There’s been a great deal of talk about the pending “great rotation” and what it means for your portfolio. We’re told that investors, facing the potential for rising rates, stand ready to dump their fixed-income positions and rush into stocks.

Don’t believe the hype. For ETF investors at least, it ain’t happening.

ETF offer the easiest way to monitor investor behavior because you can see on a daily basis exactly how much money is flowing into and out of various products. Since interest rates started backing up in early May, investors have pulled a little over $500 million out of fixed-income ETFs. That sounds like a lot, but consider that there is more than $257 billion invested in the products. In other words, for ETF investors, the so-called “great rotation” has amounted to a whopping 0.2% of assets.

But just because investors haven’t rotated out of bonds, that doesn’t mean they are sitting still. There is a great rotation going on, and it’s just not out of bonds. Instead, it’s taking place within bonds.

Two Big Bets You Should Consider

Consider this: In July, investors pulled $5.2 billion out of 74 different fixed-income ETFs, while plowing $9.4 billion into 81 other fixed-income ETFs.

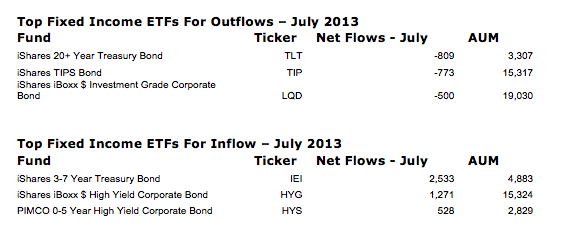

What are they doing? All you have to do is look at the top three fixed-income ETFs for both outflows and inflows for the month and it’s crystal clear.

Investors are making two big bets, sometimes independently, sometimes together. Bet 1: Shorten duration. Bet 2: Go long credit.

The first bet is obvious. The top fixed-income fund for inflows in July was the iShares 3-7 Year Treasury Bond ETF (IEI), which pulled in $2.5 billion. That more than compensated for the $800+ million flowing out of the iShares 20+ Year Treasury Bond ETF (TLT).