Inflation may follow a weaker pound due to higher import and oil prices. Given the long period of “low and slow” in the UK’s economy, inflation would normally be welcomed. However, the uncertain environment may force the BoE to keep interest rates low to support businesses.

Economy

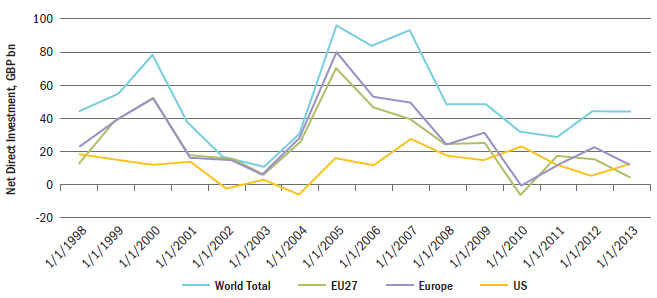

The UK’s primary concern post-Brexit would be its high current account deficit and the foreign direct investment (FDI) needed to fund it. As seen in the following chart, Europe contributes a significant proportion of net FDI in the UK.

Net direct investment in the UK by foreign companies

Source: Macrobond – April 2016

Any disruption in the flow of FDI would be problematic to the UK, although there is still a substantial proportion of FDI which originates from outside of the EU. One can only hope that this was not invested in the UK purely as a platform into the EU.

Trade with the EU (which accounts for roughly half of the UK’s total trade) would likely decrease post-Brexit. A study from the Centre for European Reform suggests that “the UK’s trade with the other EU members is 55% higher than one would expect, given the size of these countries’ economies.” This could imply that the UK is over-reliant on trade in the EU based on the ease of trade, which will almost certainly decrease with a departure from Europe.

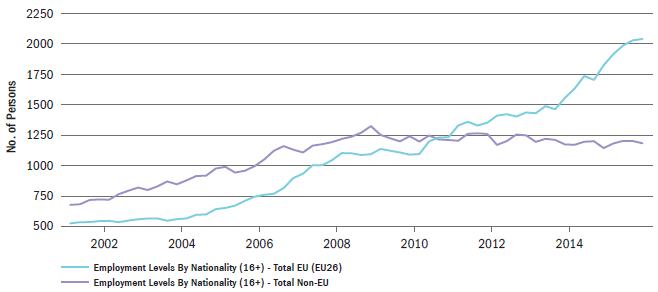

On the employment front, the following chart shows that the UK has seen a steady increase in EU workers over time.

UK employment levels by nationality – EU & non-EU

Source: Macrobond – April 2016

Outside of the free movement of labor in the EU, we would see a shift in the composition of the UK workforce. While the number of jobs available to UK citizens would increase, the time needed to fill these roles would impact companies if EU employees were unable to remain working in the UK. Ultimately, this all would put pressure on wage rates and, in turn, the economic health of the UK in the short run.

Finally, we should expect a prolonged period of uncertainty, brought about by the extended renegotiations to dampen GDP growth generally, sapping confidence and undermining activity more broadly.

Markets

Within fixed-income markets, UK gilts (bonds issued by the British government and generally considered low risk) could be seen as less of a safe haven due to the possibility that companies may move their headquarters elsewhere on fears that the BoE could struggle to maintain its grip on policy. However, the majority of gilt holders are UK pension funds and central banks, which are unlikely to leave the UK markets because of the Brexit decision.