Over the last five years, the performance of U.S. stocks has outpaced that of international stocks by a country mile. But over the next five years, it appears likely the leadership torch will pass to stock markets outside the U.S., according to Stephen Peak, director of international equities and lead portfolio manager for the Henderson International Opportunities Fund.

Peak’s viewpoint is widely shared. “Certainly, being in the U.S. has been a winning strategy for investors over the last few years, while being in international securities has cost investors money,” he says. “But you have to ask yourself what the next five years will look like.”

Peak believes change is in the wind because economies, corporate earnings and stock markets have recovered at a different pace around the world since the financial crisis. In the U.S., efforts to prop up the economy soon after the financial crisis with such measures as slashing interest rates sped up economic recovery and led to steady, if not spectacular, economic growth. Investors gravitated to the U.S. markets as companies delivered strong earnings growth and stock valuations rose.

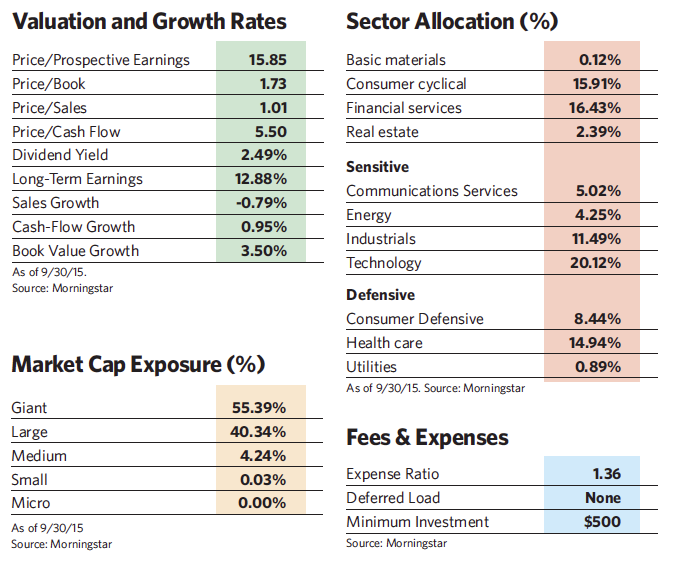

At this point, the U.S. market looks fully priced according to measures such as price-to-earnings and price-to-sales ratios, says Bill McQuaker, the Henderson fund’s asset allocation strategist. “It’s difficult to see any headroom for U.S. corporate profits given how high they have been already,” he adds.

By contrast, Continental Europe is in the earlier stages of its economic recovery, and with the tailwind of a weaker currency, its companies have a stronger shot at earnings upside than those in the U.S. Market valuations also aren’t as rich by comparison. A similar story is unfolding in Japan, where currency depreciation is increasing profitability and quantitative easing continues to open up credit markets.

Emerging markets, particularly China, remain the wild card of global markets. While economic growth in China has slowed considerably in recent years, McQuaker points out that the country has shown it can keep expansion going at a reasonable pace. “The most likely outcome in China is that the economy will continue to move along, but no salvation and no disaster seems to be the order of the day. We will likely see periodic rallies in equities and currencies, but it’s difficult to make a powerful case for a sustained upturn.”

Nonetheless, the firm is monitoring developments in the area with an eye toward a possible increase in allocations should positive trends continue. Peak, who began his career at the age of 18 at a British insurance company after graduating from secondary school, says he sometimes fields questions from U.S. financial advisors about how much of their portfolios they should devote to international securities at this point.

Although he hesitates to give specific figures, he believes “the time is right to start thinking about increasing international exposure. Of course it suits our book to make the case for international. But I believe we also have the benefit of distance from the U.S. market.”

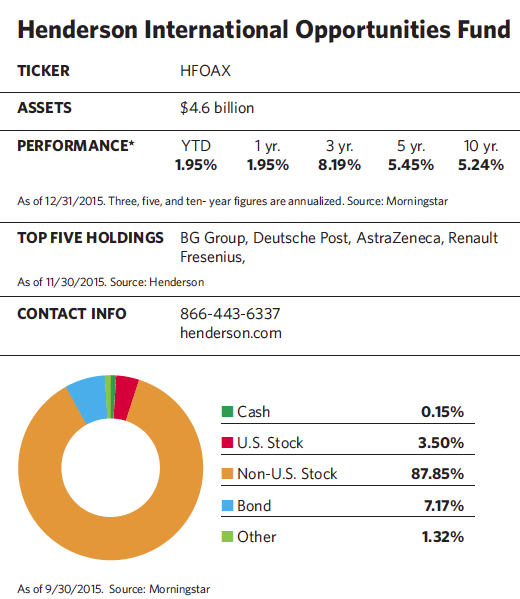

Launched in 2001, the Henderson International Opportunities Fund, offered by U.K.-based Henderson Global Investors, now holds some $4.6 billion in assets, and its performance suggests there is a foreign turf advantage. Over the three years ending December 15, the institutional class of the shares outperformed 96% of the fund’s Morningstar peer group, and over the last five years it beat 95% of its peers.

