Dividend-paying stocks are like two sides of a coin, each with unique characteristics. On the one side are “bond substitute” sectors, such as utilities or telecommunications, which yield well above the market averages. They are more sensitive to interest rates than most stocks—doing better than the market when rates fall and worse when they rise.

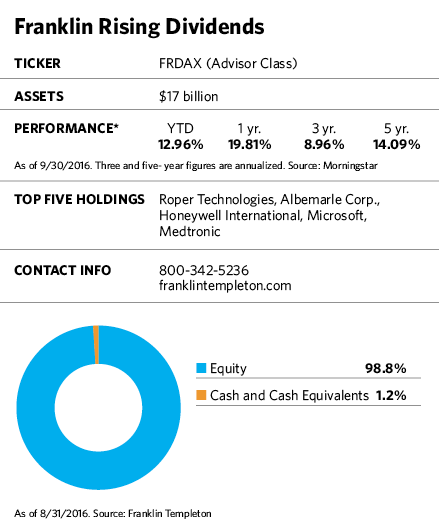

On the other are dividend-paying stocks from more varied industries such as technology, health care, industrials and consumer goods. These usually have lower yields than the bond substitutes. But they may be able to grow dividends faster because of their stronger cash flow and more robust earnings. The elite of these dividend growers, and the focus of the 30-year-old Franklin Rising Dividends Fund, have consistently increased dividends for 10 years or longer.

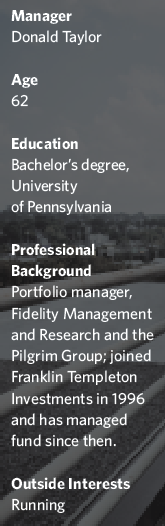

Fund manager Donald Taylor believes the dividend growers his fund focuses on have a better shot at holding their own in a rising rate environment than the more rate-sensitive bond substitutes. “If the yield on 10-year Treasurys rises to 2%, I have little doubt utilities and other bond substitutes will sell off,” he says. “On the other hand, high-single-digit or double-digit dividend growth will mitigate some of the risk posed by rising rates.”

As global economic growth muddles along and corporate earnings decelerate, dividend growers face challenges of their own, however. Over the last few years, dividend payout ratios, which measure the percentage of earnings used to pay dividends, have been creeping up for S&P 500 companies. (A lower number means a company isn’t straining too much to pay dividends, while a higher one indicates dividends are taking a bigger bite out of earnings.)

Taylor observes that companies in the S&P 500 pay out an average of about 45% of their earnings as dividends, whereas the average was in the low 30% area from the late 1990s until about three or four years ago. Those are just the averages, though. According to FactSet, some 44 companies in the S&P 500 have recently distributed more than 100% of their profits as dividends, the highest number in at least a decade. This group includes well-known names such as Xerox, Caterpillar, Merck and Chevron.

Taylor attributes the increase in payout ratios to both a decline in earnings and the intense pressure for companies to maintain or increase dividends every year. Companies have also diverted cash for stock buybacks, leaving less for dividends.

He believes the trend toward higher payout ratios is likely to continue. “We’re moving into a world where dividend payout ratios for the index of 40% to 50% is the norm,” he says. “You have to remember that during the 1970s and 1980s the average payout ratio was 50% to 60%. Thirty percent payout ratios are an anomaly.”

Dividend growth has also slowed. Over the last year, dividend growth for portfolio companies has averaged around 9%, about three percentage points lower than the average for the previous 10 years.

Despite these changes, Taylor says there’s a good argument for companies that grow their dividends at a healthy clip over the long term. Research suggests that they tend to experience greater long-term stock price appreciation than companies that maintain their dividends or don’t pay them at all. A consistently rising dividend often reflects a company’s solid earnings growth, its resilient business model and the commitment by its management to return cash to shareholders. And companies that grow dividends consistently are usually industry leaders and have experienced management.

There’s also some evidence to suggest that dividend growers may provide downside protection in bear markets. In 2008, for example, the total return of Taylor’s fund was only -27%, while the S&P 500 fell 37%.

Taylor is optimistic about the ability of his portfolio companies to maintain above-market dividend growth in the high-single-digit to low-double-digit growth range, even in the face of slow economic growth. The formula for doing this, he says, is finding companies with prospects for good cash-flow growth and modest capital needs, so that cash can be used to pay dividends.

