When asked to evaluate the factors critical to launching a hedge fund, managers are certain to focus on two key areas: investment performance and raising capital.

This is confirmed by a survey of 188 general partners at start-up hedge funds, conducted in the first quarter. Participating hedge funds had average assets under management of more than $63.2 million, with the AUM totals ranging from $42 million to $131 million, and were five years old or younger.

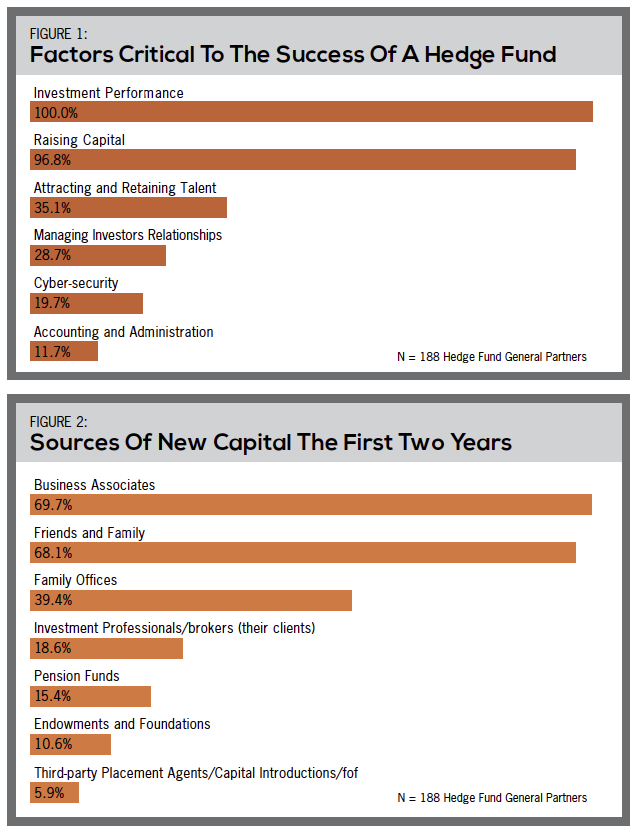

The general partners were nearly unanimous in agreeing that performance and raising capital are of paramount importance at inception. Unfortunately, the research also suggests that the early-stage focus on investment management and capital raising may lead some managers to overlook other important start-up components (Figure 1).

For example, about a third of respondents consider it extremely important to attract and retain talent. However, at this point in the life cycle of a hedge fund, much of the talent is motivated because of their current or potential position at the growing fund. About three in 10 consider managing investor relationships as critical. One in five point to cybersecurity, while about one in 10 highlight accounting and administration. These findings likely reflect a near-term need to prioritize functions and selectively deploy available resources as the fund raises capital and establishes a track record.

The First Two Years

Hedge funds launch with capital from a variety of investors, such as the personal funds of the general partners, friends and family, and key investors.

However, survey responses regarding anticipated sources of capital over the next two years suggest general partners will rely heavily on investments from personal and professional networks during the formative stages of the fund (Figure 2). About seven of 10 general partners surveyed plan to seek funds from business associates, and a similar number expect to turn to friends and family.

Nearly two in five general partners are seeking more money from family offices. Previous research has shown that many family offices are strongly interested in new hedge funds. However, accessing these boutique money management organizations can be a steep hurdle, as the family office universe, while growing by leaps and bounds, is often intentionally opaque.

A substantial minority of hedge fund general partners expects to source capital from family offices. However, most new funds are not immediately planning to seek funds from investment professionals or institutional sources such as pension funds, endowments and foundations. This is a realistic and necessary approach for most new funds. Despite increased anecdotal and documented interest in “smaller” funds among these investors, they tend to shy away from funds without an established performance history.

The situation changes dramatically as hedge funds approach maturity. After the first two years, the chart is essentially inverted, with institutional investors replacing personal and professional networks as the most likely sources of capital (Figure 2).

What is clear is that the general partners of these hedge funds are looking to leverage their existing networks to raise capital. Few expect to initially be in a position to effectively approach many institutional investors. However, that scenario changes after two years.

The Capital Roundup

July 2015

« Previous Article

| Next Article »

Login in order to post a comment