Behavioral, psychometrical, primed-state profiling, Ibbotson standard, AI facial and emotional recognition software—these are just a few of the many new approaches to assessing an individual’s level of investment risk tolerance. And yet, there are no silver bullets when it comes to risk measurement or financial plan profiling. Every tool and process has a weakness. There are so many prognosticators offering their views of how investor risk-profiling needs to be radically reshaped. Despite these prognostications, I’m less of a “Chicken Little” type, as I believe that we’re all better off if we focus on continuous improvement instead of perfection.

Investors want a simple “yes” or “no,” and advisors need to think about which tools are best for their clients and practice. The decisions we make each day add up to an investor’s overall financial health, and keeping investors involved in daily activities that support their long-term financial plan helps ensure they are more engaged in the success of an oftentimes lofty goal some 30 years out. A pervasive trend in the last few years, and perhaps for the foreseeable future, has been goals-based advice. Based on a September 2016 study by Vanguard research, advisors combining goals-based advice with interactive, investor-friendly risk measurement and a cohesive communication strategy, (“behavioral coaching”) presents the single largest opportunity to provide value to an investor. The study estimates the value provided through behavioral coaching at 150 basis points.

Given how valuable goals-based investing and planning can be, any new approach that a financial advisor considers must be able to address risk in the context of a client’s goals. Such an approach requires acknowledging that the quantitative aspects of risk, also referred to as risk capacity, can differ for goals of varying time horizons and magnitude. A risk assessment should then layer in behavioral tendencies to build an investment plan that the client can stick to. The risk assessment can vary based on the investor’s goal and their priorities relative to one another, and in reality, behavioral tendencies are not static and tend to vary over time and across goals. No single risk assessment will be able to incorporate all the factors discussed above, which is why it is critical for an advisor to incorporate a self-assessment of the client’s risk into their process. At a minimum, this self-assessment should include a goals-based plan that lets the client prospectively evaluate different risk levels associated with each goal against important trade-offs, such as evaluating different income levels related to specific goals and changing spending patterns to save more now rather than later. Advisors have seen clients answer questions one way at the beginning of the process and yet respond differently to those same questions over time, so showing clients different visions of the future relating to their specific goals is sometimes most effective in helping them define a true sense of their own risk tolerance.

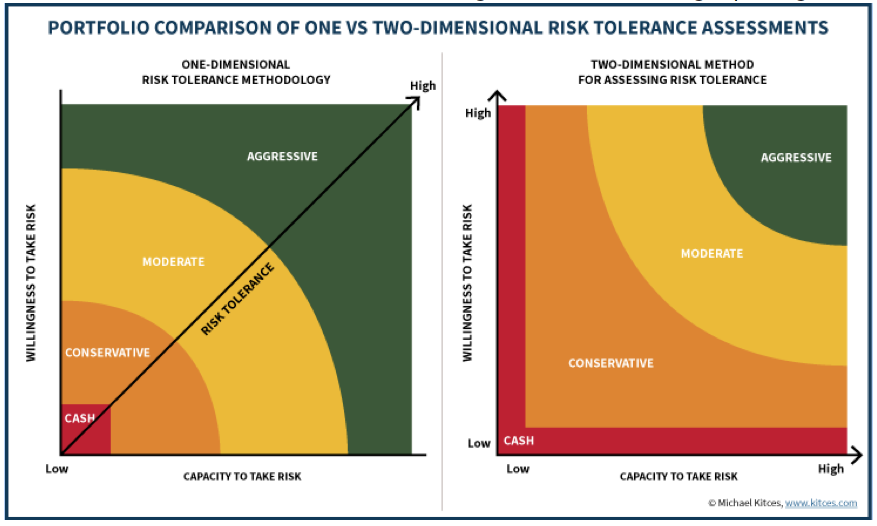

Financial consultant Michael Kitces laid out a great explanation for why a two-dimensional risk approach (capacity and tolerance) should be the basis for all evaluation methods. A client’s capacity should act as a constraint to their overall risk tolerance or when setting risk related to achieving a specific goal.

Of course, it’s not all about the measurement, and it’s important to note how clients engage with the process and the tools. Firms that engage in end-user testing know that investors relate to managing towards short-term micro goals and seeing the impact of daily activities. Suggesting that an investor track themselves against a goal with a 30-year time horizon is too amorphous. Rather, a broader goals-based approach lets an advisor focus on smaller short-term goals to demonstrate “wins” along the way, such as fully funding a 529 plan or making that last mortgage payment. This approach provides opportunities for celebration and achievement as investors move towards their ultimate goals.

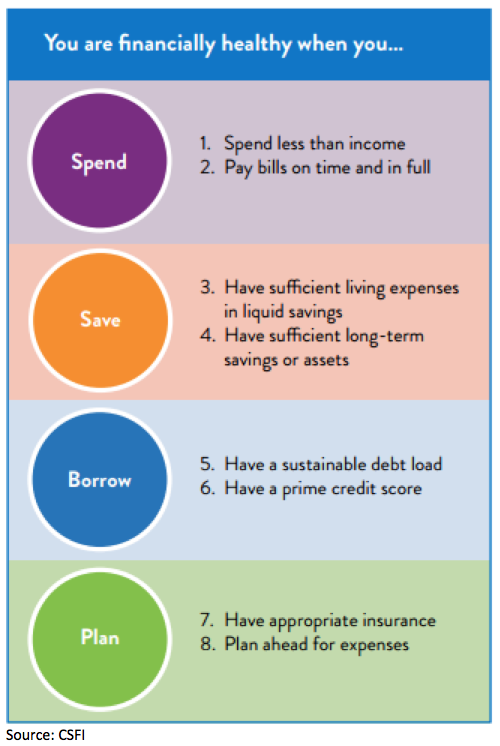

Another observation is that too many advisors focus only on investable assets. Many consumers struggle with daily goals and budgeting, which may prevent them from meeting their longer-term finance goals. The Center for Financial Services and Innovation (CFSI) has created a framework to expand this conversation that includes four components and eight indicators of financial health. The eight indicators focus both on outcomes and behaviors. Outcomes tend to be more stable or static, while behaviors tend to fluctuate more over time. It is important to monitor the fluidity of both to get a full picture of a client’s financial health within the context of their risk and ultimate financial goals.

According to CFSI, “For consumers, improved financial health is a gateway to other goals and dreams; it is closely tied to mental and physical health, family stability, education and economic mobility. For providers, focusing on consumer financial health provides a business opportunity to expand into new market segments, increase customer loyalty and drive long-term revenue streams, while addressing unmet market needs. Incorporating financial health indicators into regular business practices and key performance indicators (KPIs) is the key to unlocking deep insights about the state of customers’ financial health and identifying the products, services and strategies customers need to improve it.”

Advisors are encouraged to use tools that enable your clients to engage with these daily metrics so they feel involved in real life decisions and their daily transactions will create and power a “living plan”—one that’s not just updated annually, but rather is updated frequently with actionable intelligence for them. It’s critical not to just focus on your client’s wealth, but also to help improve their financial health, which has generally been outside the purview of many financial firms for a long time.

To help be successful in creating this living plan, I recommend the following three steps:

-

Pick a tool/process that you and your clients understand; it should measure capacity and willingness to take risk.

-

Broaden the view beyond your advisory assets to focus on your client’s overall financial health.

-

Integrate this into your offering not only from a process and procedures standpoint, but also holistically into your client portal and communication strategy.

Blake Wood is senior vice president and director of program innovation at Envestnet.