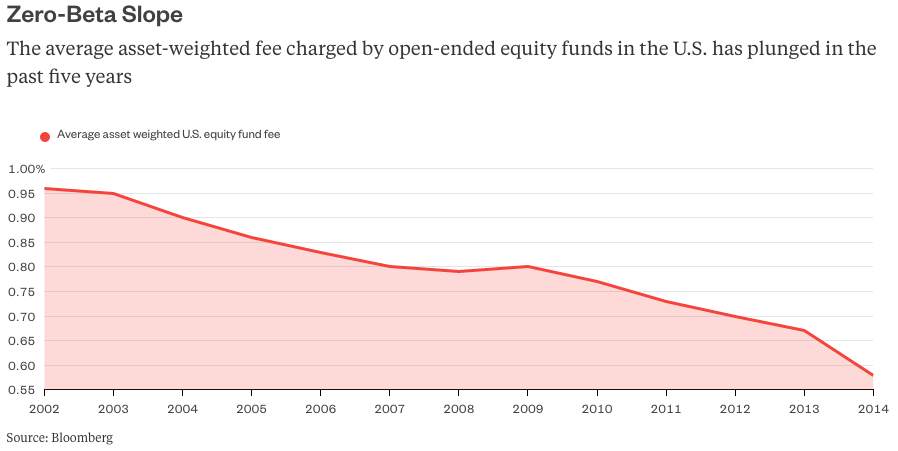

People in finance are often creative. But lately they've been unable to crack a phenomenon that's changing the investment landscape: Low-cost exchange-traded funds that simply replicate an index have undercut fees everywhere.

Tyler and Cameron Winklevoss may have just solved the equation -- make the fees from the trades, not the management. Their Bitcoin Trust, which applied to list a bitcoin ETF on the Bats exchange in the summer, will execute its trades through Gemini, the digital currency exchange that the brothers own.

While Gemini charges lower fees than many of its competitors and offers big discounts to clients moving large volumes, it's not free. (As an aside, the supposed free flow of money is one of the great myths of the Bitcoin world, since most exchanges charge around 5 percent of the value to either buy or sell Bitcoin.) Once it comes to life, the Bitcoin ETF is likely to be a major revenue generator for Gemini.

A 2013 study showed that for mutual funds, transaction costs can be equivalent to the expense ratio and could knock out as much as 3 percentage points of performance. In other words, the cost of buying and selling the securities can exceed the fund manager's fee -- and for an ETF, by several times more. So even if an ETF manager isn't making much money, the broker is.

That's the beauty of the system the Bitcoin ETF plans to adopt. To ensure the safety of their holdings, the managers are using a single exchange -- effectively a digital currency broker -- that happens to be owned by the managers.

It's often said that the people who made the most money in the U.S. gold rush of the 19th Century were sellers of picks and axes. Now that fees for managing money are being compressed, just make them up in trading.

This column was provided by Bloomberg News.