Hedge funds attracted a net $44 billion in assets globally last year, the smallest amount since 2012, according to data compiled by Hedge Fund Research Inc. That reflects a volatile year, when unanticipated economic events rattled markets and led to declines and losses for many funds. Others were hurt by crowded and sometimes concentrated trades and poorly timed bets on energy as oil prices continued to fall.

Still, there were bright spots: many long-term holdings paid off and some managers made well-timed buys, while others combed through small-caps or illiquid securities to find opportunities for arbitrage. Even some funds that didn't perform particularly well were diversified or hedged enough to protect their investors from the worst of the "downside," in a year that had plenty of it.

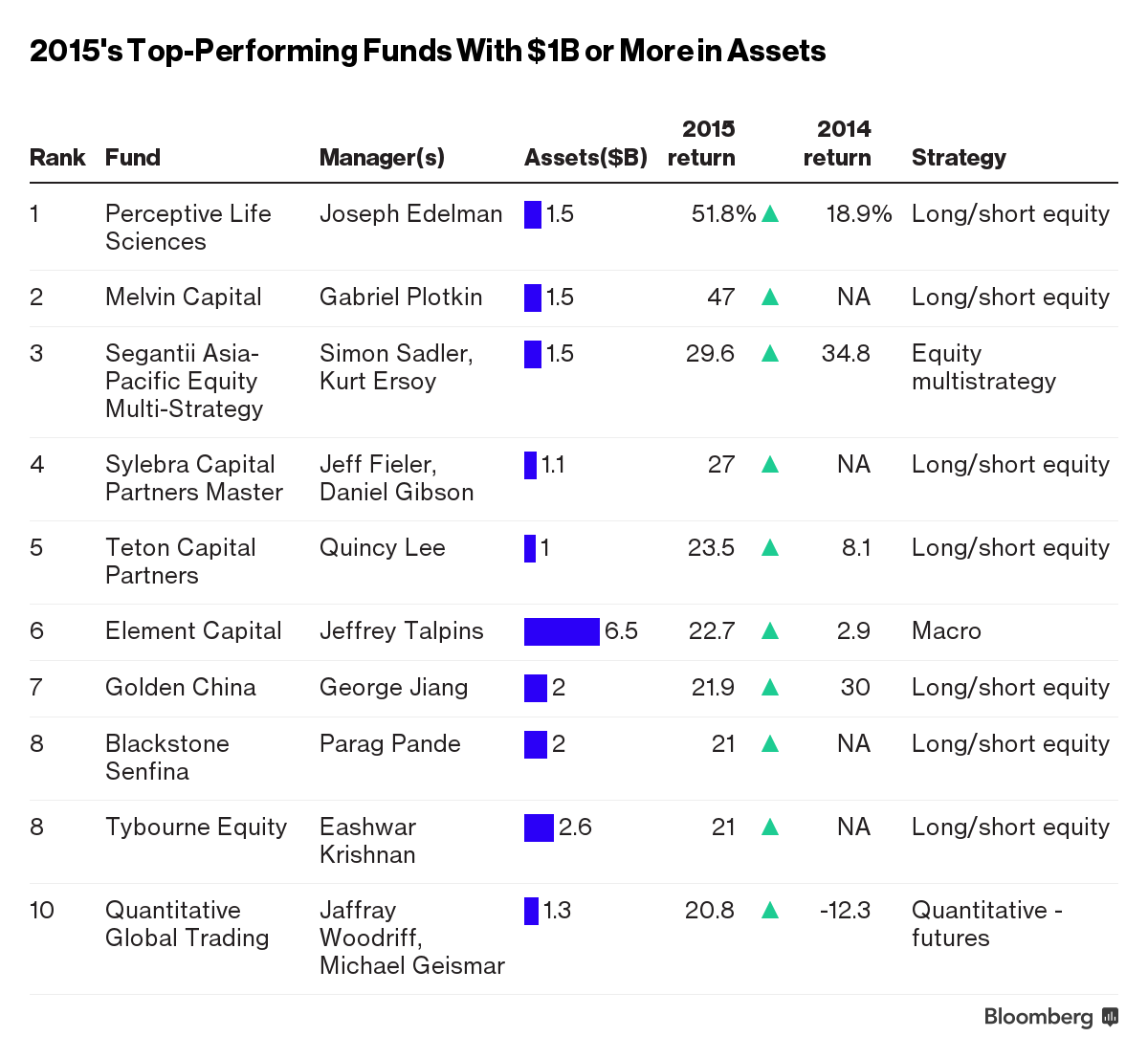

This special report on 2015 Hedge Fund Rankings looks at two groups — the top 50 best performers with $1 billion or more in assets and the top 25 best-performing hedge funds with $250 million to $1 billion in assets. The rankings are based on data compiled by Bloomberg's Anibal Arrascue and Laurie Meisler and information supplied by hedge-fund firms, databases and investors.

2.png)

In analyzing the returns, a few key themes emerged:

• Asia hedge funds as a group performed better than their competitors in Europe and North America in what was the most volatile year for Chinese equities in a decade.

• It was a year for stock pickers, with half of the top 50 funds focused on equity markets. Sector-specific strategies were some of the biggest winners, with Perceptive Advisors's life sciences fund taking the top spot on the list of hedge funds with more than $1 billion in assets. The firm's CEO Joseph Edelman discussed his strategy in an exclusive conversation with Bloomberg.

• The sector-specific theme was not limited to the U.S., or even to equity markets, as Ping Capital Management's macro strategy, which topped the medium-sized funds list, successfully bet on Argentina.

• Multimanager firms featured prominently on the top 50 list. Perhaps as a result, they are in expansion mode and ramping up hiring in 2016.

• Many managers who once called Steven A. Cohen their boss performed well last year, led by Gabriel Plotkin, who grabbed the No. 2 spot on the top 50 ranking.

• It may be too late for some, but the lessons learned feature in this edition imparts some wisdom from this difficult year while the closures pages analyze the carnage with a non-exhaustive list of the funds that shut their doors or returned outside capital during 2015.

Bloomberg's rankings of the top-performing hedge funds are based on funds' net returns for 2015. Because hedge-fund returns can be difficult to obtain, our lists are not all-inclusive. In addition, some of the numbers were difficult to verify. Unless the information came from Bloomberg data or the hedge-fund firm itself, we tried to verify it with other sources, including investors and other fund databases. All returns are for full-year 2015; fund assets are the latest available. Onshore and offshore assets were combined for a number of funds, while figures for other funds were only for the larger or better-performing class of the fund.