Julian Robertson and his prolific offspring of Tiger Cubs. David Einhorn’s Greenlight Capital. James Simons’ Medallion Fund.

These may not be household names to many financial advisors. But in the $400 billion universe of equity long-short hedge funds, these are a few of the demigods who have mastered stock investing, regularly delivering annual double-digit returns.

Unlike Peter Lynch and Warren Buffett, who have also made billions picking stocks, Robertson et al have achieved stardom by also betting on which stocks will go down.

If that extra strategy suggests long-short equity managers have a performance advantage over long-only investors, well … that’s simply not the case.

While virtually all long-short managers will maintain a net long bias—meaning that they will have more money betting their stock picks will go up than on stocks they think will go down—over the long term, most of these managers will underperform the market.

The reason is simple: A long-short strategy is designed to reduce volatility and, therefore, investment risk. They run their books with limited to no leverage, designed for equity investors seeking protection from shocks. A look back to pre-tech bubble days makes this point.

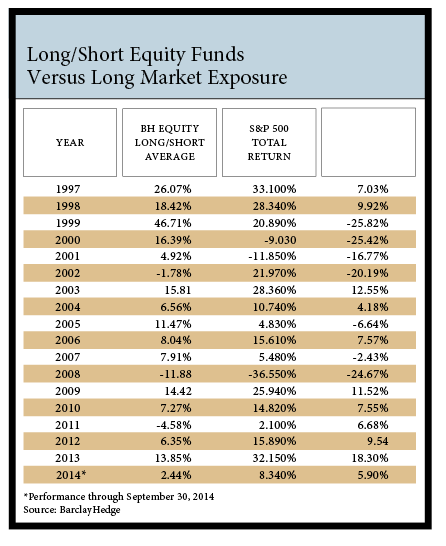

Before shares blew out in 2000, many hedged equity managers not only got out of overvalued stocks before they fell or shorted them, but smartly rotated into more stable industries. This independent thinking produced four straight years in which fund managers more than doubled market returns. From 1999 through 2002, long-short funds outperformed the market by an average of more than 20% a year (Figure 1).

When the bear struck again in 2008, equity hedge funds stood out for their performance, declining less than 12% while the market was down nearly 37%.

But there’s a rub. When there’s smooth sailing, most long-short managers will invariably underperform the market. And this has been most evident since stocks started recovering from 2008 and as the hedge fund investor base shifted from more risk-embracing, high-net-worth and family office investors to more reticent institutional investors.

Between 2009 and September 2014, the S&P 500 has consistently outperformed long-short managers, sometimes by a great deal. In 2009, the market was up nearly 26%, outpacing funds by 11.5%. In 2013, the market more than doubled the average long-short manager when it returned more than 32%. And through the first three-quarters of this year, the average fund gained a paltry 2.44% versus the market’s 8.34% return.

Among various hedge fund strategies, equity long-short is the most appropriate for advisors who want to maintain stock exposure—mindful of the age of the bull market and clients with low risk tolerance.

The Long And Short

November 2014

« Previous Article

| Next Article »

Login in order to post a comment