The fund has a somewhat unorthodox decision-making process. While most actively managed funds have one or two managers supported by a team of analysts, this one segregates its portfolio into six distinct and independently run geographic “sleeves.” Each has a separate manager with ultimate authority over the 10 to 15 best stocks from his particular region. Although the managers often run their ideas by Peak, they are not required to.

One thing he does insist on is that selections don’t focus too heavily on a particular stock or sector. The fund limits sector weightings to 20% of assets (unless the sector represents more than 20% of an index). With about 75 holdings, the fund owns fewer stocks than most of its international competitors. But there are no big individual stock bets, and the top 10 holdings usually account for only 20% to 35% of assets. The fund’s annual stock turnover is 75%, which is about average for its peer group.

While regional allocations vary, depending on market conditions and outlook, the fund usually allocates between 50% and 60% of its assets to Europe, 15% to 20% to Japan, 10% to 15% to Asia (outside Japan) and 2% to 5% to Latin America. Another 4% to 10% goes into “global growth,” a catchall category for growth companies around the world. What’s unused goes to cash.

Because Europe is such a large part of the portfolio, the region is divided into two parts overseen by different managers. Europe 1, which Peak covers, focuses on growth-at-a reasonable-price stocks and turnaround situations of any size. Europe 2, handled by Tim Stevenson, zeros in on mid-cap and large-cap companies with above-average prospects for earnings growth and higher valuations.

The mix among turnaround value companies and those with better growth prospects can vary, depending on market conditions. In 2014, for example, a conviction that the economy appeared to be bottoming out and that a recovery was on the horizon led the fund to overweight Peak’s side of Europe, which contained a number of companies with reasonable valuations that the market had misjudged and that stood to benefit from more favorable market conditions.

The Henderson fund’s holdings include Nokia, which it first acquired in late 2013. The Finnish telecommunications company’s announcement of intentions to acquire France’s Alcatel-Lucent has been met with skepticism by investors, who believe the combination would be a repeat of the ill-fated and unsuccessful merger of Alcatel and Lucent in 2006.

But Peak believes the combination will be successful for a number of reasons. While it was unclear which company would take charge after the Alcatel/Lucent merger, Nokia’s position as the acquirer makes it the choice for leadership. The combination will also improve the new entity’s pricing power and expand its footprint in the region.

Another contrarian pick of the Henderson fund was BG Group, the U.K.-based oil and gas company that became part of the portfolio in early 2015 as it was being acquired by Royal Dutch Shell. In exchange for its BG shares, the fund will now receive a mix of Shell’s shares and cash. Peak believes the acquisition will benefit Shell by lowering its costs and expanding its natural gas operations.

Moreover, the fund purchased the BG shares at a discount of about 9% to their value at acquisition (slated to occur in early 2016). Peak says he intends to hold on to the acquirer’s shares after the takeover. “The Shell shares yield about 8%, and I don’t think the company will cut its dividend in 2016,” he says. “I’m not trying to call oil prices, but given the risk/reward profile of BG, I feel this is a decent case for contrarian exposure.”

On the growth side of the Europe sleeve the fund holds French company Essilor, a leading global provider of corrective lenses. The company operates in 54 countries and boasts a suite of headline lens brands such as Varilux and Crizal. It also develops and sells equipment for prescription laboratories, as well as instruments and services for optical professionals. “With an aging population, Essilor has broad demographic support and the ability to gradually grow market share over time,” Peak says. “Its medium and long-term future seems pretty well assured.”

Holdings in the Asia/Pacific sleeve of the portfolio include Hong Kong’s Cheung Kong Property Holdings, a large property developer in Hong Kong with a strong presence in mainland China. The fund picked up the stock about a year ago after a currency devaluation in China heightened investors’ concerns about property values there. “Shares are trading at about half the asset value of the company, so this presents an interesting opportunity,” Peak says. “I think investor unease will dissipate and the discount will narrow, so there should be some decent upside.”

His fund’s Japanese holdings include Denso, a leading supplier of advanced automotive technology, systems and components for major automakers. Peak believes the company will be a major beneficiary of the increasing use of collision avoidance systems and other technology to enhance automotive safety.

“Automotive technology used to be things like headlight bulbs,” he says. “Now this is more like a quasi-technology company, and the business is more profitable than it was five or 10 years ago.”