Although many were predicting a significant pullback on Mr. Trump’s election, we, in fact, got a fairly significant advance. What’s up with that? I suspect there are several reasons.

The nine-day pullback before the election—the longest since 1980—certainly was pricing in some probability of a Trump win. When he actually won, the uncertainty risk disappeared. That alone could have driven markets back up.

A Republican sweep may have been perceived as positive for business and the economy, which would also have supported markets.

Markets tend to sell the rumor and buy the news, and this could have been just a normal reaction.

Whatever it was, clearly the financial markets are not upset by the Trump victory.

Market and economic fundamentals

On a deeper level, however, I think the reaction speaks to the fundamentals of how markets and the economy work. I have written many times about what creates a bear market. You almost always have a recession, which we don’t, as well as other supporting factors, such as rising oil prices and interest rates, which we also don’t have. Current market risk factors, which I update below, are also generally on the positive side, although risks are rising. In other words, on a fundamental basis, there simply does not appear to be a reason for the market to pull back in a significant way. That doesn’t mean it can’t happen, but it does mean it is less likely.

The Trump news, therefore, hit a market that was reasonably solid and bounced. You could take this as further evidence of the market’s strength given that we just experienced an event that was expected to knock it down 5 to 10 percent, or even more, and instead it rallied. Clearly, there is solid demand for stocks at this point. Plus, as I continue to write, the fundamentals here in the U.S. remain sound. Are there risks? Sure, and Chinese currency is at the head of the list of international concerns, but we are doing pretty well, which is something to keep in mind in the days ahead.

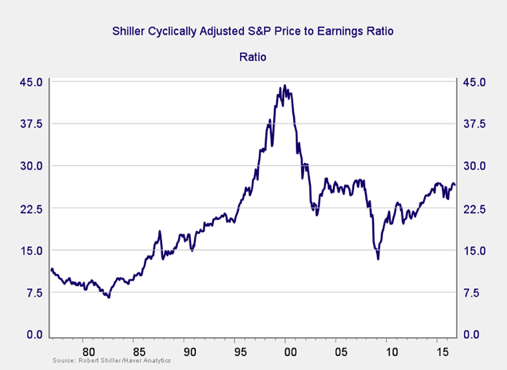

So how much risk is in the market right now? Just as I do with the economy, I review the market each month for warning signs of trouble in the near future. Although valuations are high—a noted risk factor in past bear markets—markets can stay expensive (or get even more expensive) for years and years, which doesn’t give us much to go on timing-wise.

Of course, there are other market risk factors beyond valuations. For our purposes, two things are important: (1) to recognize when risk levels are high, and (2) to try and determine when those high risk levels become an immediate, rather than a theoretical, concern. This regular update aims to do both.

Risk factor #1: Valuation levels

When it comes to assessing valuations, I find longer-term metrics—particularly the cyclically adjusted Shiller P/E ratio, which looks at average earnings over the past 10 years—to be the most useful in determining overall risk.