The price of an asset is the result of thousands of different investors deciding if they want to buy or sell.

Understanding the mindset of investors is therefore a critical element in an investment process.

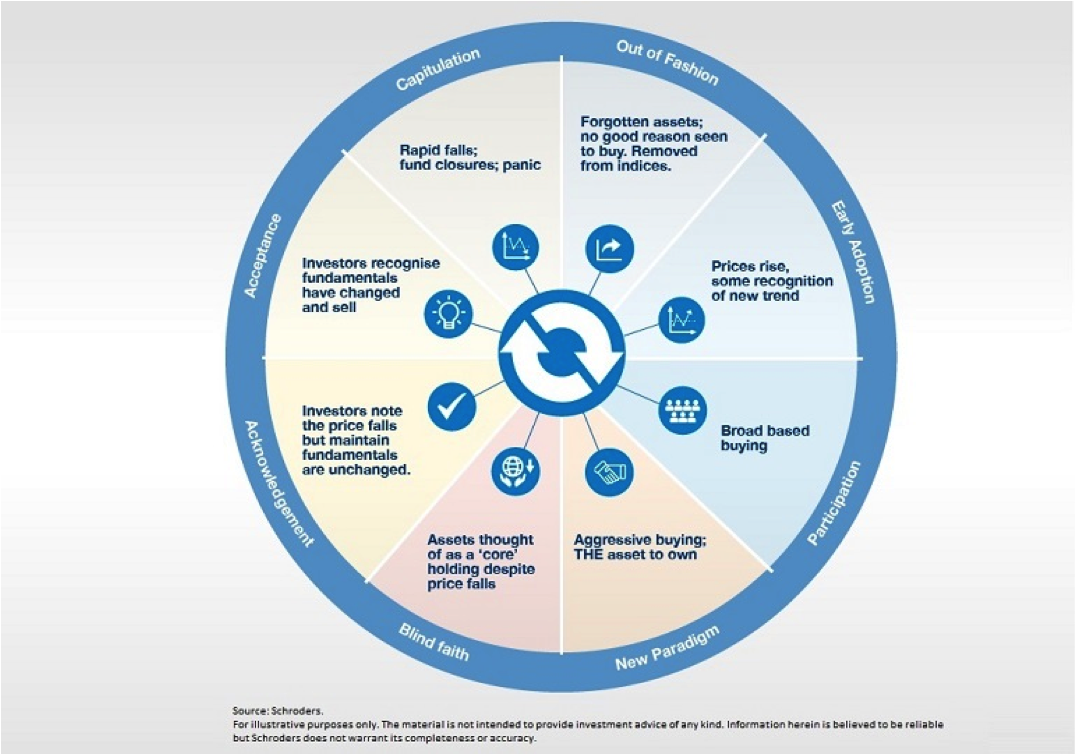

In order to draw reliable conclusions from this rather woolly area a systematic framework is needed; our approach is to use the long-term sentiment cycle.

What is the crisis mindset?

The global financial crisis of 2008 resulted in most assets falling into “capitulation” in the cycle.

This episode scarred many. Investors have been looking over their shoulders ever since.

There have been just enough events since to keep this crisis mindset alive: the eurozone crisis of 2011/12, the China slowdown and more recently concerns about interest rates in the US and Brexit.

This crisis mindset means investors are always worried. They think if an asset starts to fall it’s the start of a new bear market, not a buying opportunity.

How do we gauge sentiment?

This was clear in February this year, when stocks fell and pessimism became extreme.

Our sentiment indicator for global stocks shows investor despair collapsed to levels last seen in the global financial crisis.

The peak in pessimism marked the low in global stocks, which have since recovered.