The price of an asset is the result of thousands of different investors deciding if they want to buy or sell.

Understanding the mindset of investors is therefore a critical element in an investment process.

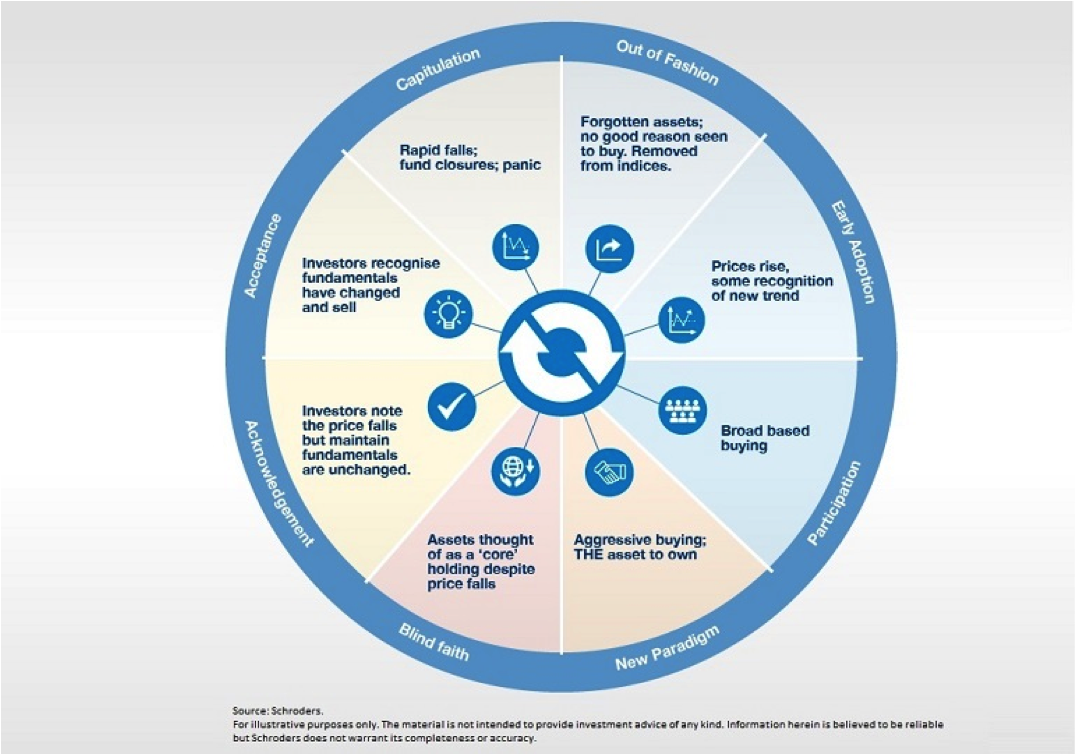

In order to draw reliable conclusions from this rather woolly area a systematic framework is needed; our approach is to use the long-term sentiment cycle.

What is the crisis mindset?

The global financial crisis of 2008 resulted in most assets falling into “capitulation” in the cycle.

This episode scarred many. Investors have been looking over their shoulders ever since.

There have been just enough events since to keep this crisis mindset alive: the eurozone crisis of 2011/12, the China slowdown and more recently concerns about interest rates in the US and Brexit.

This crisis mindset means investors are always worried. They think if an asset starts to fall it’s the start of a new bear market, not a buying opportunity.

How do we gauge sentiment?

