Finding The Right Match

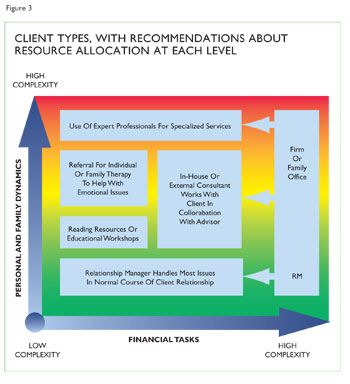

Many missteps in wealth management are the result of mismatches between the needs of the family and the approach taken by the wealth manager. Make sure your services and skills are consistent with the level your clients need due to their family complexity. Figure 3 shows a method of allocating resources to green, yellow, and red zone clients.

Monitor yellow zone clients closely and bring in outside consultants if the situation demands it. With at-risk clients, it's important to know when to call upon family dynamics experts, mental health professionals or other specialists. Other consultants who may be useful for serving this clientele include financially trained therapists, family business consultants and family wealth counselors. Yellow zone clients can turn into red zone clients if you are not careful or if you underestimate their complexity.

Recognizing when you need outside help is even more imperative with red zone clients. Red zone clients need highly expert consultation by both advisors and outside professionals. However, don't assume the entrenched red zone client will respond to even highly skilled family dynamics consultants. Clients deep in the red zone can be impervious to the best efforts of experienced professionals, leaving in their wake fired consultants and failed referrals. Finally, know when it's time to simply end the relationship. The goal, after all, is to embrace the Huxtables among your clientele, and weed out the Sopranos.

James Grubman, PhD ([email protected]), is a psychologist and consultant to families of wealth, their advisors, and other resources in the financial services industry. His practice, FamilyWealth Consulting (www.jamesgrubman.com), is based in western Massachusetts.

Dennis T. Jaffe, PhD ([email protected] and www.dennisjaffe.com), is professor of organizational systems and psychology at Saybrook University in San Francisco, and an advisor to families about family business, governance, wealth and philanthropy.