As the nation recovers from the Great Recession and stability returns to the markets, high-net-worth investors are once again returning to alternative investments-usually hedge funds.

But as they maneuver their way through a low-return market, wealthy investors are becoming ever more conscious of their tax burdens and the impact a good tax management strategy can have on their investment returns.

One tax management solution, in fact, has come to be recognized by some high-net-worth investors as a perfect complement to their hedge fund investments: private placement insurance-in the form of both life insurance and annuities.

These products essentially allow accredited investors to put alternative investments inside a tax-free insurance wrapper. The products take advantage of long-standing tax rules that allow income earned on assets inside insurance or annuity policies to accumulate free of taxes. Moreover, gains remain tax-free when distributed as life insurance proceeds-as a death benefit or the cancellation of loans made to a policy owner-and tax-deferred if distributed as annuity benefits.

These features are of great value to hedge fund investors, who understand the impact ordinary tax rates have on gains derived from short-term trading and credit-oriented investments, phantom income produced by market-to-market elections by fund managers (often to justify fees), and PFIC treatment of offshore fund investments. Hedge fund investors have learned that taxes paid on current gains are not recovered if losses are suffered in later years. Those losses can only be carried over to future years when or if gains are realized.

Old Product, New Strategies

Private placement insurance is not new-insurance products have offered tax-free or tax-deferred benefits for many years. Private placement life insurance is structured as variable universal life insurance. Unlike conventional insurance, however, private placement products are tailored to meet the specific investment objectives of high-net-worth investors. In particular, a policy owner can select the manager of a policy's cash value account from a group of third-party managers selected by the insurance carrier or invest in a hedge fund designed for insurance company accounts.

The number of companies offering these policies is relatively small. The big sellers include MassMutual, the American International Group, New York Life, the Phoenix Companies in Hartford and Boston, Prudential, John Hancock and Crown Global Insurance, according to a recent New York Times article.

The choice of managers is limited among most of the large commercial carriers, but is virtually unlimited through carriers that are focused on private placement insurance. The number of insurance dedicated funds-hedge funds designed for insurance accounts, called IDFs-is growing rapidly.

Private placement policies can offer the same returns as managed accounts or hedge funds with one key exception: The returns inside a policy are tax-free or tax deferred, while the returns of a direct investment are currently taxable, often at ordinary income rates.

Private placement policies are only available through a private placement offering to accredited and/or qualified purchasers, who must meet the suitability standards required under the applicable securities laws. These rules are the same as the rules that apply to an investment in a hedge fund, and in each case, the beneficial owner of the policy must complete a questionnaire establishing suitability. Most carriers require minimum premium commitments of $3 million.

Private placement policies are "variable," which means that the policy owner allocates the assets to one or more third-party asset managers or an IDF. The proceeds of the policy will be a combination of the return on these investments and, in the case of a life insurance policy, the amount of death benefit set forth in the contract. To qualify as life insurance, a certain amount of risk must be borne by the insurance company based on the insured's age, health and sex.

Private placement policies are also "universal" policies, meaning that after the first premium payment there are no mandatory payments required as long as there are sufficient assets to pay for the cost of insurance on the policy and other current charges. Private placement policies usually require minimum premium payments on the order of several million dollars, and premium payments can stretch over several years.

Once the insurance company receives the premium and the funds are allocated to one or several managers or IDFs, the policy owner is generally permitted to change managers or select new funds at periodic intervals. Such changes or reallocations are tax-free so that the gains derived on the sale of one fund are available in full for an allocation to a new fund. Moreover, the administrative charges for the changes are minimal or nonexistent.

Loan Opportunities

Private placement investors can borrow from the policy if it is structured as a non-modified endowment contract. The funds may be borrowed at market interest rates without any tax effects. The loans do not have to be repaid during the lifetime of the borrower and may be repaid tax-free out of the proceeds of the policy upon the death of the insured.

Private placement deferred variable annuities operate in the same fashion as life insurance policies during the lifetime of the owner in that gains accrue tax-free. Distributions are taxable, however, at ordinary income rates, generally over the lifetime of the annuitant starting in the first year after the deferral period. Distributions are apportioned between income and the return of capital. The period of deferral can be continued where the beneficiary of the policy is a spouse and taxes can be avoided if there is a charitable beneficiary. Gains distributed to an annuitant who has not reached the age of 59½ are subject to an additional 10% penalty tax. The advantage of an annuity is that it does not require underwriting-there is no life insurance component, which means that it can be issued quickly. Moreover, the cost of an annuity is less since there is no insurance risk.

The assets of most private placement policies are held in segregated accounts, which protect the owners from creditors of the insurance carrier. This also eliminates the risks associated with comingled accounts and assets. Each policy account stands alone and is not part of the carrier's general account.

