When Brian Singer and Thomas Clarke worked at UBS Global Asset Management in the early 2000s, they noticed that the lines between hedge fund managers and traditional institutional portfolio managers were blurring as alternative strategies became more mainstream. At the time, Singer was helping the firm’s institutional clients implement alternative strategies as the chief investment officer for the Americas at UBS Global Asset Management. Clarke was doing the same as the firm’s head of currency analysis and strategy.

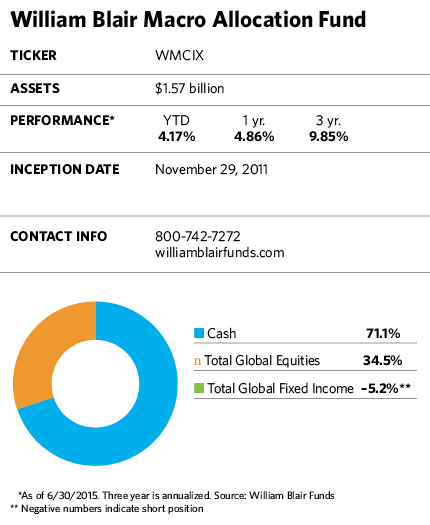

But the same trend didn’t seem to be taking hold in the mutual fund world, where traditional stock and bond long-only investing remains the industry’s bread and butter. In 2011, Singer and Clarke joined a small but growing contingent of mutual funds that take a less-traveled road, joining asset management firm William Blair to run the William Blair Macro Allocation Fund.

In Macro Allocation, which now has nearly $1.5 billion in assets, the managers make allocation decisions based on top-down, broad macroeconomic trends and the valuation measures of various asset classes. They translate their convictions through a number of strategies, one of which is to hold long and short positions in equities, fixed income and currencies. Instead of using individual securities, the fund turns to exchange-traded funds and other investments that provide broader index and currency exposure.

Singer believes that the fund’s bird’s-eye view element is more important to investment portfolios than many investors realize. “We wanted to create a fund driven by macroeconomic consideration to complement the traditional stock and bond holdings investors already have,” he says. “While most portfolios diversify among asset classes, they only take a bottom-up perspective. They have a limited amount of diversification on a top-down basis. This fund provides that macroeconomic diversification.”

Currency trading, an important part of the fund’s strategy, is an asset class and source of diversification and returns that’s missing from most portfolios, even those with international holdings. “An unhedged international fund will give you unconsidered currency exposure that happens to be tagging along with the equity markets,” Singer says. “We are introducing thoughtfulness into the process by taking advantage of mispricing opportunities around the world.” He estimates that about 40% of the fund’s returns since its launch are attributable to the currency side of the portfolio.

The Trend Spotters

August 3, 2015

« Previous Article

| Next Article »

Login in order to post a comment