Requiring these funds to lose 1Ž2% would mean they start in the hole. Not what a fund manager wants to do. But it has to be short-term cash, as the money has to be available on very short notice since it’s the collateral for a futures contract. I’ve sat and thought about this and still haven’t come up with a way around this. I wonder how many other funds will have the same issue. (We will discuss this subject in further depth in a few paragraphs.)

Go Thou and Do Likewise

The Fed is specifically warning banks, but NIRP will affect the whole economy. If you own any kind of business or you are an active investor, I expect that NIRP will create significant headaches for you. Are you ready?

Most of us have no idea whether we’re ready, but we might be able to find out. Here’s a simple test. Go to whatever accounting software or spreadsheet program you use, find the interest rate setting and see if it will let you enter a negative number.

If it won’t accept a negative rate at all, now might be an excellent time to update your software.

If the program does let you show a negative rate, dig a little and see how that rate affects the rest of your bookkeeping. Most of us have created numerous Excel spreadsheets. You know that if you get your programming off a little bit, you end up with ##### signs in some of the cells. When you enter negative interest rates into your software, you may find similarly weird things happening. They could be good-weird or bad-weird, but in either case you might want to consult your brokerage firms, investment advisors, accountants, and tax advisors about possible consequences.

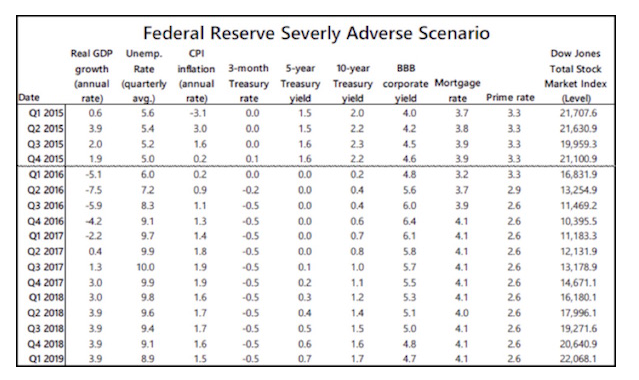

While you’re at it, think about how the rest of the Fed’s “severely adverse” scenario might affect you. Here is the guidance the Fed gave the banks:

(Yes, I know they spelled severely wrong. Clearly the Fed needs a new proofreader along with new policies. That said, you just can’t catch all the mistakes. There are at least three professional editors who read my letter prior to publication, and misteaks still happen.)

I didn’t even mention the Fed’s stock market scenario in the right column above. It shows the Dow dropping almost to 10,000 by the end of this year and recovering very slowly. In a world where anything is possible, I suppose it is prudent to ask what if questions. I do not see the Dow’s dropping 10,000 points this year, but in a deep recession? That plunge would not be out of the realm of historical precedent. If banks are planning for adverse scenarios, it would be a good idea for you to do so, too, even if you think there is no chance in hell those scenarios will play out. Contingency planning is simply prudent management. Don’t let a recession catch you without a plan.