Exciting small companies receive their fair share of attention from investors, even if their stocks have short track records. Less-glamorous but more predictable large company stocks with greater stability also get noticed. But sandwiched in the middle of these are a huge swath of medium-sized companies.

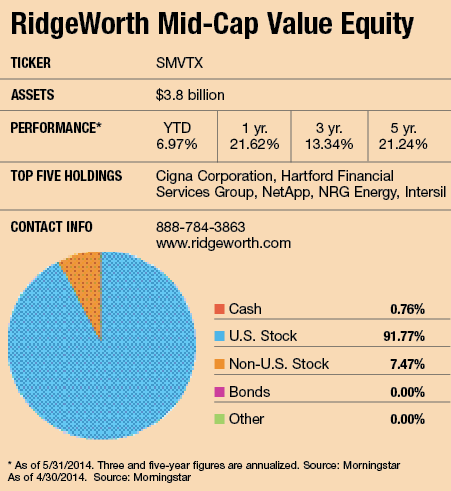

Investors who ignore these in-betweeners or get them only through indexes may be selling them short says Don Wordell, who manages the $3.8 billion RidgeWorth Mid-Cap Value Equity Fund. According to Wordell, the beauty of mid-caps is that they offer the same opportunity to exploit market inefficiencies that small-cap stocks do, yet mid-caps also have the kind of liquidity large companies do. “They combine the investment characteristics of both,” he says.

Investors who ignore these in-betweeners or get them only through indexes may be selling them short says Don Wordell, who manages the $3.8 billion RidgeWorth Mid-Cap Value Equity Fund. According to Wordell, the beauty of mid-caps is that they offer the same opportunity to exploit market inefficiencies that small-cap stocks do, yet mid-caps also have the kind of liquidity large companies do. “They combine the investment characteristics of both,” he says.

Because mid-cap companies have already been small caps at some point in their lives, Wordell contends that they have tested business models and experienced management. They’re especially well-suited for an economic recovery because they often have higher earnings growth than small caps and greater expansion potential than their more mature large counterparts. And mid-caps can be swallowed up by larger companies with swollen stock values seeking to complement core competencies or reach new markets.

Mid-caps have also done well against other stocks over recent short and longer-term periods. Over the five years ended March 31, mid-caps gained 212%, while large caps gained 169% and small caps 197%. Led by the numerous real estate investment trusts (REITs) and utilities in the mid-cap space, the Russell Mid-Cap Index posted a 4% gain during the first quarter of this year as bond yields moved lower and investors sought high-yielding safe havens. The large-cap Russell 1000 gained 2%, while the small-cap Russell 2000 rose 1% over the same period.

Mid-caps can also can make sense as a longer-term portfolio diversifier, according to a study from RidgeWorth last year noting that mid-cap stocks have delivered higher returns than large- and small-cap stocks for most rolling periods during the past 33 years. While mid-caps have participated in most of the market’s upside, they have also avoided much of the downside of small caps. Historically, the standard deviation of mid-caps has been closer to that of large companies than that of smaller ones.

The study also suggests that the stocks offer a way to balance market risk with appreciation potential, a characteristic that’s particularly attractive when markets appear to be at an inflection point. If the economy continues to gain momentum, mid-caps could outperform large caps. But if it falters, or if economic indicators begin to languish again, mid-caps would likely have better downside protection than more speculative small company stocks.

The Case For Mid-Caps

July 1, 2014

« Previous Article

| Next Article »

Login in order to post a comment