The State Matters - By Richard P. Breed III , Jennifer A. Civitella

As the federal estate tax exemption climbs and as the 2010 repeal approaches, many families and their advisors are relieved that $2 million to $7 million of assets can be inherited free of federal estate taxes. However, residents of most states must still plan for looming and often substantial, state death taxes.

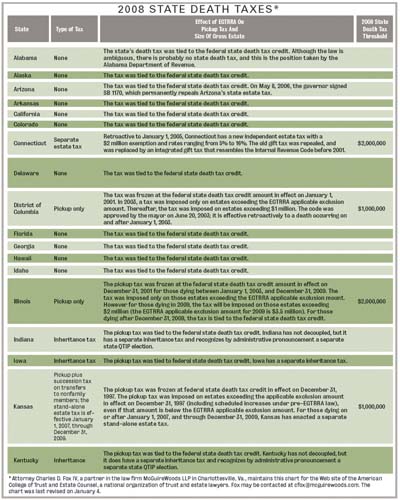

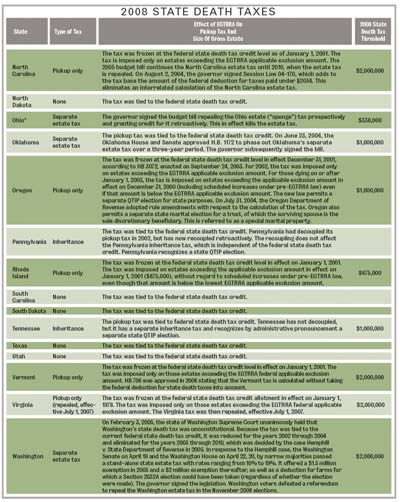

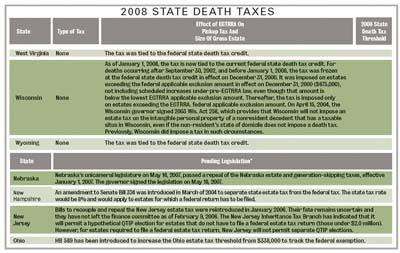

In 2000, most states imposed an estate tax equal to the full amount of the state death tax credit allowed under section 2011 of the Internal Revenue Code. Their estate tax systems were "coupled" with the code and "picked-up" an estate tax to the extent of section 2011's credit allowance.

Until 2001, the typical estate plan of a married couple with a federal taxable estate called for the estate of the first deceased spouse to be divided into two shares. One share (the "credit shelter trust") would be funded with an amount equal to the applicable federal estate tax exemption. The rest would fund the "marital deduction trust," which qualified for the marital deduction, usually achieved by making a "QTIP election." As a result of this estate planning technique, both federal and state estate taxes would be deferred until the death of the surviving spouse.

Example 1

A married resident of Maine (a "pickup" state) died in 2000 with a gross estate of $3 million. The decedent's revocable trust stipulated that his estate be divided into two shares: a credit shelter trust equal to the applicable federal estate tax exemption at the time of his death ($675,000) and a marital deduction trust equal to the rest of his estate ($2,325,000). This formula would result in no estate tax liability in the event of the first spouse's death and would fully "fund" his federal estate tax exemption.

The Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA), however, changed the federal estate tax system significantly: The applicable federal exemption was increased; the maximum federal estate tax rate was decreased; and the the state death tax credit under section 2011 was gradually phased out and replaced with a deduction under section 2058 for state estate taxes paid.

The repeal of the credit pulled the rug out from under the pickup states. They were left with two choices: Do nothing and allow the state's death tax to evaporate with the repeal of the section 2011 credit, or respond with legislation to "decouple" from the federal estate tax system. About one-third of the pickup states have eliminated their death taxes. Several others have separated entirely from the federal estate tax system and have enacted their own independent inheritance or estate tax. The remaining pickup states have "decoupled" from the federal estate tax, but are "coupled" with the pre-EGTRRA version of the code.

Most estate plans drafted before

2001 set out a maximum estate tax deferral based on a coupled

state-federal estate tax system. Such estate plans may no longer

provide the desired estate tax deferral because of the new state death

tax laws.

Example 2

Say that a married New Jersey resident dies in 2008 with a gross estate of $3 million. His revocable trust directs his estate to be divided into two shares: The credit shelter trust would be funded with the applicable federal estate tax exemption ($2 million) and the marital deduction trust would be funded with the rest of the estate ($1 million). New Jersey decoupled in 2002 and limited its applicable exemption to $675,000. The estate tax liability would be $99,600.

Credit Shelter Trust Planning

A state death tax liability may be looming for older estate plans that have not been updated since the 2001 federal legislation was enacted. The estate plans of a married couple may be amended so that upon the death of the first spouse the decedent's estate is divided into three shares.

The first share (the "credit shelter trust") is equal to the applicable state estate tax exemption and will not be subject to any estate taxes.

