• Market expectations for Federal Reserve rate hikes are too low considering developments in fundamental economic data.

• The U.S. economy is near full employment and inflation is approaching the Fed’s target 2% rate.

• Market expectations will eventually align with economic fundamentals, which point toward higher interest rates over the next year.

Divergence between market expectations and Federal Reserve outlook

The Federal Reserve and the market are strange bedfellows. The Fed is ponderous and deliberate, while the market has recurring and often wild mood swings. As the market interprets economic data and messaging from the Fed, it cycles through periods of accelerating and dampening expectations. Today the market is dampening expectations: economic fundamentals remain solid enough for interest rates to gradually rise, but markets are expecting the Fed to raise rates just once in the next 12 months.

The market’s view seems increasingly disconnected from the fundamentals of the U.S. economy. While not exciting or overwhelming, fundamentals show a healthy economy with inflation approaching the Fed’s 2% target and near-full employment.

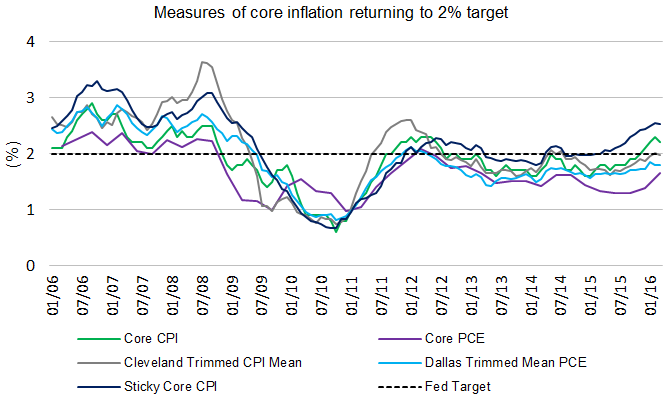

Inflation measures approaching Fed’s 2% target

After a period of extraordinarily low inflation in the U.S., many of the higher quality measures of inflation are near or above the Fed’s 2% target. Perhaps the most important for the Fed, core Personal Consumption Expenditures (PCE) inflation sits at 1.65%, up from 1.3% last September. Other similar measures, like core Consumer Price Index (CPI) inflation and sticky core CPI, have been above 2% for nearly six months. These core inflation measures capture the underlying trend of prices without shocks from volatile goods like food and energy.

Sources: Bloomberg, Columbia Management Investment Advisers, LLC, May 20, 2016