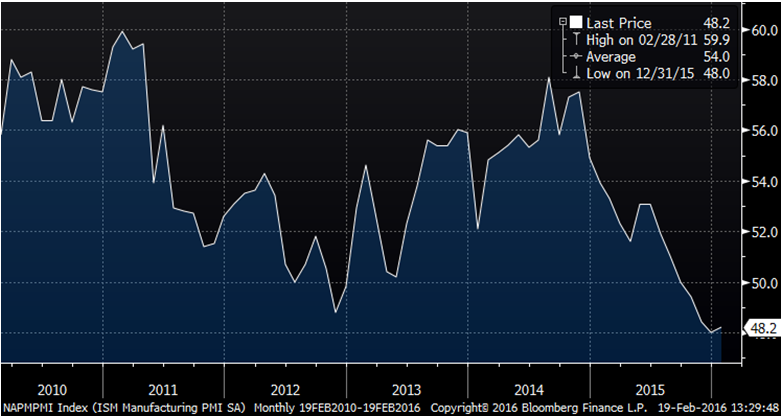

An almost 2% drop in inflation in two months provides a substantial boost to the economy. We would therefore argue that the sustained downtrend in manufacturing activity may be about to end.

Exhibit 3: U.S. ISM Manufacturing Purchasing Managers’ Index

Source: Bloomberg

If that expectation comes true, there are two market implications. First, we should see a rebound in the broad stock market aggregates as optimism around the economic recovery feeds into improved earnings expectations as well as dramatically reduced default concerns centered in the materials space. Secondly, the overwhelming pessimism gripping the commodities space, which has resulted in underperformance of the global oil and gas sector by more than 15% and the basic materials sector by more than 14% over the past 12 months, could reverse sharply. It wasn’t that long ago that we thought we were going to run out of oil, and as recently as a year and a half ago the price of a barrel of oil was over $90. Now oil is hovering around $30 and we have so much oil that there isn’t enough room to store it. The takeaway is that when sentiment changes the results can be truly spectacular.

Positioning and sentiment in stocks levered to global trade, of which the direct commodity plays are the poster child, is incredibly lopsided. If the data gets a bit better due to stimulus already in the pipeline, the snapback rally in the underperforming segments of the market could easily result in whiplash.

A window of opportunity for equity investors

At some point, the cyclical and structural influences on the economy are going to align in a negative direction, possibly as early as the second half of 2016, at which point the market could be in for a rough time. However, until that point, it is possible that we have a window of opportunity for the stock market to rise, accompanied by a sectoral rotation that could be breathtaking in its violence. Inflection points tend to be hugely volatile periods, and it takes intestinal fortitude to fight the trend. But even for those not willing to bet on the beleaguered materials sector, covering the shorts may be a prudent strategy.

Fred Copper is senior portfolio manager at Columbia Threadneedle Investments.