A lot of funds say they march to a different drummer without being really all that unique, but in the case of global absolute return funds, that description is quite accurate. Unlike traditional portfolio managers, who are bound by an investment style, predetermined mandate or universe of securities, absolute return managers are free to roam the investment universe and face few constraints on how they can invest. They can own traditional assets, such as stocks and bonds, but can also invest in commodities, currencies and derivatives. They can bet on the rise of some markets with long positions, and a fall in others with shorts.

Such funds are members of Morningstar’s increasingly popular multi-alternative category, a catchall that covers funds employing multiple investment strategies under one roof. In 2015, multi-alternatives experienced some of the strongest net flows of any fund category, and at year-end the 157 funds in the group held more than $55 billion in assets, when there had been only 25 funds holding $6.3 billion in assets in 2007.

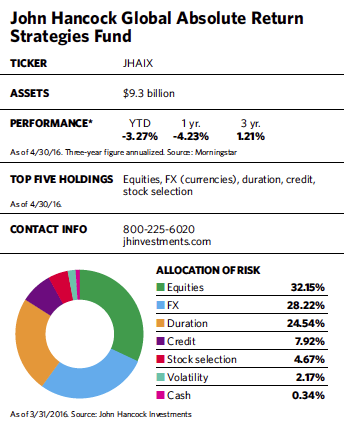

At $9.3 billion in assets, the John Hancock Global Absolute Return Strategies Fund is by far the largest U.S. fund in this trendy category. Managed by Edinburgh, Scotland-based Standard Life Investments, which runs more than $75 billion in the strategy, it follows in the footsteps of its older and even bigger U.K. sibling, the $37 billion Standard Life Global Absolute Return Fund (GARS).

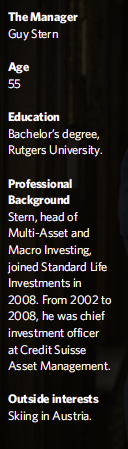

At the helm of this massive and complex ship is Guy Stern, an American transplant raised in New Jersey who left the U.S. in 1993 to join Deutsche Bank and has lived in Europe ever since. He served as chief investment officer at Credit Suisse Asset Management from 2002 to 2008 before joining Standard Life, where he is now head of multi-asset investing.

The 55-year-old manager, who has implemented global absolute return strategies for most of his career, believes they are “the most interesting and rewarding way to manage portfolios. I get to think about investing and take a world view that is much, much different from that of a traditional portfolio manager.”

The fund’s mission is to make money in any rolling 12-month period irrespective of market conditions, and to do so with about one-third to one-half the volatility of stocks and a low correlation to traditional investments. Stern shoots for returns of anywhere from cash plus 3% to cash plus 7.5% over a three-year period.

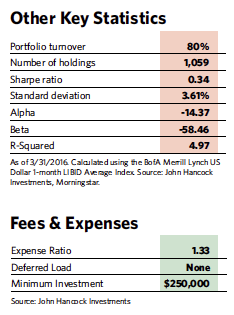

From its inception in December 2011 through the first quarter of 2016, the fund has met the lower range of that goal, with an average annual return of 3.54% over the period for institutional class shares. By comparison, the Bank of America Merrill Lynch U.S. Dollar one-month London Interbank Bid Rate, a measure of returns from cash investments, returned 0.11% over the period.

While the fund’s returns are modest compared with what investors could get from the U.S. stock market over the same period, Stern believes that a global multi-asset strategy speaks to what clients really want from their portfolios. “For a typical client, the desired outcome isn’t beating a benchmark by a certain number of basis points,” he says. “It’s earning a certain level of return regardless of what markets are doing.”

Standard Life learned the value of that philosophy in 2005, when a pension shortfall prompted the company to search for a more reliable way to match pension liabilities with portfolio returns. Today, the company has become a leader in the global absolute return strategy and runs it for mutual funds, pension plans, endowments and private wealth clients seeking greater predictability from their investments.

Along with this popularity comes increased scrutiny about how the vast amount of money Standard Life has under its GARS belt might affect management’s ability to stay competitive. In a Morningstar report issued earlier this year, analyst Jason Kephart noted that even though the Hancock fund trades in very liquid markets, “the sheer size could be an impediment to the team’s ability to generate alpha.” A few publications in the U.K. have voiced similar concerns about that country’s version of the fund.

