"Does the Fed have a credibility problem?"

That was the first question posed to Federal Reserve Chair Janet Yellen at Wednesday's press conference following the central bank's decision to leave monetary policy unchanged, and its signal that instead of the four rate increases it anticipated implementing this year, there will be just two.

Forward guidance, remember, was supposed to give businesses and consumers a reliable feel for where borrowing costs are headed. Increasingly, though, central banks, in the argot of financial markets, are becoming price takers rather than price makers.

Forward Guidance

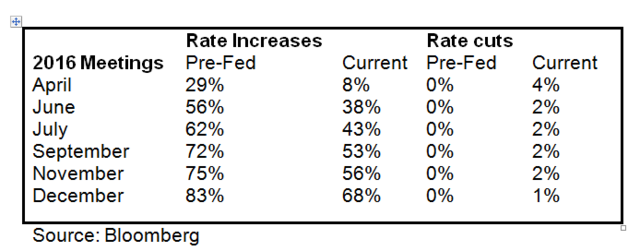

As well as reducing bets on the likelihood of further Fed monetary tightening this year, traders in the futures markets are starting to anticipate the possibility, although still remote, of lower borrowing costs. The following table shows market expectations for Fed rate moves, contrasting levels prior to the Wednesday announcement with current prices:

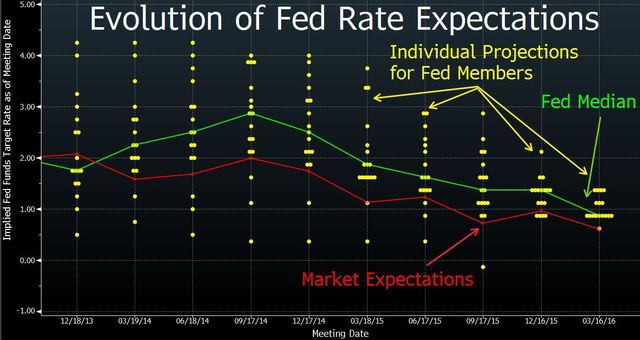

Fed members haven't just been reducing their own expectations for how much borrowing costs might rise; the range of likely outcomes has also compressed, as measured by the so-called dot plot in the Fed's press releases showing individual projections of Fed members. And, importantly, market expectations as measured by a market measure called Overnight Indexed Swaps have led, rather than followed, those Fed projections:

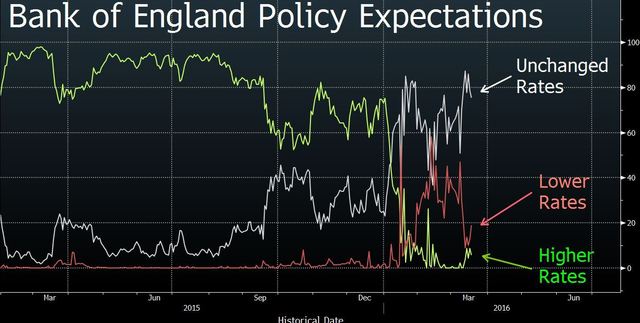

To be fair, the Fed isn't alone in having to backtrack. The Bank of England also left borrowing costs unchanged on Thursday. Traders who had previously taken Governor Mark Carney at his word that the next move in rates was likely to be an increase are now convinced that the current 0.5 percent rate will stay in place at least for the rest of the year:

The two increases that the Fed still anticipates this year now seem as unlikely as the four it previously saw; and while Yellen says April remains a "live meeting," traders see a less than 8 percent chance of an increase next month. With other central banks still on the path of monetary easing -- Norway drove its benchmark rate down by a quarter-point to 0.5 percent on Thursday -- the Fed's December rate increase looks increasingly like a policy mistake that may have to be unwound, rather than augmented. If there is indeed a U.S. rate cut this year, the Fed's credibility will suffer, and the reputation of forward guidance may be fatally wounded.