Conventional wisdom about retirement has been slowly shifting over the past couple of decades. Many people realize they might have to work past age 65, that they haven’t saved enough, that they might be caring for both adult children and aging parents. They fear college tuition costs for their children might rise well in excess of inflation. Some economists even argue that we’re at a bizarre and minatory inflection point—in which stocks are at their peak value and bonds, languishing amid rising interest rates, will lose their power to yield—and that the two awful trends, when taken together could whipsaw older Americans trying to draw blood from their securities.

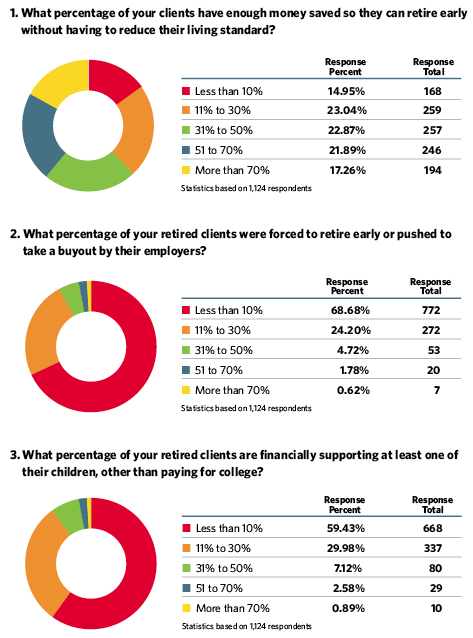

In a recent survey of 1,124 advisors performed by Financial Advisor magazine, 62.90% of advisors said that their clients decided to work longer because they felt their savings were not enough to retire on, though this was one of many options they could choose; 88.97% said their clients made the choice because they enjoy working. Health benefits also played a big role in the decision, as some half of the advisors (49.56%) said their clients were continuing to work because they needed the health benefits. A substantial number (37.46%) said their clients were continuing to work because they had a business or practice they couldn’t sell.

“The last five years for interest-only savers has been a total loss,” says survey participant Louis Avalos, an advisor with Waddell & Reed in Cosa Mesa, Calif. “However, for those who have used bond funds, dividends stocks and income portfolios, the results have been much better. If they are bold, the use of income annuities has helped provide some real income.”

When asked whether their working clients are more optimistic or less optimistic about having enough money for their lifetimes, only 10.68% of advisors said their clients were more optimistic, while 35.41% said their clients were less optimistic (53.92% said their clients felt about the same). Some 42.79% said that their prospects (as opposed to their clients) were unrealistic about what they would need to save for retirement, while only 6.5% were very realistic (50.71% were “somewhat realistic.”)

When 1,124 advisors were asked what percentage of their clients age 65 and older were still working, the average percentage was 31.52%. But when they were asked what percentage of their clients age 55 and over had planned to work past age 65, the number was much greater: 67.25%.

The answers also showed the changing nature of the retirement plan landscape. Of 1,060 advisors polled, the average percentage of clients receiving defined benefit plan income was a measly 21.53%, whereas DC plan participants, on average, represented 52.41% of those getting income.

The political landscape has bred pessimism among older clients, says Joseph Tovey, an advisor in New York City speaking to Financial Advisor in a follow-up interview. He says there are a few reasons why those clients are more pessimistic about their ability to save.

“No. 1 they have already been advised it’s a high probability that Social Security payments will be reduced,” he says. “No. 2 they’ve been advised that there is a great deal of stress in the economy”—and that inflation will destroy the dollar value of whatever they have, whether it’s annuities or pensions.

No. 3 they feel they have been set up for political reasons and they are very distrustful of the current administration, he says. At least that’s the feeling among older clients. Those in their 20s to their 50s feel they will not do as well as their parents did—that cost-of-living adjustments have been manipulated “and that they have a declining standard of living to look forward to,” Tovey says.

That means people are going to have to adjust their spending and not take as many trips or eat in fancy restaurants. For investments, Tovey says, it means taking a middle-of-the-road approach and addressing the twin concerns of liquidity and inflation: he mentions high-quality government bonds in the former case and, in the latter, gold and possibly things like farmland.

Jeffrey E. Budd, an advisor with Strategic Advisers in Paramus, N.J., says he’s been surprised by the pessimism expressed by his clients, whom he classifies as mainly high-net-worth. “I have never seen more upset/nervous people, despite an absolutely wonderful run from both the bond and stock market over the last five-plus years,” he says. “Many people left the workforce early or were underemployed at the end of their careers.”

Budd adds many clients don’t believe we are in an actual recovery. “They are seeing their pensions cut, their health-care costs are going through the roof, and early retirees are fearing bridging the gap to age 65 for Medicare benefits,” he says. “There is zero wage inflation, and virtually every consumer cost (except gas) is moving up. Food prices, taxes, health care, etc., are experiencing massive inflation costs. Employment-wise, virtually every industry is negatively impacted.”

