Few people would disagree with the notion that the federal income tax regime has become so complex that few taxpayers can actually understand their federal income tax returns, not to mention state, city and local taxes. From a federal income tax perspective, taxpayers essentially have four tax regimes to deal with. The first is the ordinary income tax, which, under the American Taxpayer Relief Act of 2012 (ATRA), exposes high income earners to a 39.6% marginal income tax rate. High income earners are classified as single people with taxable income above $400,000 and married couples filing jointly with taxable income above $450,000 (these amounts are annually adjusted for inflation). The second regime is capital gains; these same high-income earners are exposed to a 20% long-term capital gain tax rate. For those who do not fall into the high-income-earner category, the long-term capital gain tax rate is 15%, with certain low-income earners paying no tax on long-term capital gains. The third regime is the alternative minimum tax (AMT). The fourth, for some lucky taxpayers, is a 3.8% net investment income tax to deal with.

With all of these various taxes to deal with, accountants, attorneys and financial planners should understand how all of them operate and overlap. Before 2011, when the estate and gift tax exemptions were increased to $5 million (indexed annually for inflation), estate tax planning was a hot topic and concerned many clients. But now in 2015, with the $5.43 million unified estate and gift tax exemption, estate tax planning is dead in the eyes of many clients because most Americans don’t have over $5 million in net worth. Furthermore, with the ability to use a deceased spouse’s unused exemption (“portability,”) married couples can transfer up to $10.86 million in 2015 to their children free of estate and gift taxes. There is also a $5.43 million exemption for generation-skipping transfer (“GST”) taxes, although there is no portability for the GST tax exemption. So now, with the high transfer tax exemptions and the higher income tax rates, the income tax has become the new estate tax to many clients.

While all clients should be doing some form of estate planning, most Americans don’t need estate tax planning. However, almost all Americans need and want advice about how to reduce their income taxes, and it is important for advisors to have at least a basic understanding of the four federal income tax regimes, because while one strategy helps avoid one type of income tax, it may result in other income taxes. Clients may be appreciative of tax planning strategies advisors help them implement, but at the end of the day clients only truly care about how much tax they saved. So if a strategy results in lower ordinary income taxes but correspondingly causes AMT and the 3.8% surtax to increase by a greater amount, the client is not better off and is probably not going to be happy.

Let’s briefly go over the four federal income taxes.

Ordinary Income Tax

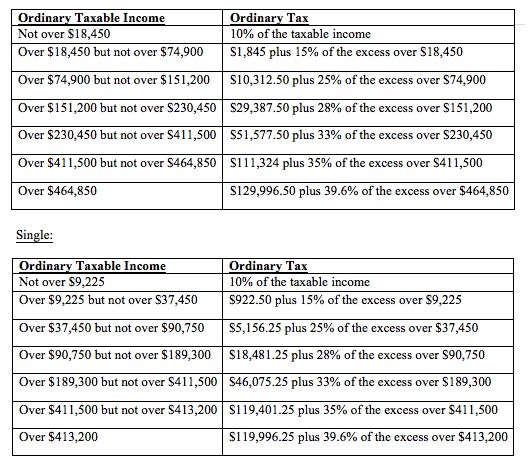

At a high level, ordinary income tax is levied on “ordinary” taxable income. For example, ordinary items of income would include wages, qualified retirement plan distributions, short-term capital gains and ordinary trade or business taxable income, among many other items of income. Certain deductions are allowed to reduce one’s gross income and compute ordinary taxable income that is subject to the ordinary tax rates. For 2015, the federal ordinary income tax rates are as follows:

Married Couples Filing Jointly:

Long-Term Capital Gains Tax

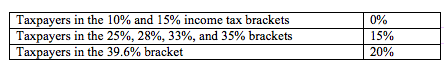

Capital gains are income from the sale of capital assets, which, to put it as simply as possible, are nonbusiness assets. The sale of a capital asset is generally subject to ordinary income tax rates. It is only when a taxpayer owns a capital asset for more than 12 months that the preferential and lower long-term capital gain tax rates apply. A donee can add the donor’s holding period to the donee’s holding period in determining if the donee has met the 12-month holding period. Someone who inherits property from a decedent automatically is treated as having met the 12-month holding period requirement and, thus, will receive long-term capital gains treatment upon a sale of the inherited asset (not including income in respect of a decedent). Also, qualified dividends are subject to these favorable long-term capital gain tax rates. The long-term capital gain and qualified dividend tax rates under ATRA are:

The long-term capital gain tax rates, however, are intertwined and dependent on ordinary taxable income and ordinary income tax rates. Based on the complexity of the tax code, a capital gain tax calculation may result in some of the gain being taxed at 0%, some at 15% and some at 20%. For example, if a married couple files a joint income tax return for 2015 and has $50,000 of ordinary taxable income and a $4,000,000 long-term capital gain, the result would be:

- $24,900 of the capital gain would be subject to a 0% tax rate.

