When $45 billion dollars is pledged to charity, it’s bound to start a lot of conversations. Facebook founder Mark Zuckerberg and his wife Dr. Priscilla Chan recently shared they intend to move 99 percent of their Facebook shares into a limited liability company (LLC) for charitable purposes. Justifiably, this announcement has received a lot of attention and has started a conversation about the next generation of philanthropy. A notable twist was the choice to set-up the Zuckerberg Chan Initiative as an LLC, rather than the traditional philanthropic routes such as, creating a trust or foundation or giving the shares directly to charity. The choice of structure has some interesting control and tax implications, but in the end the Zuckerberg Chan Initiative is less about avoiding legal structures and tax strategies than it is about innovating the philosophy of philanthropy.

This recent announcement, from a modern technological billionaire using the latest technology to shake up the philanthropic world, echoes the thoughts and actions of another notable American, John D. Rockefeller. Adjusting for inflation, John D. Rockefeller may have been the wealthiest American to have ever lived, holding assets estimated at $253 billion in today’s dollars. In his lifetime, he actively supported the University of Chicago, helped found the General Board of Education and formed the Rockefeller Foundation, one of the most recognizable names in philanthropy. The goals of the foundation echo many of the same ideals of the Zuckerberg Chan Initiative: reducing global poverty, eradicating preventable fatal disease and bolstering education worldwide. The Rockefeller Foundation today is worth a far more modest $4 billion, but has been setting a standard for philanthropy for the past 100 years.

Today, at over $41 billion, the Bill & Melinda Gates Foundation is by far the largest foundation. Their efforts instruct the opportunities and challenges faced by large foundations. From a positive side, the Bill & Melinda Gates Foundation receives significant press coverage for their efforts and bring much needed publicity to their causes. Their efforts focus on ending global poverty, preventing death from curable diseases and bolstering education—and they have brought not only dollars, but attention to these issues. Further, the size of the foundation allows them to actually shift the philanthropic world toward an approach called outcome investing, which calls on charities to actively document the outcome of the dollars they receive and report back to the foundation. This “activist” approach to charitable work clearly informed the approach taken by Zuckerberg and Chan. Even the optimistic tone of their open letter echoes a 2014 letter from Bill and Melinda Gates.

From a negative side, the Bill & Melinda Gates Foundation may have further informed the plans of Zuckerberg and Chan. By law, foundations must continue to fund charities each year at a certain percentage of their assets or stand to lose their status as a private charitable foundation. The Bill & Melinda Gates Foundation hasn’t given away less than $2 billion in any year since 2005. It can be very difficult to find charities effectively utilizing that level of investment, but the tax law is inflexible to that point, and does not allow a foundation to wait until the charity is ready.

Additionally, the Gates’s have significant investments in eco-friendly and socially conscious firms, but those must be managed separately, again due to the way the laws are written for private charitable foundations. All of which has caused Bill and Melinda Gates to slow their charitable contributions to the trust and consider other possible vehicles for their philanthropic efforts. An unintended consequence of the tax law may disincentivize charitable giving at high asset levels, due to the restrictions and controls involved.

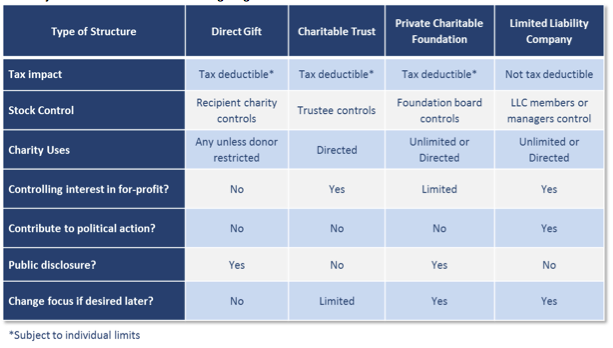

Into the world of revolutionary technology and life-altering wealth are Mark Zuckerberg and Dr. Priscilla Chan! As the founder and primary shareholders of Facebook, they were faced with additional consideration for gifting their shares—financial control of the firm. For most of us, shares gifted outright to a charity generate a tax deduction equivalent to their value at the time of the gift. The charity can then retain the shares or sell them, and upon sale, incur no taxable obligation due to their charitable status. Cleary, the outright gift of the Facebook stock would have had several unsatisfactory results. There is no scenario in which the tax deduction generated by the gift can be effectively utilized. The astronomic income level it would take to use the tax deductions at the highest tax bracket would trigger the alternative minimum tax and wipe out almost all the deductibility of the gift. But far more importantly, in doing this, Mark Zuckerberg would give up financial control of the company he founded. As each charity sold the stock, the financial control he once enjoyed would dissipate across thousands of new individual owners.

In the end, the most logical choice of entity for the Zuckerberg Chan Initiative was a limited liability company. First, the LLC allows the gifts to charitable organizations to be done over time and be modified based on the opportunities available. A charitable distribution isn’t mandated each year, so the LLC can work with charities over time to get them ready to receive larger donations. Second, an LLC can invest in for-profit organizations under the same legal structure and executive managers. This allows for potential investments in public/private cooperative efforts and allows the foundation to harvest the profit motive for positive change. Third, the LLC is controlled by the partners in the LLC or the managers they designate. This allows Mark Zuckerberg to retain de facto financial control of Facebook, and offers complete flexibility to the direction of the LLC going forward. The creation of this initiative will not immediately generate any taxable implications, as an LLC is taxed to the individual partners which created it—so the conversations about skirting taxes is a bit misplaced. The real conversation should be about harnessing a financial structure to achieve the public good and the possible outcomes collaborative problem solving may have on the issues of global poverty, preventable disease and lack of education. Regardless of legal structure, the Zuckerberg Chan Initiative focuses attention on working together to positively impact the world. Creativity led to the Zuckerberg fortune by changing the way we stay connected. Now, we’re about to see how creativity changes the next generation in philanthropy by making new connections.

Robert J. Holton is vice president, Private Client Group at Cleary Gull www.clearygull.com.