The monthly job market report is valued for its timeliness and its ability to drive the outlook for a number of sectors, including manufacturing, construction, and retail sales. Still, the figures are statistical estimates and seasonal adjustment is often difficult. The upside surprise in June followed a downside surprise in May. Such large month-to-month swings are unusual, but they do happen from time to time. Yet, if the weak May number was an anomaly, then so too was the figure for June. Job growth appears to have slowed, but not terribly.

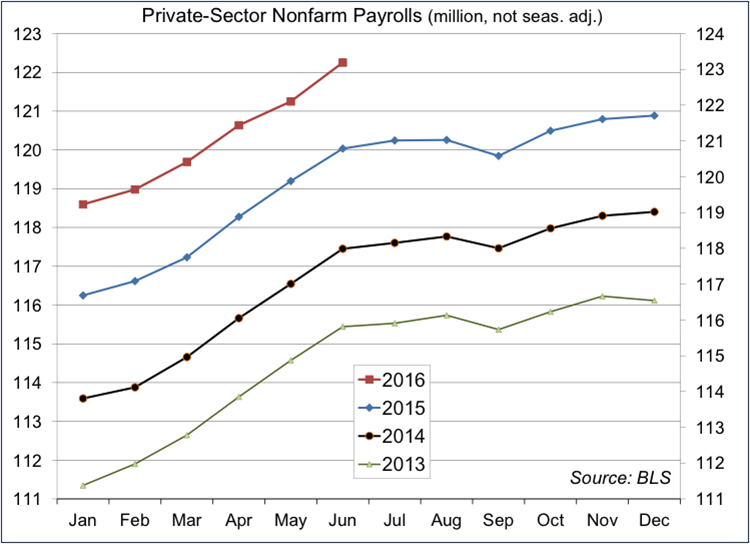

There is a seasonal pattern in jobs. A steep fall in January (marking the end of the holiday shopping season) is followed by strong gains in the spring. Last year, the economy added 4.098 million jobs between January and June. This year, 3.962 million were added over the same period – slower, but not by a lot.

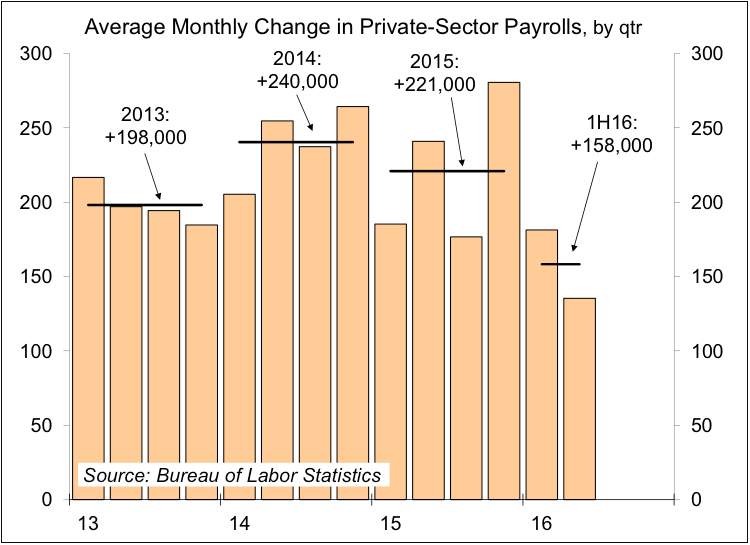

The three-month average reduces a lot of the noise in the monthly payroll figures. Job growth for the first half of the year was slower than in 2015 – the question is why.

Economic growth in the U.S. is expected to be moderately strong in the near term – not too fast, not too slow. However, the financial markets are likely to remain battered off and on by ongoing worries about the rest of the world.

Scott J. Brown, Ph.D., is chief economist at Raymond James & Associates.

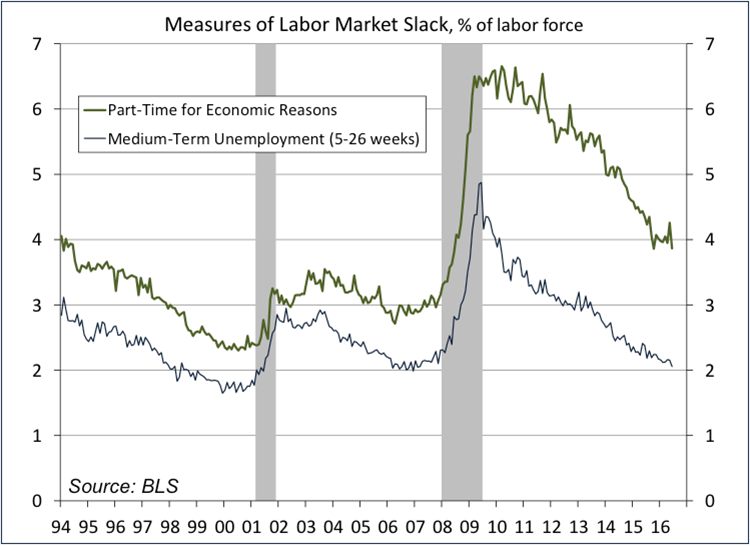

There is still a fair amount of noise in quarterly averages of payroll gains. So, some of the first half slowdown could be a fluke. However, more likely, firms have reduced their hiring. The ADP estimate of private-sector payrolls has shown a slower trend in hiring by large firms, which are likely more sensitive to the global outlook. Hiring has remained relatively strong for small and medium-sized firms, although somewhat slower this year. Anecdotally, many businesses report difficulties in hiring qualified workers (that is, those willing to work for what the firm wants to pay). With population growth slowing, the job market will tighten more rapidly than it would otherwise. Long-term unemployment and the percentage of people working involuntarily part-time are still above normal levels, suggesting that there is still a lot of slack in the job market, but they have been trending in the right direction.

The Fed needs to set monetary policy with an eye to where the economy is likely to be 12 months from now. It’s easy to imagine that the job market will be even tighter. Most Fed officials see this as justification for moving to a more neutral policy position. However, wage growth is still relatively moderate, hardly suggesting a “tight” job market. Moreover, the risks to the outlook are weighted to the downside. The problems in the rest of the world, and there are many, from Brexit, to shaky Italian banks, to a major restructuring in China, will have some impact here. However, the flight to safety has pushed long-term interest rates down, which ought to provide further support to the housing sector and should be stimulative for business fixed investment. Still, while the Fed is expected to remain in tightening mode (that is, pondering an increase in short-term interest rates), it is unlikely to act anytime soon.