Key Points

- In June, the European Central Bank (ECB) will begin buying European investment-grade corporate bonds as part of its economic stimulus program.

-

Because bond yields move inversely to bond prices, the ECB's buying may lead to lower European corporate bond yields.

- We think this may indirectly support the U.S. investment-grade corporate bond market, as international investors may be pushed to seek out higher-yielding alternatives.

In June, the European Central Bank (ECB) will start buying investment-grade corporate bonds as part of an economic stimulus program known as quantitative easing (QE). This would mark an expansion of a program that has so far focused mainly on government and agency bonds.

We believe the additional demand from the ECB, which is poised to buy billions worth of European corporate bonds, may push European corporate bond prices higher and yields lower. ECB bond purchases may even be supportive of the U.S. investment-grade corporate bond market, as lower yields on European bonds could encourage international investors to seek out higher-yielding alternatives—and U.S. corporate bonds offer some of the highest yields in the developed world.

Why is the ECB buying corporate bonds?

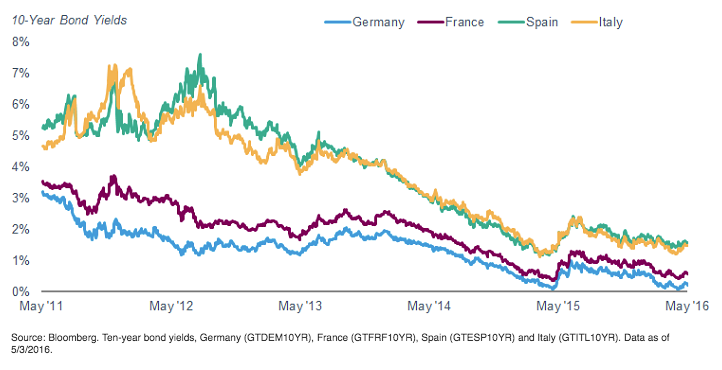

Because it's running out of other bonds to buy. The ECB has been buying bonds for years in an effort to pump cash into the economy, reduce bond yields, increase businesses' access to credit, and boost growth and inflation. While the jury's still out on the success of boosting the economy, yields in the euro zone have fallen significantly over the past few years.

European bond yields have dropped to historically low levels

In March 2015, the ECB launched its most expansive asset purchase program yet—the Expanded Asset Purchase Programme. Eligible securities included government bonds, certain types of European agency bonds and asset-backed securities, to name a few. However, there are both issue and issuer limits to the program. The ECB can only hold so much of a certain issue, or a certain percentage of an issuer's bonds, and the purchases are getting close to those limits. It's also limited to buying bonds whose yields are higher than the ECB's deposit facility rate. At the rate it has been buying bonds, the central bank soon will run out of bonds to buy, given those limits. That's one reason the ECB decided at its March 2016 meeting to make corporate bonds eligible for purchase.

What does it mean for U.S. corporate bonds?

We think the ECB's corporate bond-buying will be supportive of the U.S. investment-grade corporate bond market. Increased demand from the ECB likely will push up European corporate bond prices and push down yields. Over time, yield-seeking international buyers may have to look elsewhere.

Corporate bond yields in Europe are already well below those of similar-maturity U.S. corporate bonds. The average yield to worst of the Barclays U.S. Corporate Bond Index is 3.1%, compared with just 1.1% for the Barclays Euro Corporate Bond Index.1 We think that yield advantage already makes U.S. investment-grade corporate bonds attractive relative to European bonds. If the ECB's buying leads to even lower yields, demand for U.S. corporate bonds may remain high, especially from international investors.