• If the downtrend in manufacturing activity comes to an end as we expect, we should see a rebound in the broad stock market.

• The overwhelming pessimism gripping the global oil and gas sector and the basic materials sector could reverse sharply under this scenario.

• The cyclical and structural headwinds to the economy will eventually align in a negative direction, but until that point, we have a window of opportunity for the market to rise.

Cyclical and structural headwinds

There are lots of things in the world to be worried about right now, and the world is certainly worried.

Exhibit 1: US Investor Sentiment Bullish Readings

Source: Bloomberg

Structurally, we have poor demographics, over-indebtedness and underinvestment. Cyclically, we have a slowing China (though this could be structural), a tightening Fed and a market micro-structure that has become increasingly fragile as the historical providers of liquidity have been regulated out of the business. There are other issues as well, including the migrant crisis in Europe and unrest in the Middle East. While there is always a lot to be concerned about, a simple tally doesn’t provide much insight into the potential for a major shock to the markets. In our view, the structural backdrop for growth is less than supportive, meaning the multi-year trendline for global economic growth is likely to be a fraction of what it had been for the 50 years prior to the 2008 financial crisis. The business cycle still exists though, and around that depressed trendline there is still the potential for bursts of above average growth as well as for periods that will be sub-par.

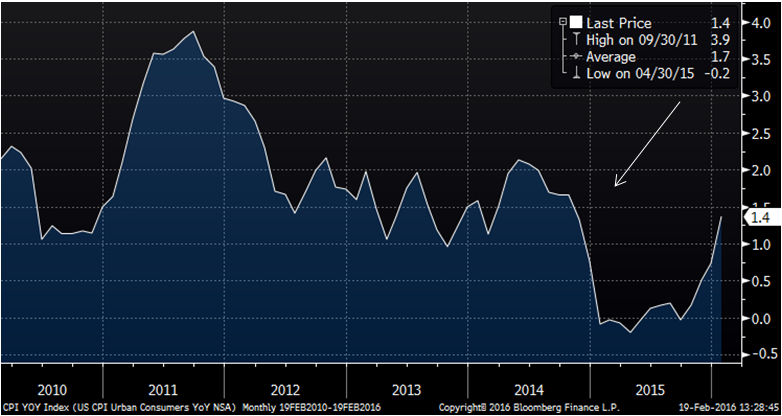

The stimulus of falling inflation

In a zero interest rate world, inflation becomes the new interest rate. Therefore, even though the Fed has lost the standard policy lever of nominal interest rate adjustment, there is still the potential for stimulus in the system. In fact, for consumer-based economies such as the U.S., Japan and most of Europe, falling inflation can provide tremendous stimulus as lower costs for everyday items like food and energy boost household cash flow which can then be spent on other goods and services, recycling it back into the economy. Since the financial crisis, inflation trends have led economic activity by about a year, which is how long it takes for the stimulus to show up in the output data. Interestingly, about a year ago the U.S. economy received a pretty potent boost of stimulus in the form of significantly lower inflation.

Exhibit 2: US CPI YoY Index

Source: Bloomberg