The world’s central bankers are tired of having to do all the heavy lifting to support growth. Some have suggested the need for fiscal policy to take a bigger role. Is that a good idea? Is expansionary fiscal policy even feasible at this point?

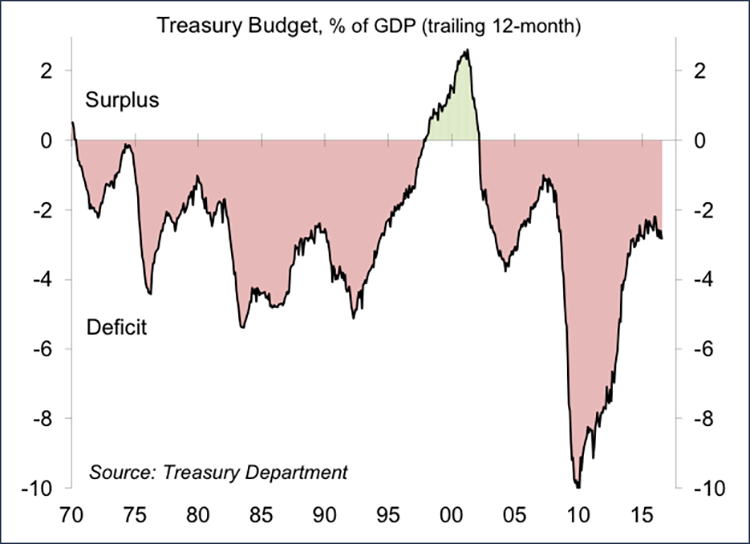

The American Recovery and Reinvestment Act of 2009 (ARRA), provided support for the economy at a cost of $831 billion, mostly spread between 2009 and 2011. A little over a third of that was in temporary tax cuts (ineffective). ARRA provided $543 billion in additional spending. That sounds like a lot, but it wasn’t compared to the decline in overall economic output (nominal private domestic purchases had fallen by $754 billion from 4Q07 to 2Q09). The federal deficit ballooned to $1.4 trillion (or 10% of GDP) in FY09, but that simply reflected the magnitude of the economic downturn. Revenues dried up. Spending on things like food stamps and unemployment benefits rose sharply. As the economy recovered, revenues improved and the recession-related spending went away. With less than a month remaining in FY16, the deficit is on track for about 2.9% of GDP, up from 2.5% of GDP in FY15.

While there was much hand-wringing over the deficit in 2009 and 2010, the problem has always been in the future. While the deficit has declined as a percentage of GDP, pressures will build as the baby-boom generation continues into retirement. Social Security is not in a terrible situation, but Medicare spending is set to explode, reflecting the ageing of the population and the long-standing trend of high inflation in healthcare. Paying for the healthcare and retirement of the elderly is not an issue unique to the U.S. Every other country faces a similar problem.

While the ARRA did help to limit the economic downturn, it wasn’t large enough to propel the economy to a strong recovery. This recovery also differed from past recoveries in that state and local government did not provide a base level of support. In fact, they made the recovery worse. Most states and cities have balanced budget requirements. So, when the recession hit and revenues dried up, most cut spending (laying off teachers, police, and firemen). Employment in state and local government is still well below the pre-recession level.

And yet, there is a definite need for more infrastructure spending in the U.S. Both presidential candidates have proposed spending more to repair roads and bridges. Even if you don’t believe in global warming, improvements in sewer, drainage, and other systems are clearly needed (as evidenced by the aftermath of Hurricanes Sandy and, more recently, Hermine). The question is who is going to pay for that.

Fiscal policy refers to using tax cuts or spending increases to spur economic growth. The idea is that if the government builds a road or a bridge, the wages earned will be spent, and that spending is someone else’s income, part of which also gets spent. If well below full employment (as in a recession), the impact of additional government spending will be multiplied. The tricky part is in deciding when that added spending will be pulled back (hopefully, after the economy has fully recovered). Government debt will be higher, but may be paid down gradually once the economy recovers. Tax cuts can also stimulate the economy, but only if seen as permanent (temporary tax cuts in a recession are ineffective, but politicians always seem to include them in stimulus packages).

No serious economist advocates using fiscal policy to fine-tune the economy and many are divided on whether fiscal policy works well in fighting a recession, but that’s precisely when you’re going to get more bang for your buck. In an economy that is closer to full employment, fiscal policy is going to be less stimultive and may crowd out private activity. Moreover, with budget pressures looming, there’s little political scope for expansionary fiscal policy (but at least we should see the end of counter-productive austerity measures).

Scott J. Brown, Ph.D., is chief economist at Raymond James & Associates.