Over the last five years, the performance of U.S. stocks has outpaced that of international stocks by a country mile. But over the next five years, it appears likely the leadership torch will pass to stock markets outside the U.S., according to Stephen Peak, director of international equities and lead portfolio manager for the Henderson International Opportunities Fund.

Peak’s viewpoint is widely shared. “Certainly, being in the U.S. has been a winning strategy for investors over the last few years, while being in international securities has cost investors money,” he says. “But you have to ask yourself what the next five years will look like.”

Peak believes change is in the wind because economies, corporate earnings and stock markets have recovered at a different pace around the world since the financial crisis. In the U.S., efforts to prop up the economy soon after the financial crisis with such measures as slashing interest rates sped up economic recovery and led to steady, if not spectacular, economic growth. Investors gravitated to the U.S. markets as companies delivered strong earnings growth and stock valuations rose.

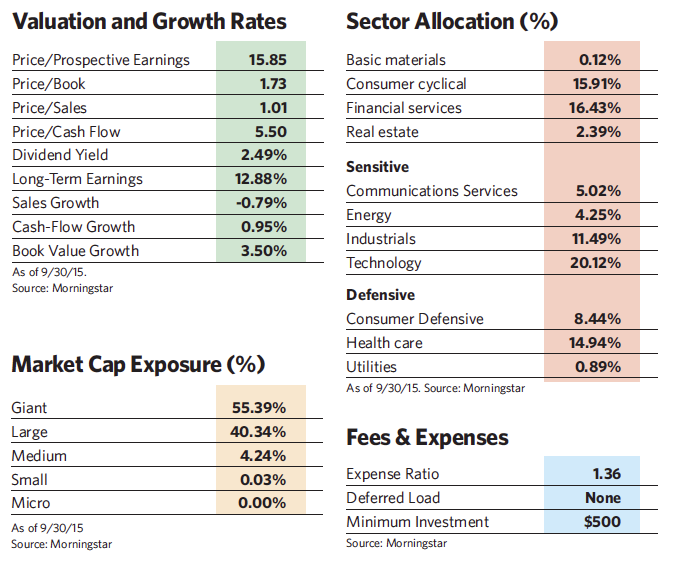

At this point, the U.S. market looks fully priced according to measures such as price-to-earnings and price-to-sales ratios, says Bill McQuaker, the Henderson fund’s asset allocation strategist. “It’s difficult to see any headroom for U.S. corporate profits given how high they have been already,” he adds.

By contrast, Continental Europe is in the earlier stages of its economic recovery, and with the tailwind of a weaker currency, its companies have a stronger shot at earnings upside than those in the U.S. Market valuations also aren’t as rich by comparison. A similar story is unfolding in Japan, where currency depreciation is increasing profitability and quantitative easing continues to open up credit markets.

Emerging markets, particularly China, remain the wild card of global markets. While economic growth in China has slowed considerably in recent years, McQuaker points out that the country has shown it can keep expansion going at a reasonable pace. “The most likely outcome in China is that the economy will continue to move along, but no salvation and no disaster seems to be the order of the day. We will likely see periodic rallies in equities and currencies, but it’s difficult to make a powerful case for a sustained upturn.”

Nonetheless, the firm is monitoring developments in the area with an eye toward a possible increase in allocations should positive trends continue. Peak, who began his career at the age of 18 at a British insurance company after graduating from secondary school, says he sometimes fields questions from U.S. financial advisors about how much of their portfolios they should devote to international securities at this point.

Although he hesitates to give specific figures, he believes “the time is right to start thinking about increasing international exposure. Of course it suits our book to make the case for international. But I believe we also have the benefit of distance from the U.S. market.”

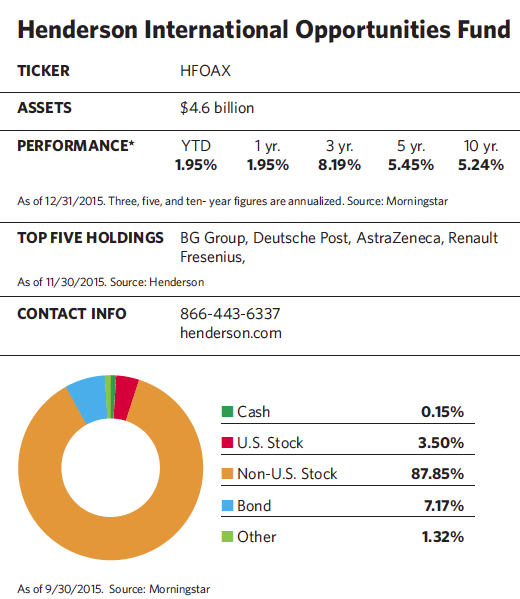

Launched in 2001, the Henderson International Opportunities Fund, offered by U.K.-based Henderson Global Investors, now holds some $4.6 billion in assets, and its performance suggests there is a foreign turf advantage. Over the three years ending December 15, the institutional class of the shares outperformed 96% of the fund’s Morningstar peer group, and over the last five years it beat 95% of its peers.

The fund has a somewhat unorthodox decision-making process. While most actively managed funds have one or two managers supported by a team of analysts, this one segregates its portfolio into six distinct and independently run geographic “sleeves.” Each has a separate manager with ultimate authority over the 10 to 15 best stocks from his particular region. Although the managers often run their ideas by Peak, they are not required to.