Advisors to the wealthy are in the throes of a paradigm shift. While there will always be a place for high-end specialists, the affluent are increasingly gravitating to comprehensive advisory relationships. Like all paradigm shifts, this one has been building momentum and is reaching critical mass.

The wealth management revolution is being driven by the wealthy. For them, the attraction of wealth management is that it's solution-centered and results-oriented. The financial advisory community has come to recognize the profitability of delivering wealth management but, by and large, it is playing catch-up. In a best practices survey of 4,712 advisors, we identified four segments of professionals based on their primary business model and statistically compared the income differential between the two largest segments: generalists and wealth managers. Generalists are advisors who offer a range of products without a unifying theme or plan and often shift emphasis based on market and product development trends. Wealth managers also offer their clients a range of products and services, but do so exclusively in the context of a personal program they have developed in conjunction with the client and, often, other relevant experts. The generalists represented 63% of the sample and the wealth managers represented the remaining 37%.

Our data shows a clear link between business model and income, with the most lucrative structures being those that allow for a more comprehensive and multifaceted relationship with clients, such as family office and wealth management platforms. More basic approaches, such as the generalist and specialist models, offer the least upside. It's not surprising that some models are more effective with certain types of clients. It's likely because of a confluence of factors: the client's needs and expectations, the range of products and services used, the cost of the business infrastructure and the professional's mind-set and capabilities.

Logic tells us, and research substantiates, that the least wealthy clients are the least profitable for any business model. But as a client's wealth increases, different business models can be more or less effective. We used the generalist as the baseline since it is the most pervasive. Figure 1 illustrates how the income of a business model is impacted by a client's level of wealth. In particular, the breadth and flexibility of the wealth management business model allows it to be the most consistently profitable across all levels of client wealth-and to benefit exponentially as client wealth increases. This means when a generalist earns $100,000 from a client with a net worth of $25 million, a wealth manager earns ten times as much, or $1,071,000.

Despite the variations in advisory roles-an advisor can be anyone from a life insurance agent to an accountant, for example-when it comes to working with the affluent, you must have a clear sense of how well you are able to service clients with various levels of wealth and what the impact is on your profitability and your income.

What's Stopping Your Success?

Every

study examining the benefits of wealth management supports its adoption

regardless of channel. Investment advisors, life insurance producers

and commercial bankers, for instance, will all increase their clients'

satisfaction and personal wealth by using a wealth management model.

When we coach advisors, it's not unusual to see a 30% to 50% boost in

income after their first full year of operating as a wealth manager.

Obviously, the more motivated and open an advisor is to changing his

habits and adopting new skills, the more results he can achieve.

The

reality for most advisors and their firms, however, is vastly

different. While many financial organizations and practitioners are

espousing wealth management, the business model has been difficult to

implement and the results have been disappointing. The three most

significant reasons for this are:

Companies falsely assume that

developing a wealth management platform will enable the delivery of a

wealth management experience.

Advisory professionals have not

changed their mind-set and approach along with the transition in

business strategy and service capabilities.

They fail to replicate

and systematize successes and decrease time spent on administrative

activities that do not produce revenue.

The Platform Is The Foundation

Too

many executives and representatives at financial services firms confuse

the ability to access specialty products and services, such as modified

defined benefit plans and estate planning, with the ability to serve

wealthy clients in a high-touch, effective and customized fashion. This

perspective is built on the flawed belief that their wealth management

platform is irrefutable evidence that they're in the wealth management

business.

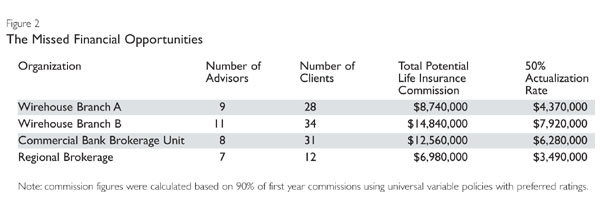

Over the past several years, we've assessed the viability of many wealth management platforms, and the extent to which advisors are offering products beyond their or their firm's core competency. Figure 2 illustrates the potential for small groups of investment-oriented advisors, from four types of firms, to provide life insurance to their clients with a net worth of $15 million or more. The sales are viewed in the context of estate planning only. Business succession sales are excluded.

Given the platforms of capabilities and the quality of the advisor-client relationships we analyzed, there are millions of dollars in revenue being left on the table. In every case, the firms could have accessd the expertise and products required to complete more sales. But most of the advisors focused on a small group of products to the exclusion of everything else. They didn't, or couldn't, spot the insurance-related opportunities from their investment-oriented vantage point-to the detriment of both the clients and providers.

As "open architecture" platforms become ubiquitous, an advisor's ability to access specialized financial products and services is no longer a distinguishing factor and, as a result, the platform itself doesn't drive the success of a wealth management business.

Attitude Is Everything

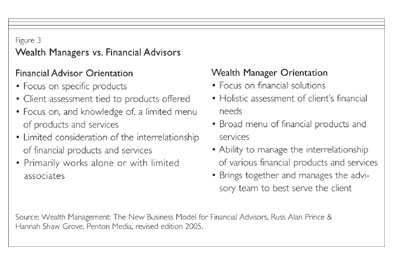

A

significant portion of an advisor's facility and effectiveness as a

wealth manager is derived from his vision for the role and how that

shapes the service and solutions he delivers. Advisors that migrate to

wealth management from another model must adopt a new operating

philosophy that reflects their new business approach. Figure 3

contrasts the mind-set and limitations of

average advisors and the perspective of wealth managers.

Wealth Management Is Process Driven

A

final shortcoming of the wealth management initiative at most financial

firms is their inability to create, adopt and use critical processes

that help business opportunities become revenue-generating

transactions. At a minimum, wealth managers must be able to:

1.

Identify the client-specific situations that may call for additional

products and services. This may require the involvement of outside

specialists and can be a complex and rapidly changing process depending

on the client's finances and needs. There are many ways to do this. We

created and continue to use a process based on the Whole Client Model

that allows advisors and their networks of experts to develop a

comprehensive understanding of an affluent client.

2. Convert a

specific opportunity to deliver new products or services into an

accessible and actionable recommendation that suits the client's style

and communication preferences, crystallizes the benefit and expected

results and presents a meaningful solution to a pressing issue or

concern. The best way to do this is with an individualized client

strategy that accounts for the unique qualities of each relationship.

The output from the Whole Client Model (see insert) will provide a good

deal of information for a client's strategy, as

will identifying a client's high-net-worth personality.

3.

Manage the many stages and facets of the implementation process in a

way that sustains momentum, keeps the client informed about timing and

results, galvanizes the team of specialists to work collaboratively and

continually measures the solutions against the client's goals and

objectives.

The Moral Of The Story

Affluent

individuals and families want the benefits of wealth management, and

financial services providers can be rewarded in numerous ways-not just

financially-by offering such capabilities to their wealthy clients.

Wealth management, however, is not a promise to be taken lightly, and

simply wanting or needing it will not be enough. The important lesson

for organizations and practitioners that advocate a wealth management

approach is that it requires dedication and commitment on the part of

everyone involved to do it well, deliver a worthy experience and reap

the rewards.