Confessions first: I’m actually not predicting a recession in 2020. Everybody knows that it is impossible to forecast the ups and downs of the business cycle several years ahead. Even six to 12 months ahead, it is extremely difficult to call a recession correctly – in fact, most economists forecast a recession only after it has started. At PIMCO, we are adamant about revisiting our near-term outlook every quarter, for humility is essential to our business – let’s face it, economists are masters of hindsight, but perhaps closer to apprentices at foresight.

So whence the title? One reason is to entice you to read yet another piece on the risk of recession. The more important reason is that while financial markets and a rising number of pundits now place a very significant probability on a U.S. recession later this year, I still think it is much more likely that the next recession occurs in, say, 2020 – or any other year of your choice in the intermediate future – than in 2016.

Of course, this is not to say that the risk of a recession over the cyclical horizon, i.e., the next six to 12 months, is negligible. Even if you just returned from an extended excursion to Mars and haven’t had a chance yet to watch CNBC or study the recent economic statistics, you would have to attach an unconditional probability of about 15% to a recession over the next year. After all, the U.S. economy has on average been in recession in one out of six years since 1945.

Neither would I dispute that the risk of a 2016 recession has been on the rise in recent months, for two reasons. First, initial conditions matter a lot, and there is no denying the loss of growth momentum in the course of 2015 and going into this year. U.S. GDP growth decelerated from an above-trend pace of 2.5% in 2014 to 1.9% over the four quarters of 2015, with Q4 growth falling to only 1.0% (the seasonally adjusted annual rate) – not exactly a great starting point into 2016. Somewhat encouragingly, the available data so far suggest Q1 GDP growth is tracking in a 1.5% to 2.5% range, but such estimates are highly uncertain this early in the quarter. And to re-emphasize the point about initial conditions: In an economy that’s cruising close to stall speed, the risk of a plane crash is inevitably higher than otherwise.

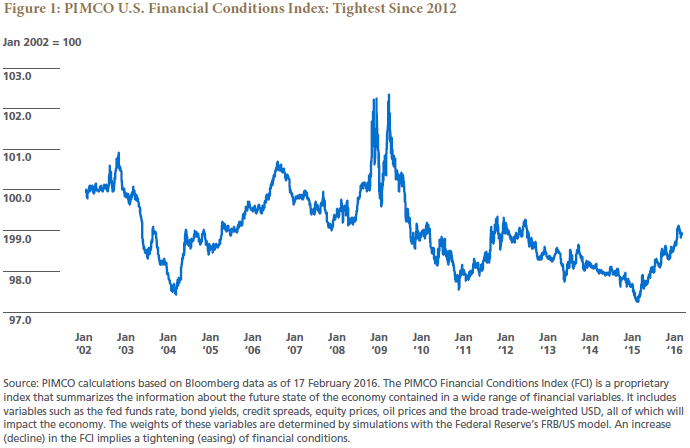

Second, financial conditions have tightened further since early December as the Federal Reserve hiked rates for the first time in more than nine years, equities sold off, credit spreads widened and the broad trade-weighted U.S. dollar appreciated further. Lower bond yields have helped, but this only partially offsets the deterioration in other asset classes. Our proprietary PIMCO U.S. Financial Conditions Index (FCI) has tightened by close to 50 basis points (bps) since early December (see Figure 1). If sustained, this would shave about one-quarter of a percentage point from GDP growth over the course of the year, according to our simulations with the Fed’s FRB/US macro model for the U.S. economy. However, models like this are unable to capture potential non-linearities that may well be present in the current environment of global and domestic uncertainty – just think of the vagaries of China’s economic policies and the uncertainty about the U.S. presidential election outcome.

Taken together, the combination of weak growth momentum and tighter financial conditions suggests that the probability of a recession this year is higher than it has been in a while.

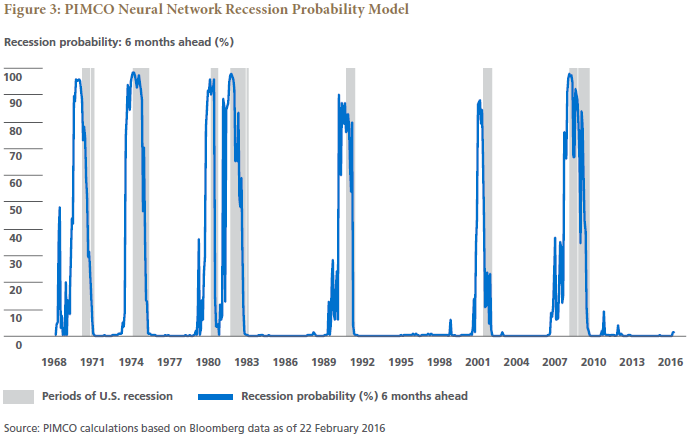

An alternative recession probability model we monitor at PIMCO is a neural network system run by portfolio manager Emmanuel Sharef, which tries to detect patterns in a wide range of economic and financial market indicators that resemble those before past recessions. The advantage of this “black box” approach is that it allows for non-linearities and tries to exploit information from a wide range of sources without imposing any theory or biases. The model results are similar to the ones from the more traditional model: The probability of a recession has recently spiked but remains far below previous pre-recession periods (see Figure 3).

