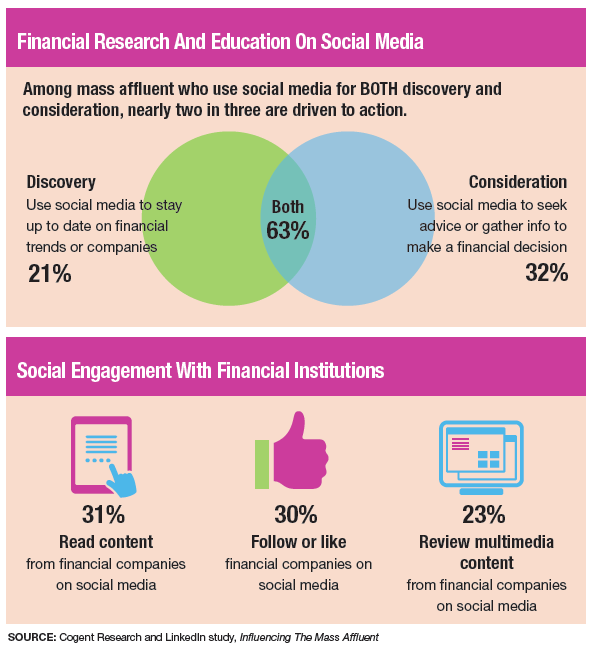

A recent survey conducted by LinkedIn and Cogent Research found that nearly 90% of the mass affluent––defined as people with investable assets between $100,000 and $1 million––are active social media users. And many of them use it to learn about financial trends, companies and products, as well as to seek advice and further information to evaluate what they’ve learned.

The study, Influencing The Mass Affluent, paints a picture of what social media users expect regarding content from financial institutions such as brokerages, banks and credit card companies, along with what these institutions can do to make their content more relevant to the mass affluent.

Forty-four percent of survey respondents said they engage with financial institutions on social media, and 34% said they engage with content shared by financial institutions on social media. But Jennifer Grazel, LinkedIn’s global head of category development for financial services, writes that there’s a gap between what information people want and what financial companies are providing. One possible solution: segmenting their social media strategies by life stage.

The three most valuable outcomes the mass affluent get from a financial institution’s social media presence are improved customer service, timely updates and relevant content. The survey finds that brokerages can score points by providing market commentary and product performance updates.

A similar study done last year by LinkedIn and Cogent that focused more specifically on personal investing and financial advisor relationships found a disconnect between both the level and types of engagement clients want and how they’re actually engaging with financial professionals on social media.

“What we saw last year was that investors were looking for market updates and commentary information from trusted sources,” says Christopher Savio, senior project director at Cogent.

The Rich Go Online

June 2013

« Previous Article

| Next Article »

Login in order to post a comment