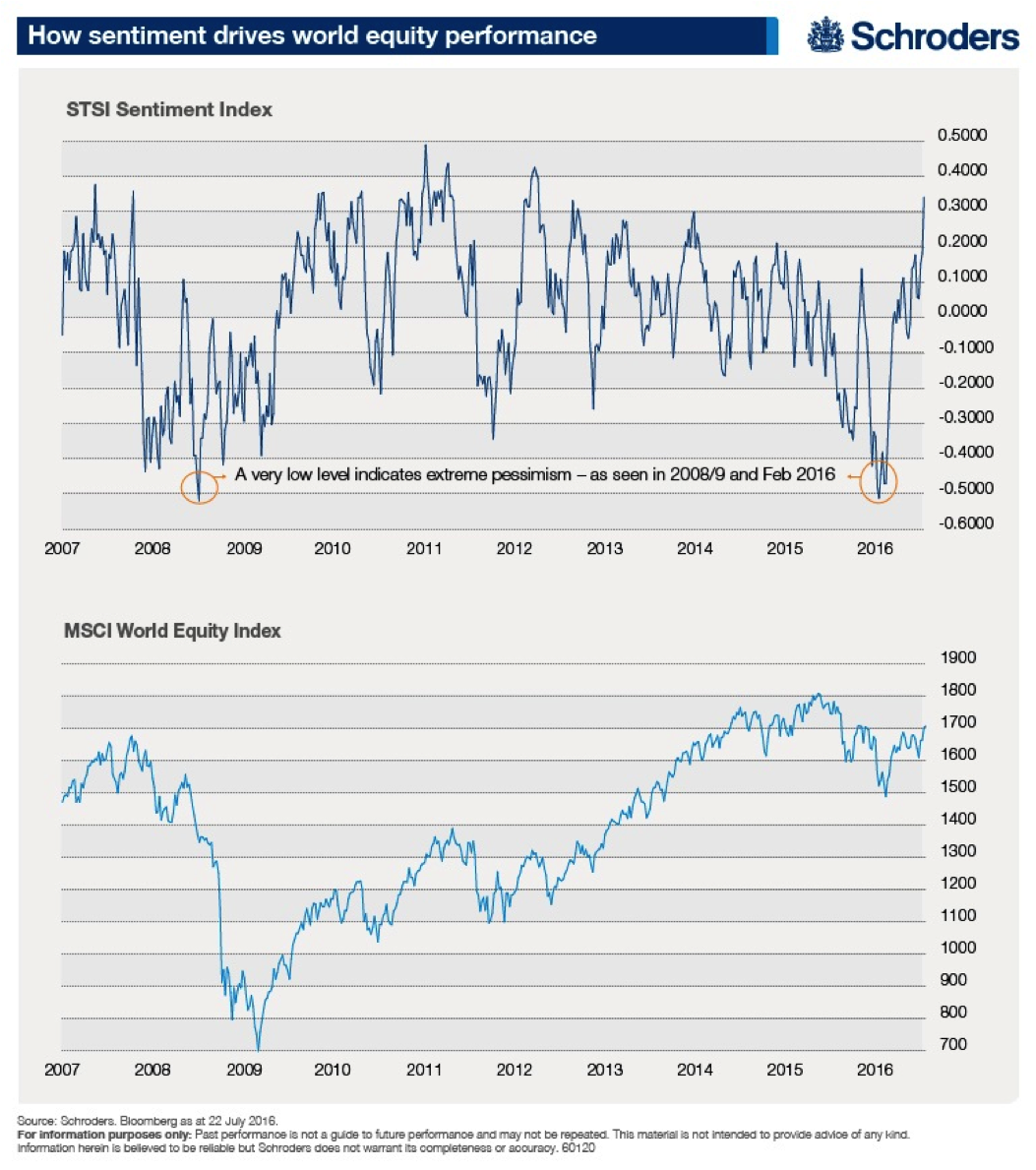

This was clear in February this year, when stocks fell and pessimism became extreme.

Our sentiment indicator for global stocks shows investor despair collapsed to levels last seen in the global financial crisis.

The peak in pessimism marked the low in global stocks, which have since recovered.

How can sentiment stifle a recovery in assets?

There is an important time element to the sentiment cycle, the longer it takes to work through the “capitulation” and “out of fashion” phases, the slower an asset will progress through the positive stages of the cycle.

The crisis mindset has become so engrained assets can appreciate in price in an orderly nature, but investors are slow and reluctant to buy the asset as they are afraid of losing money and don’t really believe the rally for years.

The crisis mindset means investors are unwilling to seize opportunities and only participate after persistent, strong returns.

Is confidence emerging among investors?

This has been the case this year, particularly for emerging markets and commodities.

Skepticism is still high but reluctantly investors are starting to dip their toes back in the water as the fear of missing out overwhelms the caution.

The time for caution is when most are optimistic and euphoric; we are a very long way from that.

Bull markets climb a wall of worry; at the moment the crisis mindset still dominates.

This is now the most positive part of the sentiment cycle. It has taken years to get here but the new bull market in emerging market bonds, stocks and currencies may now be in its infancy.

Malcolm Melville is wealth preservation manager at Schroders.