• If the downtrend in manufacturing activity comes to an end as we expect, we should see a rebound in the broad stock market.

• The overwhelming pessimism gripping the global oil and gas sector and the basic materials sector could reverse sharply under this scenario.

• The cyclical and structural headwinds to the economy will eventually align in a negative direction, but until that point, we have a window of opportunity for the market to rise.

Cyclical and structural headwinds

There are lots of things in the world to be worried about right now, and the world is certainly worried.

Exhibit 1: US Investor Sentiment Bullish Readings

Source: Bloomberg

Structurally, we have poor demographics, over-indebtedness and underinvestment. Cyclically, we have a slowing China (though this could be structural), a tightening Fed and a market micro-structure that has become increasingly fragile as the historical providers of liquidity have been regulated out of the business. There are other issues as well, including the migrant crisis in Europe and unrest in the Middle East. While there is always a lot to be concerned about, a simple tally doesn’t provide much insight into the potential for a major shock to the markets. In our view, the structural backdrop for growth is less than supportive, meaning the multi-year trendline for global economic growth is likely to be a fraction of what it had been for the 50 years prior to the 2008 financial crisis. The business cycle still exists though, and around that depressed trendline there is still the potential for bursts of above average growth as well as for periods that will be sub-par.

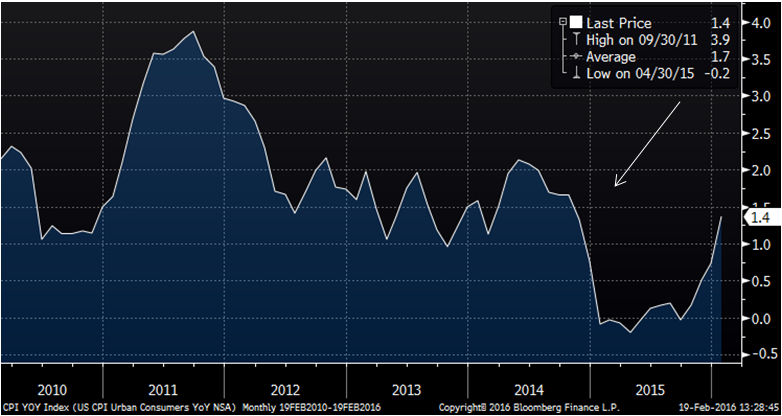

The stimulus of falling inflation

In a zero interest rate world, inflation becomes the new interest rate. Therefore, even though the Fed has lost the standard policy lever of nominal interest rate adjustment, there is still the potential for stimulus in the system. In fact, for consumer-based economies such as the U.S., Japan and most of Europe, falling inflation can provide tremendous stimulus as lower costs for everyday items like food and energy boost household cash flow which can then be spent on other goods and services, recycling it back into the economy. Since the financial crisis, inflation trends have led economic activity by about a year, which is how long it takes for the stimulus to show up in the output data. Interestingly, about a year ago the U.S. economy received a pretty potent boost of stimulus in the form of significantly lower inflation.

Exhibit 2: US CPI YoY Index

Source: Bloomberg

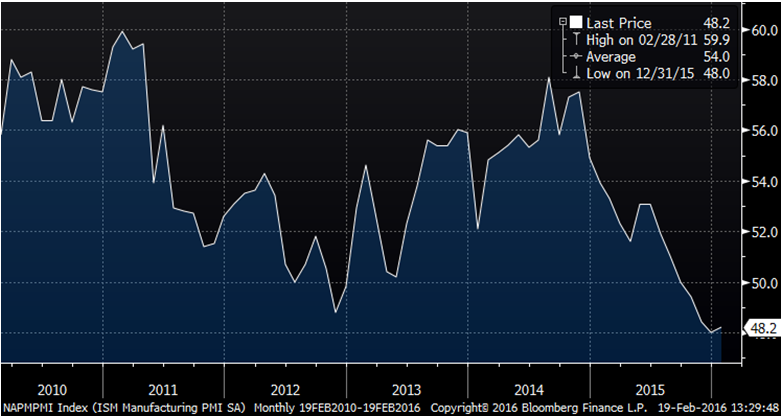

An almost 2% drop in inflation in two months provides a substantial boost to the economy. We would therefore argue that the sustained downtrend in manufacturing activity may be about to end.

Exhibit 3: U.S. ISM Manufacturing Purchasing Managers’ Index

Source: Bloomberg

If that expectation comes true, there are two market implications. First, we should see a rebound in the broad stock market aggregates as optimism around the economic recovery feeds into improved earnings expectations as well as dramatically reduced default concerns centered in the materials space. Secondly, the overwhelming pessimism gripping the commodities space, which has resulted in underperformance of the global oil and gas sector by more than 15% and the basic materials sector by more than 14% over the past 12 months, could reverse sharply. It wasn’t that long ago that we thought we were going to run out of oil, and as recently as a year and a half ago the price of a barrel of oil was over $90. Now oil is hovering around $30 and we have so much oil that there isn’t enough room to store it. The takeaway is that when sentiment changes the results can be truly spectacular.

Positioning and sentiment in stocks levered to global trade, of which the direct commodity plays are the poster child, is incredibly lopsided. If the data gets a bit better due to stimulus already in the pipeline, the snapback rally in the underperforming segments of the market could easily result in whiplash.

A window of opportunity for equity investors

At some point, the cyclical and structural influences on the economy are going to align in a negative direction, possibly as early as the second half of 2016, at which point the market could be in for a rough time. However, until that point, it is possible that we have a window of opportunity for the stock market to rise, accompanied by a sectoral rotation that could be breathtaking in its violence. Inflection points tend to be hugely volatile periods, and it takes intestinal fortitude to fight the trend. But even for those not willing to bet on the beleaguered materials sector, covering the shorts may be a prudent strategy.

Fred Copper is senior portfolio manager at Columbia Threadneedle Investments.