The second share (the state QTIP trust) is funded with an amount equal to the difference between the deceased spouse's state exemption and his federal exemption and is then subject to the state's death tax upon the surviving spouse's death.

The third share (the federal QTIP trust) is funded with the rest of the decedent's estate and is subject to both federal and state estate taxes when the surviving spouse dies. A complete estate tax deferral is possible by making a state-only QTIP election to the state QTIP trust, which would qualify it for the marital deduction for state death tax purposes. Both federal and state QTIP elections will be made for the federal QTIP trust.

Example 3

If a married Rhode Island resident dies in 2008 with a taxable estate of $3 million, then according to his updated revocable trust, his estate would be divided into the following three shares: the credit shelter trust would be funded with $675,000, an amount equal to the Rhode Island estate tax exemption; the Rhode Island QTIP trust would be funded with $1,325,000, an amount equal to the difference between the applicable federal estate tax exemption ($2 million) and the Rhode Island exemption;and the federal QTIP trust would be funded with $1 million, the remainder of the resident's estate.

Sometimes, it's possible to make a state-only QTIP election when a federal QTIP election has not been made, though not always. For residents of these states, the decision must be made whether to pay state estate taxes at the first spouse's death or defer estate taxes until the surviving spouse's death. The drawback to complete deferral is the increase in the size of the surviving spouse's taxable estate for federal estate tax purposes.

Example 4

If a married New York resident dies in 2009 with a taxable estate of $5 million, according to her pre-EGTRRA revocable trust, her estate would be divided into two shares: the credit shelter trust would be funded with $3.5 million, an amount equal to the available federal estate tax exemption, and the marital deduction trust would be funded with $1.5 million- the remainder of her estate. Federal and New York QTIP elections would be made for the marital deduction trust. Since New York has decoupled and frozen its estate tax exemption at $1 million, the New York estate tax liability would be $229,200.

Example 5

Now take into consideration the same woman who died in the previous case, except that this time her estate plan has been amended since the passage of the Economic Growth and Tax Relief Reconciliation Act.

The credit shelter trust would be funded with an amount equal to the lesser of the federal estate tax exemption and the New York estate tax exemption at the time of her death, which is $1 million.

The rest of her estate, $4 million, would fund the marital deduction trust, and federal and New York QTIP elections would be made for this trust.

At the time of her death, the applicable federal estate tax exemption is $3.5 million, and $2.5 million of this exemption would be unused. Depending on the size of the surviving spouse's taxable estate when he dies, this may mean an additional federal estate tax of $1,125,000, significantly higher than the estate tax liability incurred when the same person died in Example 4.

Planning For The Patchwork State Estate Tax

A significant state death tax liability may arise as a result of a decedent having assets in multiple states. The estate tax rules of many states assume that all the states' codes are based on the IRC section 2011 state death tax credit. For example, the Massachusetts estate tax applicable to its residents is based on the decedent's federal gross estate, i.e., all of the decedent's property, no matter where located. The Massachusetts estate tax liability is decreased by death taxes paid to other jurisdictions. So what if the decedent has property in a state in which there is no death tax?

Example 6

Say a widowed Massachusetts resident dies in 2008 with a $3 million taxable estate consisting of a $1 million Miami condominium and $2 million in Massachusetts property.

The latter state decoupled in July 2002 and froze its estate tax exemption at $1 million beginning in 2006. Florida does not have a state death tax. For Massachusetts estate tax purposes, the Miami condominium is included in the decedent's gross estate. The Massachusetts estate tax would be $182,000, although the tax on Massachusetts property would be $99,600.

Example 7

Now let's assume that a widowed Florida resident dies in 2008 with a $3 million taxable estate consisting of a $2 million Boston condominium and a $1 million Florida property. The decedent does not own the Boston condominium outright; instead, she owns it as the sole member of a limited liability company, which is used for holding the title because it is a rental property. The Massachusetts estate tax applicable to nonresidents applies to Massachusetts real estate; it does not apply to intangible personal property, such as a membership interest in an LLC. There is no state death tax liability.

Conclusion

Advisors cannot assume just because a client does not have a federal taxable estate that state death taxes are not relevant, especially as those states feel the pinch from the post-EGTRRA drop in revenue. A careful analysis is necessary to determine the proper plan to minimize, defer or pay state death taxes. Such analysis should also consider both the applicable estate taxes of the client's domicile and the estate taxes of all states in which the client may own property.

Richard

P. Breed, III is a shareholder and co-founder of Tarlow, Breed, Hart

& Rodgers P.C. of Boston, which was established in 1991. He

concentrates his practice in the field of estate and business planning

and advises owners and their families on the complexities of estate

planning and administration, taxation and corporate law. He can be

reached at [email protected].

Jennifer

A. Civitella has been an associate with Tarlow, Breed, Hart &

Rodgers P.C. since 2006. She concentrates on estate planning, tax

planning and estate administration. She can be reached at [email protected].