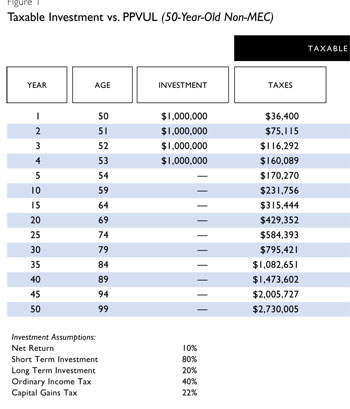

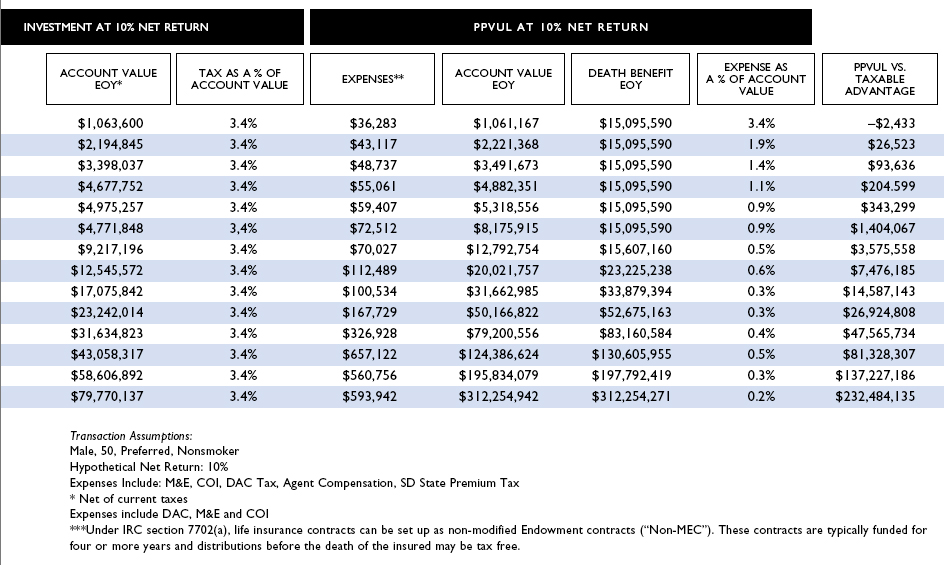

The costs of private placement policies are generally small in light of the benefits. In the case of life insurance, a portion of the cost is based on the age, sex and health of the insured. In addition, each policy covers an administrative charge, typically called a mortality and expense fee. Notwithstanding these charges, the costs of a private placement policy are far lower than the costs of a conventional insurance policy. Private placement policies have minimal distribution costs, such as commissions and other policy loads. Conventional policy loads can range from 60% to 70% of the first-year premium. Also, mortality and expense charges are generally lower so that the total policy loads-exclusive of the costs of insurance risk-rarely exceed 100 basis points per year on the assets under management. (See Figure 1.)

There are two important rules regarding investments made within a private placement policy. First, the investments must be diversified. Internal Revenue Code Section 817(h) allows no more than 55% in one underlying investment, 70% in two investments, 80% in three investments, and 90% in four investments if the investments are not an IDF. An IDF is given "look through" treatment, which means the fund will not be viewed as a single, concentrated investment. When the policy invests in a managed account, each hedge fund investment by the manager will be considered an investment in a single security, so at least five hedge fund investments will be required. Second, the policy owner is prohibited from directly controlling the investments in the account. The owner may select a third-party manager or an IDF. The manager may be required to follow certain investment guidelines but may not be directed to make specific investments. Policy owners may not communicate directly with the account managers about account management, though transparent reporting may be required.

The investor control rules comes into play if a manager wishes to invest in his or her own fund through a private placement policy, or if an investor wishes to invest in closely held securities through a policy. In both cases, the investments would have to be treated as being directly owned by the policy owner and not by the insurance policy. But this would eliminate the tax benefits of investing through a private placement policy.

Private placement policies are available through a small number of insurance carriers, both domestic and foreign. There are important differences between the two. Foreign carriers are generally prohibited from marketing their products in the U.S. by state insurance laws. Consequently, U.S. citizens may only purchase policies from a foreign carrier while outside the U.S. This generally means that all aspects of the transaction-including completing the application, executing documents and receiving illustrations and the policy-must occur outside the U.S. Private placement policies issued by a domestic carrier may be purchased in a state where the carrier is admitted to do business.

Offshore carriers generally are more flexible in allowing policy owners to select a particular manager or IDF than a domestic carrier. Domestic carriers may restrict investments to certain approved managers and funds, and the addition of funds or managers to their investment platforms may require considerable time and expense, or may even require a minimum investment size that exceeds the investment the policyholder has in mind. In many cases, states may restrict an insurance company from specific kinds of investments and liquidity restraints. Domestic carriers may also be unable to invest in offshore funds that are only available to non-U.S. investors. There are also cost differentials that may favor offshore carriers that only write private placement business. Their infrastructure costs and capital requirements are very different from multi-line carriers that are subject to many regulatory restrictions.

The important point, however, is that private placement policies written by foreign carriers receive exactly the same tax treatment as policies written by domestic carriers. If the policy complies with the rules of the Internal Revenue Code, it receives the same benefits whether issued by a domestic or foreign carrier. It should be noted that foreign life insurance carriers typically reinsure virtually all the life insurance risk with major U.S. or international insurance companies-hence, there is no significant credit risk inherent in establishing a life policy or annuity with a smaller foreign carrier that specializes in custom variable insurance and annuity products.

There are also certain non-tax advantages that can be derived through ownership of investments through an insurance/annuity vehicle. Many individuals have sought to secure greater protection for their assets through offshore, asset protection trusts. While the law varies from state to state, in most jurisdictions, assets owned in a variable life insurance or annuity contract are not subject to the claims of creditors (whether or not the policy is owned directly or through an onshore or offshore trust). The foreign jurisdictions where such insurance carriers are located likewise protect policyholders from creditor actions.

Finally, it should be noted that people who own a private placement policy issued by a foreign carrier must comply with U.S. information reporting rules applicable to the reporting of foreign bank and financial accounts (known as the FBAR rules) and with the Foreign Account Tax Compliance Act (FACTA).

Michael C. Crawford, CFP, CLU, ChFC, is managing member of Nationwide Wealth Management LLC (www.nationwidewealthmgmt.com), which provides traditional and non-traditional insurance services for high-net-worth and ultra-high-net-worth clients.

Perry Lerner, Esq., earned his law degree at Harvard Law School and is the managing director of Crown World Services (1-888-399-5169), which provides unique life insurance policies for high-net-worth individuals.