- $389,950 of the capital gain would be subject to a 15% tax rate.

- $3,585,150 of the capital gain would be subject to a 20% tax rate.

- The total capital gains tax would equal $775,523, for an effective capital gains tax rate of 19.39%.

Alternative Minimum Taxable Income (“AMTI”)

AMTI includes many items of income that are also taxable for ordinary income tax purposes, but probably most important to AMT is that many deductions that are allowed to reduce ordinary taxable income are not allowed to reduce AMTI. Also, some items of income that are tax-free for ordinary income tax purposes are not tax-free for AMT purposes, such as interest income from private activity bonds. This may result in AMTI being higher than ordinary taxable income, which may further result in AMT being more than the ordinary income tax. A taxpayer must pay the higher of the two taxes.

Taxpayers are allowed an exemption from AMT, which, up until recently, was not indexed for inflation. ATRA decreed that the AMT exemption would be indexed annually for inflation. For 2015, the exemption is $83,400 for married couples filing jointly and $53,600 for single taxpayers. However, once a single taxpayer has 2015 AMTI of $119,200 and a married couple who file jointly have 2015 AMTI of $158,900, the AMT exemption starts to phase out.

By a simple scan of IRS Form 6251 (Alternative Minimum Tax -- Individuals), one can see the many items of income and deductions that are treated differently for AMT and ordinary income tax purposes. For example, state income taxes and property taxes are not deductible for AMT purposes. Also, the standard deduction is not allowed for AMT purposes. AMT rates are 26% or 28% of AMTI depending on the taxpayer’s AMTI, although the long-term capital gain tax rate used for ordinary taxes is also used for AMT.

Medicare Net Investment Income Surtax

The surtax is an additional tax on ordinary income and capital gains that meet the definition of net investment income. Net investment income includes interest, dividends, rents, royalties, the taxable amount from an annuity and passive activity income, as well as the gain from the sale of capital assets. Taxpayers who have modified adjusted gross income (“MAGI”) above the thresholds are exposed to the surtax. The threshold for a single taxpayer is $200,000 and for married couples filing jointly is $250,000 (these thresholds are not indexed for inflation). For purposes of the surtax, MAGI is defined as adjusted gross income (“AGI”) plus foreign earned income that was excluded from AGI.

The formula to calculate the surtax for individuals is:

3.8% × the lesser of: (1) net investment income or (2) MAGI -- threshold

Sample Client

Let’s review various income tax situations for a married couple when they change their investments.

Example 1: Married couple filing jointly who have the following income in 2015:

- Wages = $650,000

- Taxable Interest = $75,000

- Qualified Dividends = $125,000

- Net Long-Term Capital Gain = $150,000

Ignoring any itemized deductions, standard deductions or personal exemptions, the couple has taxable income of $1,000,000, of which $275,000 is subject to long-term capital gains tax rates. This would result in:

- Ordinary Income Taxes = $233,016 (no AMT in Example 1)

- Capital Gain Taxes = $55,000

- Net Investment Income Tax = $13,300

- Total 2015 Income Taxes Payable = $301,316

Example 2: If the couple invested in municipal bonds that produced $300,000 of tax-free interest income instead of other investments that produced the taxable interest, qualified dividends and capital gains, the couple would have ordinary taxable income of $650,000 (wages); however, the $300,000 of interest from the municipal bonds is subject to AMT (assuming they are private activity bonds), resulting in:

- Ordinary Income Taxes = $203,316

- AMT = $266,000 ($950,000 of AMTI × 28%)

- Capital Gain Taxes = $0

- Net Investment Income Tax = $0

- Total 2015 Income Taxes Payable = $266,000 ($35,316 less than in Example 1)

Example 3: If instead of investing in municipal bonds as in Example 2, the couple invested in a tax-deferred vehicle and reduced their taxable interest, dividends and capital gains to zero for 2015, leaving only wages of $650,000, the result would be:

- Ordinary Income Taxes = $203,316 (no AMT in Example 3)

- Capital Gain Taxes = $0

- Net Investment Income Tax = $0

- Total 2015 Income Taxes Payable = $203,316 ($98,000 less than in Example 1; $62,684 less than in Example 2)

As one can see, taxes play a significant role in a client’s investment decisions and in after-tax investment returns. It is important to understand how all the income taxes work together, as well as estate and gift taxes, if applicable. Tax-deferred investments, such as deferred annuities and permanent life insurance, may be very beneficial for certain clients who are currently in a high income tax situation and who may be in a lower income tax situation later on.