Stern says GARS is designed to be highly scalable. “Our philosophy is to exploit macro ideas in a tradable way through positions that are highly liquid,” he says. “Strategies involving government bonds, currency positions or equities at the index level can be implemented in extremely large size and do not constrain capacity.” He added that the fund also has ample backup from over 50 professionals whose expertise spans a wide range of disciplines and asset classes.

There are also some issues with the multi-alternative asset class itself. Many investors are used to measuring an investment’s success against established benchmarks, and it’s hard to find one that fits here. As a group, multi-alternative funds haven’t been all that successful, and most of them are relatively new. Returns have also been dragged down by a hefty average expense ratio of 1.65%. (At 1.33%, the Hancock fund’s institutional class shares expense ratio is below average.)

The John Hancock Global Absolute Return Strategies Fund’s 1.73% return in 2015 beat 93% of its multi-alternative peers as its bets on a strong dollar panned out, and Stern was nominated for Morningstar’s “Fund Manager of the Year” in the alternatives category. But the fund also suffered the worst quarterly loss in its history in the first three months of 2016, when it fell 3.46%. Much of that loss came from long positions in European and Japanese equities, which sank during the period, as well as positions betting on the strength of the U.S. dollar over other currencies.

“A Modest Global Recovery”

For Stern, the major challenge is putting together a blend of investments where positive returns consistently outweigh negative returns. The tool box for investment and hedging purposes includes listed equity; equity-related and debt securities; and derivatives such as futures, options, swaps and foreign currency forward contracts. As an added precaution, the fund runs hypothetical stress tests under possible future economic scenarios to assess how the portfolio would react under a variety of market conditions. Such scenarios might include a full-blown crisis in China, or a period of stagflation in the U.S.

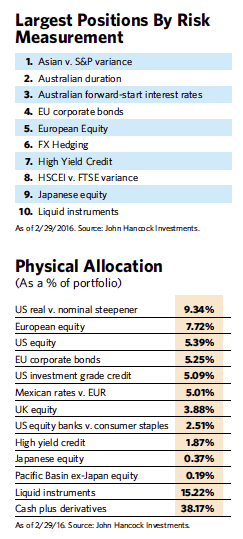

Investment opportunities fall into one of three baskets. Market returns come from traditional long positions in equity, credit or other markets that the managers believe will rise. Directional strategies encompass long and short positions in currencies or other markets. And relative value strategies involve pairing related markets or securities and profiting from the difference in their performance.

“While we have a clear perspective on the level of equity beta or total duration we have in our portfolio, we really don’t think about the fund in terms of traditional asset allocation,” he says. “Instead, we assess the portfolio at the individual investment level to understand how strategies interact with each other, and think about what would be the best blend of our investment opportunities.” Asset allocations are determined by each investment’s expected return over three years.

In funds of this kind, making the right macroeconomic calls is essential, and Stern and his team have been better at it than most. Expectations for a modest global recovery, albeit with regional variations, guide the fund’s current investment strategy. Continued Fed rate hikes in the U.S. and the slowing Chinese economy will both be powerful forces shaping asset returns, while in Europe and Japan central bank actions continue to hold sway over markets.

Many investments focus on the divergence in economic recovery cycles around the world. Stern prefers to invest in stock markets where central banks and governments are encouraging growth through measures such as low interest rates and increased money supplies. Those conditions apply in Europe and Japan, two places where the fund is long in equities. By contrast, the U.S. is further along in its recovery phase and is at a point in which bond prices could fall as interest rates rise. With that in mind, the fund is using a variety of financial instruments that effectively short long-term U.S. bonds. That strategy worked well in the first quarter of 2016 as a slight recovery in oil prices sparked concerns about renewed inflation.

On the currency side, the fund has lined up positions that would profit from a strengthening U.S. dollar against a number of currencies. Because China’s economic struggles have created difficulties for other Asian countries, the portfolio is short in a number of Asian currencies, particularly the Korean won. And while emerging markets have been badly beaten over the last few years, there are some pockets of opportunity—such as the Indian rupee (as a long play) and Mexican government bonds.

One of the fund’s relative value positions involves pitting a long position in U.S. technology stocks against a short position in U.S. small-cap stocks. Stern believes that tech stocks are a better value and have more realistic earnings expectations than small caps, which tend to issue overly optimistic forecasts.