![]() It’s no secret that growth stocks have outperformed value stocks in recent years. For example, in the two years from September 1, 2013, to August 31, 2015, large-cap growth stocks (as measured by the Russell 1000 Growth Index) returned 14.7 percent annualized versus 9.6 percent annualized for value stocks (in the Russell 1000 Value Index). This pattern of outperformance has shone a spotlight on momentum, an investment factor that works particularly well in growth-stock investing. But making money by identifying growth stocks with momentum characteristics isn’t as easy as it sounds. In this column, I will explain why and briefly describe how Gerstein Fisher addresses some of the problems inherent in tilting a growth stock portfolio to momentum.

It’s no secret that growth stocks have outperformed value stocks in recent years. For example, in the two years from September 1, 2013, to August 31, 2015, large-cap growth stocks (as measured by the Russell 1000 Growth Index) returned 14.7 percent annualized versus 9.6 percent annualized for value stocks (in the Russell 1000 Value Index). This pattern of outperformance has shone a spotlight on momentum, an investment factor that works particularly well in growth-stock investing. But making money by identifying growth stocks with momentum characteristics isn’t as easy as it sounds. In this column, I will explain why and briefly describe how Gerstein Fisher addresses some of the problems inherent in tilting a growth stock portfolio to momentum.

Momentum: A Persistent Investment Factor

First, let’s define what we mean by momentum. Momentum is the tendency for winning stocks (that is, stocks that have outperformed the market over the past three to 12 months) to keep winning and losing stocks to keep losing. First identified in papers co-authored in the early 1990s by Sheridan Titman, one of our Academic Partners, the momentum factor would seem to refute the weak form of the efficient market hypothesis, which asserts that stock prices reflect all available information and that past price movements should be unrelated to future average returns. Momentum suggests that prior movements in price are in fact related to expected stock returns—that security prices essentially have memory, which students of statistics will recognize as serial correlation.

Since those landmark studies in the 1990s, a number of other academic papers have established that a momentum strategy works not only in equity markets around the world (with the notable exception of Japan’s) but also in several other asset classes, including currencies and commodities. At Gerstein Fisher, we find that a momentum tilt works at least as well in our multi-factor real estate investment trust (REIT) portfolio as in our U.S. and international growth equity strategies.

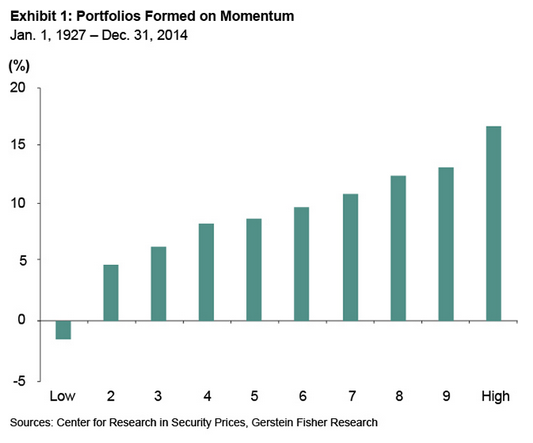

Moreover, unlike some other investment factors identified by financial academics, momentum has remained remarkably robust and persistent. For instance, since the size premium for small-cap stocks was identified in the early 1980s, it has shrunk dramatically (see my recent column for more on this phenomenon: “Is the Small Cap Stock Premium Disappearing?"); similarly, the value premium has also sharply declined since Fama and French published their pioneering paper on it in 1992. Quite possibly, once seminal research is available in the public domain, quantitative investors target and thereby reduce the available premiums, although they still exist. But momentum seems to be different: Our research shows that the strategy has remained profitable, generating a momentum premium of five to seven percentage points* even years after Titman’s groundbreaking papers in the 1990s.

The Challenge For Momentum

So if all of this academic and empirical evidence for momentum is present, then what’s the problem? For one thing, momentum stocks are also subject to short-term reversals, the tendency for stocks that have risen relative to the rest of the market in the last month to underperform those that have fallen relative to the rest of the market (for more on this topic, see our recently posted paper, “Do Past Returns Predict Future Returns? Evidence From Momentum and Short-Term Reversals.") In addition, the discipline and emotion-free decisions required to hold high-momentum winners and cut low-momentum losers every month are difficult for many individual investors to make because of human behavior.

Most important, there is a very large issue with turnover and transaction costs (and tax liabilities, if held in a taxable account) with a momentum growth stock portfolio. In short, without rules for controlling portfolio turnover, transaction costs will quickly devour the premium from the tilt to momentum (a monthly rebalanced, long-only momentum strategy may have a turnover of about 300%, implying a holding period of around four months).

We believe that an effective approach to addressing the problem of excess turnover is by combining momentum, a so-called fast-moving factor, with value, a slow-moving factor (value, which we may define, for instance, as a tilt to higher book-to-market stocks than the Russell 3000 Growth Index). Combining these two negatively correlated factors in one portfolio provides factor diversification, which is a good thing since there are pronounced and different cycles to different factors. But we also find that by combining the signals of value and momentum, we can slow down portfolio trading dramatically and improve risk-adjusted performance, both relative to the index and compared with the sum of stand-alone value and momentum strategies—a typical advantage of a multi-factor strategy in one portfolio. We will soon publish our research on the optimum way to combine momentum and value in an academic journal. In the meantime, I invite you to read our working paper: “Combining Value and Momentum."

Conclusion

Growth stocks—and momentum—have been the source of strong performance in the stock market. The momentum premium is palpable but difficult to tap profitably in a growth portfolio. We believe that combining momentum with value and other factors within a multi-factor framework is a compelling way to address this challenge.

Gregg Fisher, CIO and founder of Gerstein Fisher, an independent investment advisory firm based in New York City, has issued his latest Viewpoints piece, titled “A Third Way: Quantitative Multi-Factor Investing Explained."