, good retail, core good prices, etc.

Gambling on the EU

With quite a bit riding on the outcome of the UK vote this week, the economic players are preparing for a UK exit risk from the European Union. The Bank of England reportedly increased member bank reserves $3.5 billion in anticipation of a BREXIT liquidity rush, while mutual funds invested in UK equities recorded redemptions last week totaling $1.1 billion. Over the past 8 weeks, total UK stock portfolios have lost nearly $3 billion, while M&A activity is off 70% from this time last year. Overseas, global central banks are also taking note, including Fed Chair Yellen in her recent remarks, and in Japan, with the BoJ also noting it was making contingency plans for Brexit. Adding fuel to the fire, last week the wire houses were adding their own comments to the UK pain, with Morgan Stanley commenting that the FTSE 100 could fall 16% from current levels, and Goldman Sachs noting that sterling could decline 11% on a trade-weighted basis against a basket of currencies. We’re definitely expecting an interesting week ahead.

Energy/Commodities

Brexit poses more downside risk from “Leave” than upside risk from “Remain” for global oil markets. Concerns about a potential UK exit from the EU are weighing on investors’ risk appetite, and has boosted the USD, both of which pushed oil down much of the past week. As some polls started shifting back towards “Remain” late in the week, risk appetite improved and the USD weakened, supporting higher oil prices on Friday. If the UK votes to remain in the EU we would expect a relief rally, but some of this was likely priced in late last week. In same light, a “Leave” result could offer a deal more downside risk.

In the event Brexit is the decision, oil could be impacted on three fronts near-term:

1) The direct demand from slower GDP growth; economists at Morgan Stanley expect a potential Leave vote would lead to a downward revision in EU GDP, which would then affect oil demand. A Eurozone slowdown would likely also have consequences for the US and EM. As a rough rule of thumb, the long run global GDP multiplier for oil demand has been closer to 0.5 before considering conservation and price elasticity. Recently that multiplier has been running far lower in the developed markets (the past year or two aside for the US), and closer to 0.5 in EM.

2) Risk off and sentiment; much of the strength in the oil bid over the past few months has come from quant funds/CTAs and macro funds. These positions are more sensitive to macro events, currency fluctuations, (FX) and momentum than they are to oil fundamentals. If risk assets sell off broadly, oil will follow, typically with a higher beta - as shown this past week. Therefore, a macro-linked liquidation of these long positions is one of the greater risks for oil price stability.

3) A stronger trade-weighted USD; the inverse oil-USD link has been powerful over the past 18 months, representing almost all of the price action since the US payroll report on June 3rd. While oil’s USD sensitivity can vary, every point on the trade-weighted USD is typically worth $1.50-2.00 for oil.

Per recent sell-side commentary, the vast majority of investors are bullish on oil, but most have a “buy the dip” mentality. There is also a lot of talk about Brexit and the need for resolution there before putting more capital to work. This theme is strikingly similar to conversations we heard a couple of months ago, (i.e. bullish the commodity, worried about valuations, waiting for pullback to really get involved). Given the trend in recent commentary, it would appear that many investors have lightened up in terms of their energy weights, but are closely watching the tape and waiting to plug more capital back into sector. Hedge funds have cut exposure and are currently running market neutral, while ‘long only’ funds are increasing their weighting and adding more beta to their books. The net result is that it’s beginning to feel like there is a floor under the pricing for the sector.

Tom L. Stringfellow is president and chief investment officer of Frost Investment Advisors.