Highlights

• There Will Be Blood…and More of My Favorite Themes for 2016. California’s early 20th century oil boom depicted in the 2007 film provides this year’s lead theme highlighting the risk outlook: collapsing commodity prices’ risk of spillover into the broader outlook. Certainly, there is already blood in the energy sector. Compared to the prior year, commodity sectors in 2015 saw a quadrupling of defaults. Though much of these risks are priced into credit spreads, the prospects of even further erosion keep us cautious on credit for 2016.

• The Credit Cycle Leads the Business Cycle. Heard this one before? “As we see no signs of recession…” the advice states invariably to “keep on dancing.” But you never see the recession coming—it’s always a surprise. And that generally is because you are looking for its signs in all the wrong places. Using economic forecasting to predict the credit cycle gets it backwards because the credit cycle predicts the business cycle, not the other way around. Unique for this cycle, the Federal Reserve’s reliance on the “Portfolio Balance Channel” increases the macro vulnerabilities.

• Promises, Promises. The Fed promises “only gradual increases” in the federal funds rate and the market believes an even more gradual path than most Federal Open Market Committee members project. As the song refrain asks, “why do I believe?” Conditional on its forecasts for economic conditions, the Fed promises a “gradual” normalization. But the Fed has been a poor forecaster. Two-sided risks to the Fed’s outlook lie in faster-than-expected wage growth signaling an even tighter labor market or oil’s spillover effects halting normalization.

• Preference for preferred. In what is an otherwise defensive strategy for 2016, what do we like? Though also vulnerable to a general risk off and especially an equity market correction, we prefer to take our higher risk income allocations by going down the capital structure of higher quality names.

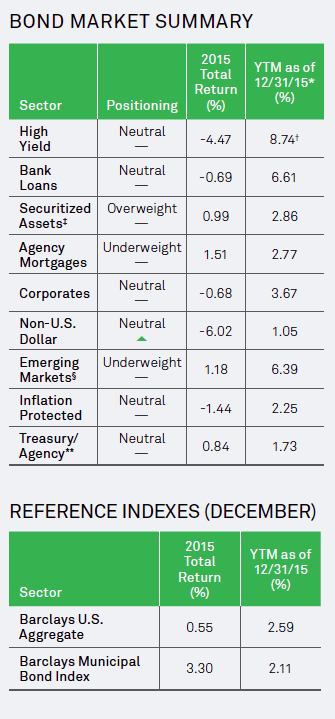

• And More of My Favorite Themes. Non-USD bonds look better positioned vs. last year given the significant repricing of the dollar and move to neutral from underweight. Treasury Inflation-Protected Securities’ (TIPS) valuations look attractive but near-term headline commodity inflation risk keeps us neutral. Downside risks plus a very gradual Fed improve the attractiveness of gold. And the back end of U.S. duration looks preferable given Fed normalization and deflationary tail risks. The U.S. consumer, residential and commercial real estate sectors stand far removed from the epicenter of this credit cycle, leaving their mid- and higher-quality securitized exposures a good source of carry, but we limit their allocations due to their relative illiquidity. Finally, we see the outlook for stocks vs. bonds more balanced than in prior years given extended stock valuations and the significant repricing of risk in bonds.

There Will Be Blood

California’s early 20th century oil boom depicted in the 2007 film provides this year’s lead theme highlighting the risk outlook: collapsing commodity prices’ risk of spillover into the broader outlook. Commodity and credit risks dominate the risks to the benign base case for 2016. That base case sees stabilization and recovery in commodity prices, and along with it broader financial market stability, reversing the losses seen in credit sectors most heavily exposed to the commodity sectors. The tail risk—that this stabilization fails to materialize —grows the longer and lower commodity prices fall and represents a meaningful risk to the consensus benign outlook.

The Base Case For 2016: Low Growth, Low Returns And Low Risk…

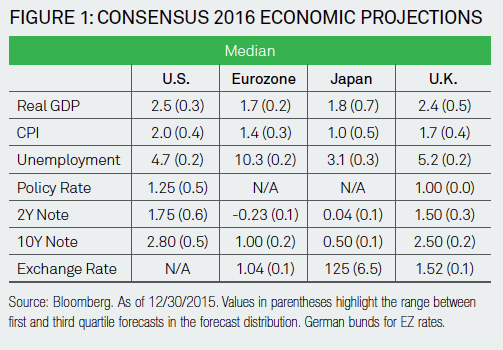

Figure 1 below highlights the summary of consensus economic, interest rate and FX forecasts for 2016, along with the variability around these forecasts. Generally, the consensus view holds stable U.S. growth, with growth in Europe and Japan offsetting emerging markets weakness, increasing but still low inflation, modest increases in interest rates and continued dollar strength.

…And Consensus Risks

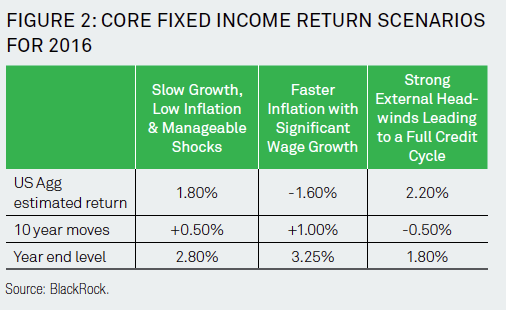

Similar to the base case, the consensus risks to the outlook coalesce around two scenarios. The first, and the focus of our lead theme, is the continuation of last year’s China, commodity and credit concerns. On the other side of the risk distribution is rising wage inflation in the U.S. fueling fears the Fed is behind the curve in normalizing interest rates. Figure 2 to the right summarizes Core fixed income returns under these scenarios.

The base case benign scenario shows another year of low expected returns for the Core fixed income category. The tail risk scenario, while significantly negative for credit returns (e.g. High Yield declines 12% under this scenario) shows the best scenario return for Core, clearly as the duration benefit under the extreme tail event in Treasury, Government and Mortgage sectors outweighs the losses in credit.