Key points

Richard Turnill is global chief investment strategist for BlackRock.

• We prefer U.S. stocks, particularly dividend growth companies, as U.S. earnings could experience a recovery later this year.

• The yen reached an 18-month high vs. the U.S. dollar, with no signs the government would intervene to halt the currency’s rise.

• Economic reports this week may shed light on whether the U.S. can improve on a sluggish pace of around 1% annualized growth.

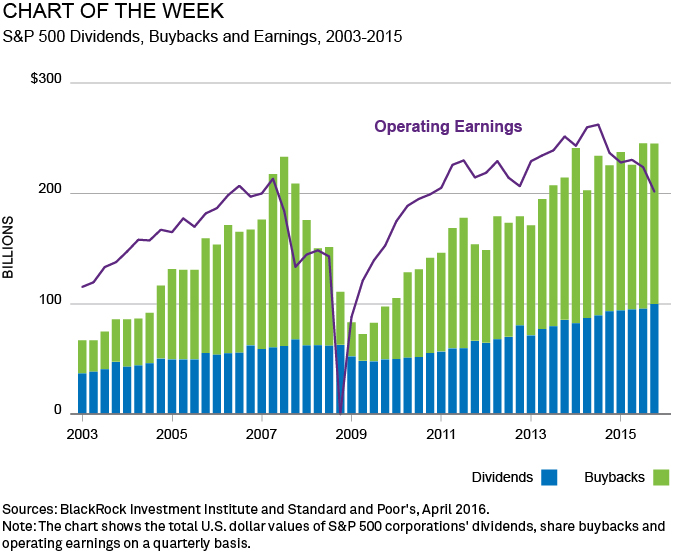

Rising multiples and increasing dividends and share buybacks have fueled U.S. stock market returns since 2009. Earnings growth will now be critical for generating gains in today’s low-return environment.

Companies have been rewarded for returning capital to shareholders, contributing to rising multiples. Such payout strategies make sense in a low-yield environment, but the trend is unsustainable. The ratio of payouts in the form of buybacks and dividends to operating earnings of S&P 500 companies is now at 120%. Companies cannot keep paying out more than they earn without increasing corporate leverage.

We like U.S. stocks

We see limited scope for further increases in U.S. equity valuations, and see the tailwinds from debt-fueled dividend growth and buybacks fading. This points to lower equity returns, with the path of corporate earnings now key. For sustained earnings growth, companies need to increase capital expenditures at the expense of payouts, we believe.

U.S. earnings have been falling since 2014, largely driven by energy sector declines. Profit growth remains constrained by low nominal gross domestic product (GDP) growth, and rising U.S. wages will likely put near-record-high corporate margins under pressure over the long term.

Yet there are signs we could see positive U.S. earnings surprises later this year, driven by a stabilization in oil prices and a halt in the U.S. dollar’s rise. Also, the bar for upside surprises is unusually low given depressed earnings expectations. Consensus 12-month forward estimates for the S&P 500 are at the lowest levels since 2009, Thomson Reuters data show.

We like U.S. stocks given the potential for a U.S. earnings recovery later this year. Income-seeking investors should focus on U.S. companies with the potential for dividend growth from earnings. We see select opportunities in technology and health-care companies that have strong balance sheets and good cash flows.

The Key Return Ingredient

April 13, 2016

« Previous Article

| Next Article »

Login in order to post a comment