There’s been a great deal of talk about the pending “great rotation” and what it means for your portfolio. We’re told that investors, facing the potential for rising rates, stand ready to dump their fixed-income positions and rush into stocks.

Don’t believe the hype. For ETF investors at least, it ain’t happening.

ETF offer the easiest way to monitor investor behavior because you can see on a daily basis exactly how much money is flowing into and out of various products. Since interest rates started backing up in early May, investors have pulled a little over $500 million out of fixed-income ETFs. That sounds like a lot, but consider that there is more than $257 billion invested in the products. In other words, for ETF investors, the so-called “great rotation” has amounted to a whopping 0.2% of assets.

But just because investors haven’t rotated out of bonds, that doesn’t mean they are sitting still. There is a great rotation going on, and it’s just not out of bonds. Instead, it’s taking place within bonds.

Two Big Bets You Should Consider

Consider this: In July, investors pulled $5.2 billion out of 74 different fixed-income ETFs, while plowing $9.4 billion into 81 other fixed-income ETFs.

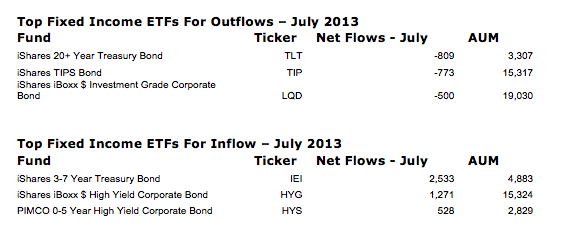

What are they doing? All you have to do is look at the top three fixed-income ETFs for both outflows and inflows for the month and it’s crystal clear.

Investors are making two big bets, sometimes independently, sometimes together. Bet 1: Shorten duration. Bet 2: Go long credit.

The first bet is obvious. The top fixed-income fund for inflows in July was the iShares 3-7 Year Treasury Bond ETF (IEI), which pulled in $2.5 billion. That more than compensated for the $800+ million flowing out of the iShares 20+ Year Treasury Bond ETF (TLT).

When rates rise, you want to shorten up on duration. TLT pays a much higher yield than IEI – 3.03% vs. 0.76%, according to IndexUniverse ETF Analytics. But the duration mismatch between the two funds is extreme: 18.8 for TLT versus 4.5 for IEI. Duration calculations are complex, but essentially, they measure how sensitive a bond is to increases in interest rates. Roughly speaking, a 1% backup in rates on long-dated Treasuries will cost you 18.8% in TLT; the same move in intermediate Treasuries will cost you just 4.5% in IEI.

With the long-term outlook for rates, it’s easy to see what investors are thinking.

The more interesting play we see throughout ETF-land is embracing credit. There’s been a great deal of discussion about the high-yield bond trade being crowded, but ETF investors are betting that’s not true. The second-most popular ETF for July was the iShares iBoxx $ High Yield Corporate Bond ETF (HYG), which pulled in nearly $1.3 billion in new assets. By comparison, its investment-grade counterpart (LQD), coughed up $500 million.

Is that a sensible bet?

Consider the numbers. LQD pays a 3.01% yield, but has fairly long duration at 8.2. HYG yields a massive 5.98% and has a duration of just 3.9. And if you want to cut down yet more on duration, the third-most popular fixed-income ETF in July -- the PIMCO 0-5 High Yield Corporate ETF (HYG) – nets you a yield of 5.02% and a duration of just 2.1.

You can get 60% more yield with 25% of the duration risk. With the economy continuing to strengthen and default rates approaching record lows, ETF investors are saying this is worth the risk.

We see other bets on the short duration/long credit spectrum, including the massive success of funds like the PowerShares Senior Loan ETF (BKLN), which has $5 billion in assets and pulled down $409 million in net inflows in July. The fund yields more than 5% with very low duration.

All told, fixed-income ETFs pulled in more than $4 billion in net new inflows in July. Evidence suggests the “great rotation” out of bonds is not going to happen any time soon. But the great rotation inside of bonds? It’s happening already, and if you’re not keeping pace, be prepared to tell your clients why.