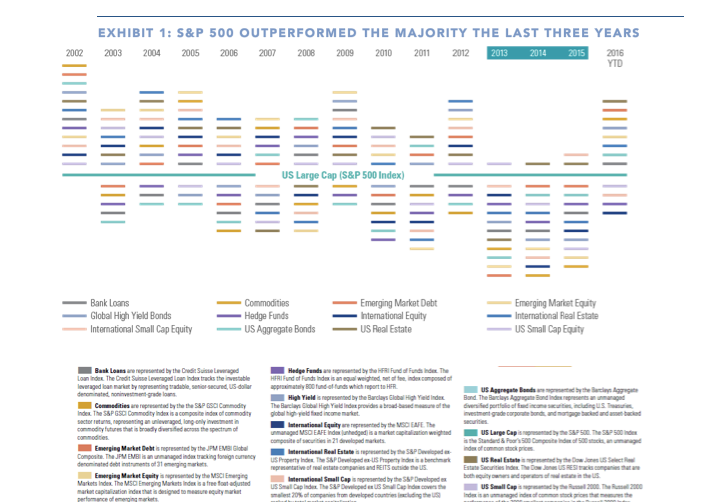

For several years, it has been challenging even for professional investors to stay diversified. Pure equity market beta has outperformed a well-diversified approach by historic margins in recent years (Exhibit 1).

In this context, clients sometimes tell us it has been tempting to succumb to “recency bias,” meaning the tendency to over-emphasize the recent past. This tendency today may come at the expense of a well-diversified approach to portfolio construction.

We would stress that the recent past has been historically unusual, even aberrational. The three consecutive double-digit S&P 500 Index gains investors enjoyed in 2012-14 have been matched or exceeded only four other times since the start of S&P data in the 1920s.

The good news is, recent performance shows hints of more historically “normal” patterns of investment returns. The first half of 2016 saw asset classes such as emerging market debt and equity, high yield bonds and bank loans outperform US large cap equities (Exhibit 1). We see select areas of emerging markets debt as attractive, especially in the event of a “lower for longer” interest rate environment, and we think the US real estate market remains firmly in an expansionary phase.

These trends, should they persist, are good news for would-be diversifiers, since the risk-adjusted returns of these asset classes when combined in a portfolio historically have been higher than those of the S&P 500 index.

It is difficult, if not impossible, to predict the outperformance of a given investment in a given year. Particularly at a time of elevated US equity valuations and shocks to the system such as the UK Brexit vote, we see merits in owning a diversified range of investments, to tap into the long-term returns of many asset classes and potentially limit overall portfolio volatility.

Just as importantly, we expect investors would find it easier to embrace the tenets of diversification should the recent trend keep up.

Diversification does not protect an investor from market risk and does not ensure a profit.

Past performance does not guarantee future results, which may vary. This sample is for illustrative purposes only.

Views are as of 8/3/2016 and subject to change in the future.

Heather Miner is global head of strategic advisory solutions at Goldman Sachs Asset Management.