The year 2008 was not a good one for 529 college savings plans. Parents about to send their high school seniors off to college saw their assets, heavily weighted in equities, suddenly wrecked by a plunging stock market. The sinking returns drew harsh criticism and lawsuits.

According to the Financial Research Corporation (FRC), 529 net sales (gross sales minus redemptions) fell precipitously in 2008, to $5.2 billion from $15.2 billion in 2007.

Now, to nurse their bruised public profile, plan sponsors have spruced up their offerings with new investment choices, lower cost structures and more asset protection. For advisors, there are new share classes designed for those who charge fees rather than commissions. The market upturn, meanwhile, has helped revive both portfolio assets and 529 plan sales.

Sales came back a bit in 2009, rising to $7.4 billion, and much stronger still in the first quarter of 2010, which saw $3 billion in net sales, nearly double the $1.7 billion posted in the first quarter the year before. The College Savings Foundation (CSF), a nonprofit group comprising investment firms, governmental bodies and other nonprofits promoting 529 plans, said its own member firms (who handle 38% of 529 plan assets) saw $1.6 billion in new sales in the fourth quarter of 2009, the highest level of new quarterly contributions since mid-2008. That represents a 25% increase over the third quarter and a 26% increase year over year.

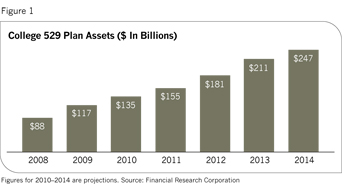

According to FRC, the assets in 529 savings plans are on track to hit $247 billion by 2014, which would more than double the size of the market at the end of 2009. And Bridget Bearden, a college savings research analyst at FRC, says there's even more room to grow, considering how much Americans are actually saving for college and how little the 529 market is in comparison.

"It is clear that this product has further opportunity for expansion," she says.

Plan sponsors have helped goose these sales forward by offering lower costs for the plans and more conservative investment options, including bank products, says Bearden.

In the last three months of 2009 alone, ten 529 college savings plans reduced their fees. FRC predicts that by the end of 2010, the total average costs for the plans, including investment management fees for component mutual funds, should drop to around 85 basis points, a 13 basis point decrease from October 2009.

Meanwhile, state 529 sponsors are now putting such ultra-conservative investment products as FDIC-insured savings accounts and CDs into their plans. Insured products now appear in the plans of Arizona, Colorado, Montana, Ohio, Virginia, Wisconsin and Utah. And new federal legislation will clear the way for more insured products: the Deposit Restricted Qualified Tuition Programs Act of 2009 (which passed April 20, 2010) clarifies that investments eligible for FDIC insurance may be held in federally tax-exempt qualified tuition programs.

This will almost certainly increase the popularity of FDIC-insured products. Some firms that offer 529 plans have added bond investments such as zero-coupon bonds, as well. Another popular option in many plans is the stable value option, where a life insurance company guarantees principal plus at least a small incremental return.

After getting slapped with lawsuits from disgruntled investors and suffering plan losses, the states also seem to be taking a more proactive role in monitoring investment managers and making changes if necessary. Ohio recently announced that in the fall it would switch program managers for its 529 advisor plan from Putnam Investments, which has held the job since 2000, to BlackRock. Meanwhile, Oregon recently tapped TIAA-CREF to replace Oppenheimer Funds, whose core bond fund created a stir when it fell 35% in 2008.

Still, the basic structure and rules governing 529 plans remain much the same as before the market downturn, including the strategies that drew so much ire. Much criticism, for example, has been aimed at those funds with high equity exposures for students who are at or close to college age. Such age-specific portfolios are supposed to hold an amount of equity appropriate for the number of years a child has until college, with the riskier investments diminishing as the time comes to pay out.

Yet many of these portfolios had one-quarter or more of their assets in equity mutual funds in 2008 when the market tanked, and many programs continue to maintain a significant amount of stock exposure in portfolios aimed at high school grads. Alliance Bernstein's portfolios have 35% of their assets in stock funds for college-age kids in its program. John Hancock has about one-quarter of assets in stock funds for the same group.

Program managers say the runaway costs of college make it necessary to maintain that exposure. "When college costs are going up at a rate of 7% to 8% a year, you need some exposure to equities even when a child is going off to college," says Jeff Coghan, director of 529 college savings plans at the Hartford Financial Services Group. The age-specific portfolios at his firm maintain a 20% exposure to equity funds for 19-year-olds.

And one of the 529 plan features vexing to financial advisors remains firmly in place-the IRS restriction limiting investment changes to only one per calendar year. While pending legislation would loosen that limit to twice a year, Coghan doesn't think it would affect investor behavior all that much. Even when students have the opportunity to switch investments once a year, they seldom do, he says, having made changes in fewer than 5% of the firm's 100,000 accounts.

For financial advisors reconsidering 529 plans, experts offer some advice on approaching the college savings market.

Look to your book. Coghan says that at his firm, more sales are made to those clients with existing 529 accounts than to brand new clients. "Advisors should consider talking to existing clients with children who already have 529 plans," he says. "They might also set up a meeting with grandparents who may be willing to pitch in. This market is more about extending current relationships than cold calling." Bearden adds that the more conservative investment options, including the FDIC-insured products, will broaden the 529 plan's appeal to risk-averse grandparents.

Expand your search. Students in some places get state tax deductions or credits if they use their own state's plan. But that's not always the case. For clients in states without tax benefits, an advisor can expand the search to other states or to other firms for something appropriate. Fee advisors should also find the universe of products more compelling as new share classes appear that dispense with sales charges or 12b-1 fees.

Examine fee structures. Bearden suggests that advisors should look closely when a company says it has reduced its fees for the plans. "Some companies are cutting their program management fees in half," she says. "But because they are raising their investment management fees at the same time, the savings may only amount to a couple of basis points."