Fed On Deck

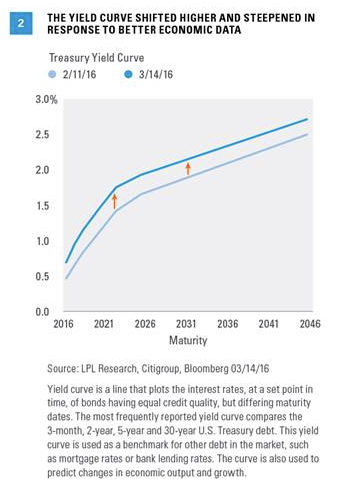

Now it is up to the Fed to support the pro-growth moves. In the U.S., bond markets have signaled more growth via a steeper yield curve since the mid-February lows [Figure 2]. Improving economic data have been the biggest driver of the move, along with a reduction in investor pessimism. The 10-year Treasury yield has increased by 0.3% since then but remains lower by a still notable 0.3% year to date, suggesting investor psychology remains fragile amid global risks. The yield differential between the 2- and 10-year Treasury, another measure of yield curve slope, has increased in recent weeks; however, it remains not far off the narrowest (or flattest) levels of the past few years. There is still room for the Fed to have a positive impact.

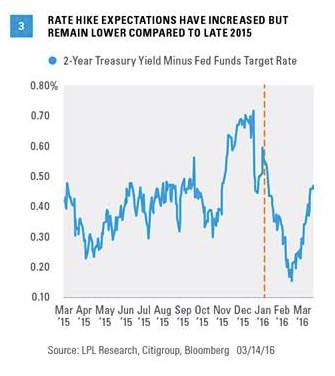

Market-implied Fed rate hike expectations have increased, as measured by the yield differential between the 2-year Treasury, among the most sensitive to Fed rate hikes, and the fed funds target rate set by the Fed [Figure 3]. The greater the yield differential, the more investors expect the Fed to raise interest rates. Rate hike expectations have increased in recent weeks but remain relatively benign. For all of 2016, only one rate hike is fully priced in according to fed fund futures and just two and a half rate hikes are priced in by the end of 2017. Bond investors expect the Fed to signal it is moving closer to these expectations.

Conclusion

Focus now shifts to the Fed possibly delivering a market-friendly message that will include a forecast of fewer rate hikes. It is unlikely the Fed will move all the way to market expectations, as it typically moves slowly. Nonetheless, failure to satisfy market expectations could undermine the rising pro-growth view and support Treasuries once again at the expense of lower-rated, more economically sensitive bonds like high-yield.

Anthony Valeri is investment strategist for LPL Financial.