That includes doctors (his specialty is physicians such as OB/GYNs, radiologists and anesthesiologists), as well as law and accounting. “My retiring doctors are telling the younger doctors to get out of the industry,” he says. They are “leaving private practices, developing multi-doctor partnerships, running to hospital practices, retiring early, etc., to escape extraordinary insurance costs and divest litigation risk.

“The lawyers are battling LegalZoom.com. The CPAs battle TurboTax. The financial advisors are facing the onslaught of robo-brokers. I can’t think of a single career (other than computers) which hasn’t been negatively impacted by technology change.”

As the landscape changes, there are worries that yesterday’s income strategies might not work. In an era of extreme volatility, unwinding assets might be difficult, especially when assets might be more expensive than you think and not as safe as advertised. There are worries that the incredible stock run-up is partly a result of distortion due to quantitative easing by the Federal Reserve and its cheap money policies, which have led to asset inflation, and that stocks might not perform as well in the future when retirees need them to.

So how do you invest? “That one is a tough question,” says Avalos. “With rates in the trash, the idea of living off the safe bank account is pretty scary. The last five years for interest-only savers has been a total loss. However, for those who have used bond funds, dividend stocks and income portfolios, the results have been much better. If they are bold, the use of income annuities has helped provide some income.”

Budd, likewise, says he uses many of the tools in the tool kit—namely, bond and CD ladders, bond funds, guaranteed investment accounts (or GIAs, a type of deferred annuity contract), stock dividends, preferred securities, convertibles, REITs and MLPs.

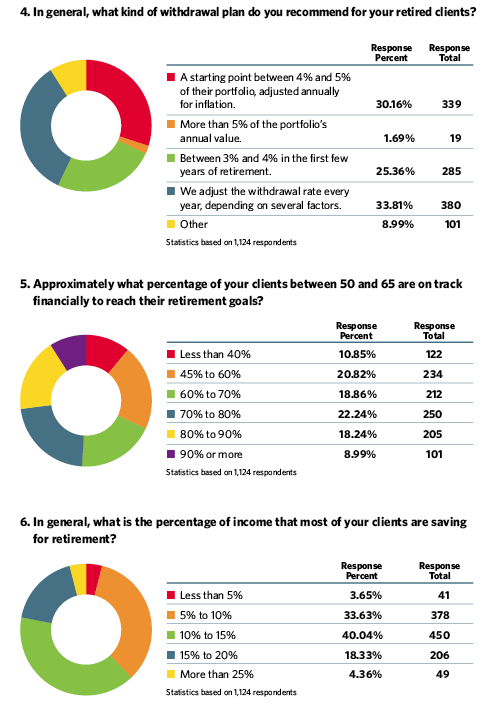

Slightly more than 30% of the 1,124 advisors in the survey said they use a withdrawal rate of 4% to 5% of their clients’ portfolios as a starting point in retirement, a rate then adjusted for inflation. A little more than 25% said they start with 3% to 4% in the first few years of retirement. But the most, almost 34%, said they adjusted the withdrawal rate every year, depending on certain factors. Among those in the last camp is Shelly Aros, founder of Aros Asset Management in Orange, Calif.

“Everyone’s situation is different,” she says. “Some have pensions, others inheritance and some just don’t get [the idea of spending less than their income.]”

In this pursuit, Aros uses muni-bond funds, fixed and variable annuities and other products.

About 40% of advisors surveyed said their clients were saving 10% to 15% of their income for retirement, while 18.33% of advisors said their clients were saving 15% to 20%. A little more than 42% of advisors said that their clients are saving more than they did at the same age in years past, while only about 36% said they were saving about the same.

Health care is a big concern of retirees. Jeffrey Budd says clients are asking about it a lot. “Retiring at 62 and not having Medicare until 65 is a big concern,” he says. “As is the cost of [long-term-care insurance].”

He says he met a client recently who needs to admit a spouse to a long-term-care facility and the net cost is $10,000 per month. “And the source of the funds will be from a 401(k)/IRA. So figure [a] withdrawal rate from an IRA will be $12,500/month gross [to net] $10,000/month to pay for care.

“A lifetime of saving can be gone through at a rapid pace,” he says. “How many people can afford to take an additional $150,000/year out of their accounts?”

In Financial Advisor’s survey, 64.5% of the 1,124 advisors said they offered “limited” health-care advice as part of retirement planning, while only 16%

offered extensive advice. A little more than 19% offered no advice.

Avalos says health planning needs to start early—he mentions clients in their 80s and 90s in excellent health who practiced a lifetime of good health planning and compares them favorably with some in their 60s and 70s who practiced bad health planning and are now always running to the doctor.

“I think as advisors we need to also talk about health planning starting in the 30s, or otherwise people will be a mess by the time they get to 60 or sooner,” he says. “We really don’t have a pill for old age or feeling skinny. Those are our responsibility, so we need to start advocating this. Crappy health cannot be fixed by all the money in the world.”

For a complete version of the survey, please visit www.fa-mag.com on January 4.