The real question investors will grapple with at the conclusion of this week’s Federal Reserve (Fed) meeting is whether the Fed is pro-growth (a friend) or a potential threat (foe) to financial markets. Market volatility increased following the Fed’s interest rate hike in December 2015; financial conditions tightened, or became less conducive for economic growth, before loosening in the past few weeks as extreme pessimism faded. Although interest rates remain low by historical standards, the market’s behavior in 2016 has clearly shown discomfort with the prospect of four interest rate hikes in 2016.

Now, the ball is in the Fed’s court to meet rising expectations that its forecast of future interest rate hikes (known as the “dot plots”), last updated in December 2015, are too aggressive and need to be revised downward. (Please see this week’s Weekly Economic Commentary for details.) Failure to reduce forecasts may disappoint investors who view gradual rate hikes as potentially restricting future economic growth. Additionally, continuing to describe low inflation or overseas risks as “transitory” may come across to investors as out of touch with reality.

Overseas Action

Will the Fed continue to run counter to global central banks? In an increasingly global financial world, the Fed also does not want to appear out of touch with global developments. Over the past year, more than 20 central banks worldwide have lowered interest rates. Last week, the European Central Bank (ECB) over-delivered by increasing the amount of monthly bond purchases, broadening purchases to include non-financial corporate bonds, and easing terms further on bank lending programs that were successful in boosting economic growth after the 2008 recession. This week, the Bank of Japan met investor expectations by suggesting that additional stimulus may be on the way, after acting aggressively in February.

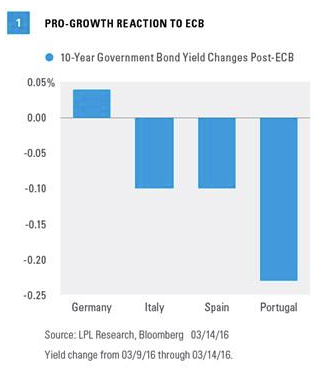

Financial market reaction to the ECB actions qualifies as pro-growth. Since the ECB’s decision last Thursday (March 10), yields on top-quality German bunds have increased (in anticipation of better economic growth) and yields on lower-rated, more economically sensitive peripheral European countries have declined (in anticipation of less risk) [Figure 1]. Corporate bond prices have also increased, with yields declining in response to corporate bond purchase announcements.

The yield increase on the 10-year German bund is modest at just 0.04%, as friendly central bank policy and the potential for more is generally supportive of high-quality bond prices. It also remains to be seen just how effective the measures will be, but the ECB has certainly done what it can. The difference between segments of the market in response to the ECB is striking.