Sidebar, sort of on topic: Today we learned that GDP growth in the second quarter was a mere 1.2%. The first quarter was downgraded, so the first six months of 2016 averaged only 1% annualized GDP growth. That’s barely stall speed. Inflation as measured by the CPI is up only 1.1% from a year ago, nowhere near the 2% that the Federal Reserve targets. Industrial production barely has a pulse.

Given these numbers, care to make a prediction of exactly when the Federal Reserve is going to feel comfortable raising rates even a mere 25 basis points? If you choose any of the remaining meetings this year, I will take the “under” on that wager. As I wrote a few weeks ago, the Fed had an opportunity to raise rates beginning in 2014, but because they were afraid the market would throw a tantrum, they simply didn’t have the, uh… (insert your favorite politically incorrect term here) conviction fortitude courage confidence nerve to do so.

Sidebar, off-topic: We will never know what would have ensued if the Fed had raised rates in 2014, but I bet they wish they could go back and have a do over. Their world would look a lot different today with rates approaching 2%, and I doubt the economy would be any worse off. Clearly, rising rates are not a problem with this economy. The problems of this economy have been made worse by monetary policy, and continuing to apply the same monetary policy principles will not fix them; it will only make things worse.

Angry Charts

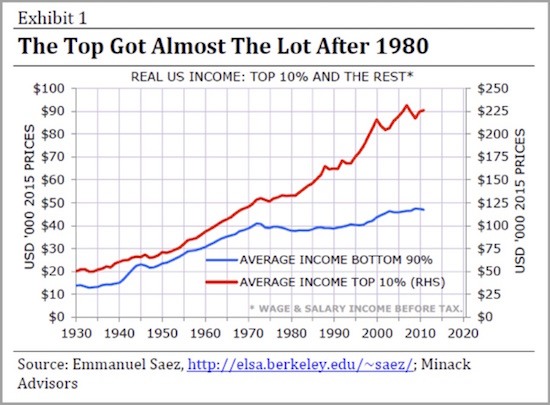

Here’s another chart, from Sydney-based Minack Advisors. Their July 21 bulletin was headlined “Angry Charts.” You’ll soon see why.

The first chart we looked at was median income. That’s what the person right in the middle made. That’s not average income, which is much higher. The average, figured as the mathematically correct “mean family income” from the same St. Louis Fed database, was $88,765 as of the beginning of 2014. The top 10%, and especially the top 1/10 of 1%, raise the average for everybody. In a universe of just Bill Gates and me, the average net worth is about $40,000,000,000. The real world removes about five of those zeros for me. (In a fire sale, closer to six. Please don’t tell my banker, who has a better opinion of me, at least financially, than I do. Which is why I keep ignoring the concept of retirement. I have a few zeros to go.)