Why expansions end

Joachim Fels is a managing director and global economic advisor based in PIMCO's Newport Beach, Calif., office.

Ask the data

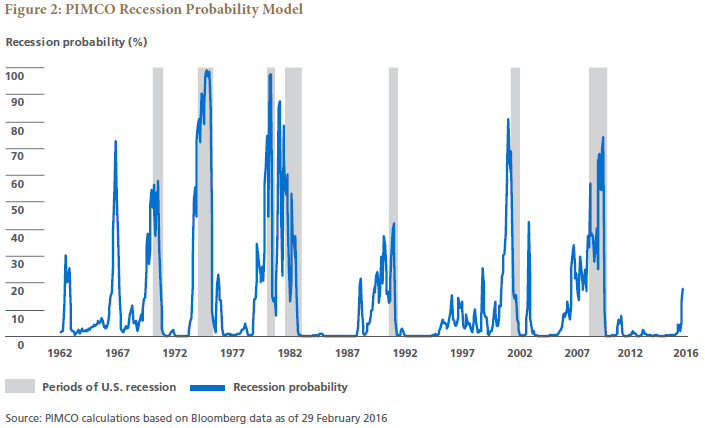

Vinayak Seshasayee, a PIMCO portfolio manager, has estimated a model that combines seven economic and financial factors – the manufacturing ISM, industrial production, building permits, real money supply M1, the 3-month to 10-year U.S. Treasury yield curve, BBB credit spreads and S&P 500 returns. As Figure 2 illustrates, the model spits out a recession probability over the next six months of 17% at the moment – the highest in this expansion to date but still significantly lower than ahead of previous recessions.

Note that a variant of the model that only includes economic variables indicates a lower probability of recession, while a variant that includes only the financial variables indicates a higher probability. One possible interpretation of this discrepancy is that financial markets are currently exaggerating the risk of a recession. However, negative financial market performance may feed back negatively into consumer and corporate spending behavior via tighter financial conditions. The existence of such a feedback loop suggests that financial variables should be included in a recession probability model.

The reassuring message from Vinayak’s and Emmanuel’s quantitative models rhymes with my qualitative assessment that a recession is unlikely (though of course not impossible) as none of the conditions that have typically contributed to or caused past recessions currently prevail. True, this expansion is already old in age – 80 months and counting, against an average length of 58 months in the post-1945 period. However, expansions don’t die of old age, they usually end from a combination of significant imbalances in the economy and excessive monetary tightening. And neither the former nor the latter are currently observable in the U.S.

Regarding potential imbalances, it is difficult to argue that household balance sheets are strained or that consumers have been overspending, as was the case ahead of the 2008 recession. Looking at the corporate sector, leverage ratios have increased in recent years, but the additional leverage was mainly used for financial engineering rather than massive overinvestment in capex as ahead of the 2001 recession. A notable exception is the U.S. energy sector, which saw overinvestment and a build-up of leverage during the shale boom and is now in recession, but this sector is too small to drag the entire U.S. economy with it. Also, wage and price pressures in the economy at large have remained absent so far. If anything, wage growth and inflation have been too low rather than too high. In short, the U.S. economy has so far shown none of the typical warning signs that preceded past recessions: no overconsumption, no overinvestment and no overheating.

Nor are there any signs of overkill by the Fed, which typically sparked past downturns. True, I believe that the Fed’s (initially verbal) tightening campaign that started in early 2015 was, in hindsight, a mistake because it hurt many dollar-indebted companies in emerging markets and forced China off the dollar peg, leading to slower global growth, further dollar appreciation and tighter financial conditions. Thereby, it contributed to the slowdown in U.S. growth last year and hence to the weaker initial conditions that I mentioned at the outset. However, it is difficult to argue that this campaign and the eventual 25 bp rate hike in December have been enough to spark a recession. Moreover, given the recent experience, the Fed will likely pass on a March rate hike and proceed even more gradually and cautiously than previously expected. And last but not least, U.S. fiscal policy is mildly supportive of growth this year for the first time in a long while.

All of this is not to deny that large parts of U.S. corporate earnings are in recession, as my colleagues Geraldine Sundstrom and Qi Wang have been rightly pointing out for a while. The corporate America that is represented in the S&P 500 has clearly been hit by its exposure to global growth, a strong U.S. dollar and weak energy prices. But this doesn’t imply that the question of whether the U.S. economy is facing a recession is futile. In fact, the answer is hugely important to future asset prices. Job losses, rising unemployment, the related consumer retrenchment and widespread corporate defaults of a broad recession would very likely lead to a very significant further drop in stock prices, much wider credit spreads and much lower bond yields even from the current low levels. Recession matters a lot.

Bottom line: Both our quantitative recession probability models and qualitative deliberations suggest that the fears of a recession in 2016 are overdone. A U.S. recession this year is much less likely than a recession in, say, 2020.