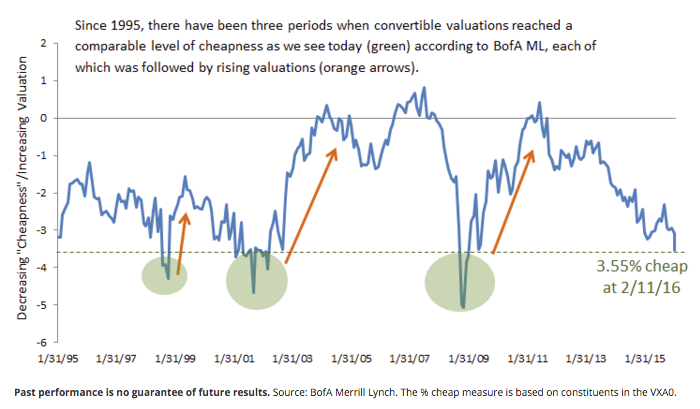

BofA Merrill Lynch: Convertible % Cheap (January 31, 1995 through February 11, 2016)

Convertible-securities-valuations

Conclusion

As we have discussed, the structural characteristics of convertibles can provide unique advantages over stocks and traditional fixed income securities. However, these same attributes also add to the complexity of the convertible security. Selectivity and experience will remain essential in identifying the specific convertibles with the most attractive risk and reward characteristics.

Past performance is no guarantee of future results. Source: BofA Merrill Lynch. The % cheap measure is based on constituents in the VXA0.

In light of our outlook for slow U.S. economic growth and continued elevated market volatility, we believe convertibles offer attractive potential for long-term investors. The potential for narrowing spreads, a rebound in convertibles’ underlying equities, and improving convertible valuations may be setting the stage for a convertible trifecta. Encouragingly, convertibles and their underlying equities have shown signs of stabilization in the second half of February. From the February 11 lows through the end of month, the underlying stocks of the VXA0 have climbed 8.45%, while the VXA0 has returned 4.47%.

Scott Henderson is senior vice president and portfolio specialist at Calamos Investments.

The Convertible Trifecta

March 3, 2016

« Previous Article

| Next Article »

Login in order to post a comment