For years, China has been perhaps the most significant driver of global savings. Current account surpluses increased given its historically heavy reliance on exports, but its reserves, at more than $3 trillion, are still the largest in the world. China’s foreign reserves have been falling recently, though, due to a slowing economy, investment in a transition to a more consumer-oriented economy, and most recently, using reserves to weaken its currency.

Eurozone: The New Source of Surplus

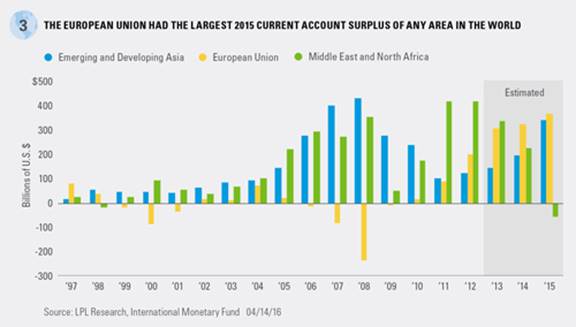

China’s slowdown has been offset by Germany, which has quietly become the new current account surplus champion of the world, first taking the crown in 2011. This surplus is in large part being caused by the “one-size-fits-all” approach of the euro. If Germany, which has one of the stronger economies in the Eurozone, had an independent currency, it would likely be stronger than the euro is now, which would make German exports more expensive. But given that the European Central Bank’s (ECB) easy money policy — mainly intended to help slower-growing peripheral nations — also applies to Germany, the weakened euro is helping boost demand for German exports, leading to a large current account surplus. Many countries in the Eurozone periphery have also seen increased surpluses; however, in contrast to Germany and EM countries, the surpluses are largely due to economic weakness, where demand for investment remains low. Figure 3 shows how the sources of global surpluses have changed over time.

The Role of Aging Populations and Corporate Cash

Aging populations in developed countries are one of the main drivers of the savings glut. An increasing proportion of employees are in the later years of their working lives, and on average, savings rates are highest in preparation for retirement. This behavior may help explain why Japan has experienced years of current account surpluses, even though it has been mired in a slow growth environment for years. The amount of cash held by corporations may also be having an impact, with much of the cash held overseas to avoid repatriation taxes.

Although surpluses are the main subject here, no discussion of surplus and deficit could be complete without addressing why the U.S., the largest economy in the world, has (and continues to run) a current account deficit. The major reason is that investment in the U.S. has continued to outpace savings due to an attractive business environment, liquid and developed financial markets that attract foreign capital, and the dollar’s position as the world’s preeminent reserve currency.

What are the Impacts of a Savings Glut?

Slower Economic Growth

In the short term, a current account surplus can be viewed as deferred economic growth, as savings do not contribute to consumption or investment today. Additionally, investments in new equipment, processes, and technology tend to increase economic growth over time, so a lack of current investment means future growth is also likely to be impacted. Slower economic growth in response to too much savings has several potential implications.