To become candidates for his fund, companies must have increased their dividend in at least eight of the last 10 years, without a decrease—and have at least doubled their dividend over the last 10 years. They must also have strong financials and low levels of long-term debt. They must also have a history of reinvesting at least 35% of their earnings into their own future growth, and have a payout ratio of no more than 65%. The fund’s requirement for long dividend histories means it is much lighter in tech names than the S&P 500, since those stocks haven’t been paying dividends long (if at all). As more tech companies establish a dividend history, their presence will likely grow in his fund, he says.

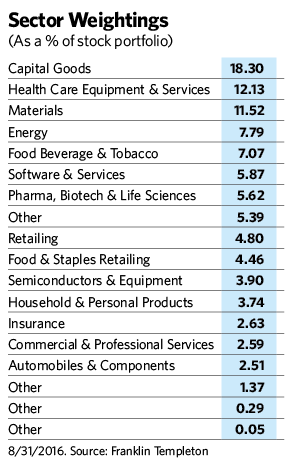

The fund also differs from the S&P in its 3% allocation to financials, a point of departure from the index, whose allocation is 16%. That’s because many financial stocks cut their dividends in the 2008 financial crisis. While some have since recovered and have been consistently growing dividends, it will be a few years before they have a decade-long record. Industrials are a bigger presence in the fund than the index because many dividend growers are concentrated in that sector. There’s also no whiff of utilities or telecommunications stocks, because despite their high dividend yields, they have meager dividend growth.

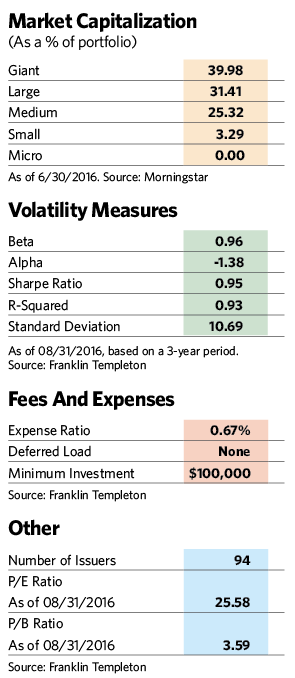

There’s a value element to the Franklin Rising Dividends fund. Taylor prefers shares that are attractively priced relative to historical valuations, which means that their price-to-earnings ratio must be in the lower half of their range over the last 10 years. Alternatively, a stock may trade at less than the current price-to-earnings ratio of the S&P 500 average.

The methodology for selecting stocks hasn’t changed much since Taylor took over management of the fund in 1996. Back then, it had $375 million in assets under management. Today, that figure stands at over $17 billion.

Taylor had considerable maneuverability when he took over the all-cap fund. In early 2000, for example, he bought cheap small and mid-cap stocks at a time when the valuations of quality mega-cap companies were unusually high. The move paid off in the following years when his buys held up better in a down market than the former high flyers.

While the fund has expanded considerably since then, Taylor believes he has a fairly free hand to invest across the market capitalization spectrum. He says he has little trouble investing in companies with market capitalizations in the $5 billion to $20 billion range, which he considers mid-caps, and points out that about 15% of the fund is in companies with market capitalizations of under $10 billion. “But there’s not much flexibility on companies in the $1 billion to $3 billion market-cap range,” he admits.

With a portfolio turnover rate of less than 10%, Taylor clearly shows a willingness to hang on to his picks for the long haul, and a number of stocks that he bought in the 1990s remain in the portfolio today. One of Taylor’s first purchases—and a current top 10 holding—was Becton Dickinson, a medical device company with a long history of dividend increases that had tripled its dividends in 10 years. The stock’s dividend has grown from an annual $0.23 a share in 1996 to $2.64 today, while its price has moved from $19 to $172 a share.

Other stocks in the portfolio tell a similar dividend growth story. In the industrial sector, Roper Technologies, a diversified industrial company that produces engineered products for global niche markets, could benefit from a modest cyclical upturn for the global economy. Roper has generated substantial cash flows for many years, using them to gradually grow its dividend and acquire smaller companies that generate a lot of cash themselves.

The fund’s technology holdings include Microsoft, which started paying dividends in 2003. The company’s core software business has high margins and generates ample cash, which is funding its transition from packaged software to cloud-based software and services. While Microsoft has had recent earnings disappointments, Taylor expects the cloud business to mature and become a bigger part of the company. At that point, he believes, earnings will reaccelerate.

The fund’s holdings in the materials sector include Albemarle, a leading producer of lithium and other industrial chemicals. The company has increased its dividend an average of 13% annually since the stock joined the portfolio in 2011. In the health-care sector, medical technology and equipment maker Medtronic has seen 39 years of dividend increases, and its most recent year-over-year increase was 13%. Taylor believes the company’s CEO is guiding it toward improved revenue growth that will help sustain future dividend increases.