While most investors tend to trade currencies to anticipate where the exchange rate will move over short-term horizons, the fund implements a longer-term approach by taking positions based on lasting economic trends and whether the managers think a currency is overvalued or undervalued relative to others. Often, they’ll maintain those positions for months, or even years. “The common view is that you cannot invest in currencies based on longer-term fundamental considerations and that they create unnecessary volatility in a portfolio. Both are simply untrue.”

The goal is to provide equity-like returns over a five- to 10-year market cycle with less volatility than the stock market, as well as to offer a source of noncorrelated returns. While the fund’s volatility is similar to that of a typical 60/40 balanced portfolio, its correlation with the equity market tends to be lower. In terms of performance, it has been in the top 3% of funds in Morningstar’s moderate target risk category over the last three years.

The goal is to provide equity-like returns over a five- to 10-year market cycle with less volatility than the stock market, as well as to offer a source of noncorrelated returns. While the fund’s volatility is similar to that of a typical 60/40 balanced portfolio, its correlation with the equity market tends to be lower. In terms of performance, it has been in the top 3% of funds in Morningstar’s moderate target risk category over the last three years.

Financial advisors incorporate the fund into portfolios in different ways. “Some fund the investment through allocations that would otherwise go to stocks and bonds because the fund has a high correlation to a balanced portfolio, yet its returns are more equity-like. Others see it as an addition to a diversified growth bucket, since it has a positive but low correlation to the equity market. And in a low-interest environment, investors looking to put money into something other than bonds are using the fund as a lower-risk source of diversification.”

With a macroeconomic outlook in mind, Singer points to several trends that will drive the fund’s strategy in the coming years.

Currencies: A Growing Source Of Returns

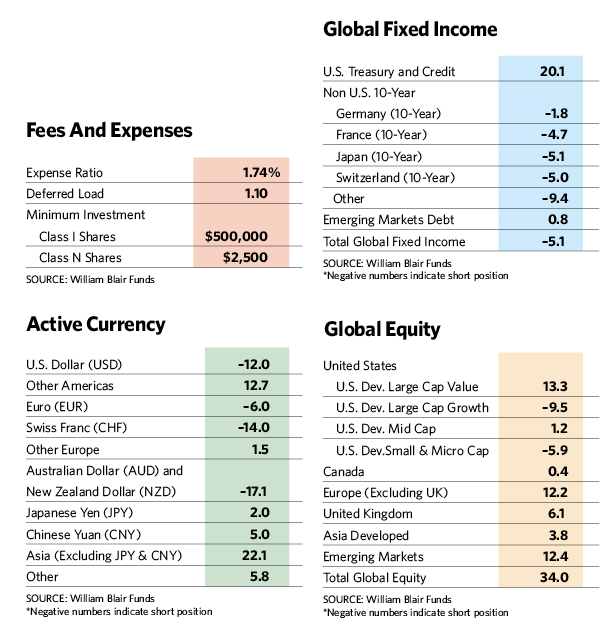

Singer suspects that in the coming years, “the greatest opportunities for the fund will come from managing currencies.” Differences in exchange rates are likely to intensify as central banks around the world pursue divergent monetary policies. China’s push to make the yuan dominant in Southeast Asia and the ascendance of emerging market countries as the engines of global growth will also create dispersion among world currencies and create opportunities for active management.

“Over the last 50 years, global growth has averaged about 3.5% and has been led by developed world economies,” he says. “We suspect that going forward global growth will be about the same, but this time emerging market economies will lead the way. That shift will almost certainly have an impact on exchange rates.”

The Trend Spotters

August 3, 2015

« Previous Article

| Next Article »

Login in order to post a comment